In 2016, I made a significant choice: I decided to take a sabbatical, loaded my family into a compact RV, and we set off on an adventure to Costa Rica.

When we came back in 2017, I officially stepped down from my role as a private banker at National Bank and committed myself entirely to my passion project: [Dividend Stocks Rock](http://dividendstocksrock.com). I also took over the management of my pension account at National Bank, publicly constructing a portfolio as a real-life example. From the outset, I resolved to invest 100% of this capital in [dividend growth stocks](https://thedividendguyblog.com/2017/10/31/how-many-stocks-should-i-hold-for-a-100k-portfolio/).

In August 2017, I received $108,760.02 in a locked retirement account. This kind of account doesn’t accept contributions, so its growth is solely dependent on capital gains and dividends. My intention in sharing my portfolio performance is not to boast or imply that anyone should mimic my specific strategy. I aim to offer insight into how I manage my portfolio on a monthly basis—the successes, the challenges, and the nuances—hoping others can gain wisdom from my journey.

Last month, I talked about why I’ve chosen to stop investing in [BCE](https://thedividendguyblog.com/bce-is-dead-to-me/). This time, let’s examine the ongoing bull market and its possible direction.

## Performance Overview

As of October 3rd, 2024, here are the figures:

– Initial investment in September 2017 (no additional funds contributed): **$108,760.02**

– **Current portfolio value**: **$283,139.51**

– **Total dividends received (last year)**: **$4,952.53**

– **Average dividend yield**: **1.75%**

– **2023 performance**: **+20.69%**

– Comparison: SPY = +26.19%, XIU.TO = +11.87%

– **Dividend growth**: **+1.7%**

**Total return since inception (Sept 2017 – Oct 2024):** **160.33%**

**Annualized return (Sept 2017 – 84 months):** **14.65%**

For comparison:

– SPDR® S&P 500 ETF Trust (SPY): **14.53%** annualized return (total return 158.50%)

– iShares S&P/TSX 60 ETF (XIU.TO): **10.42%** annualized return (total return 100.10%)

## Will the Bull Market Ever Conclude?

It seems that with each portfolio review, I reach yet another all-time high. On one hand, I feel fortunate to be fully invested, reaping the benefits of this lengthy bull market. On the other hand, the current market landscape raises some concerns. **While I remain dedicated to my strategy, I sense we might be approaching a correction.**

Nonetheless, had I received my pension account today instead of seven years ago, I’d still invest it entirely in the stock market, as **time in the market is more crucial than trying to time the market**.

The S&P 500 has climbed over 20% this year, and the TSX follows closely at +16% (including dividends). When asked if it’s the right moment to invest given the declining interest rates, my response stays consistent: the market has been anticipating this for a year now. I detailed this in my report from November 2023.

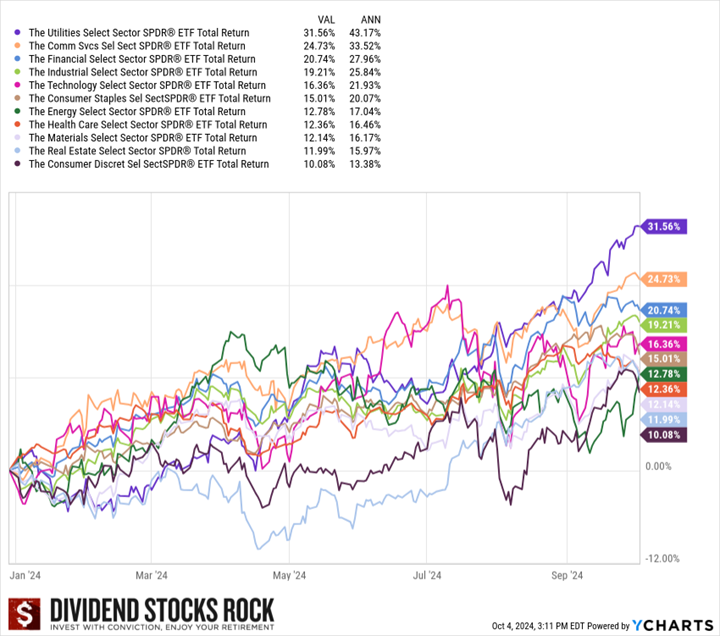

I must confess, I was taken aback by how much the U.S. utility sector has risen this year (+31.56%). The communication sector, propelled by major players Alphabet and Meta, ranks as the second-best performer, followed by the financial sector. In contrast, consumer discretionary stocks have underperformed, returning roughly half of the S&P 500’s gains (~10%). It’s the sole sector hinting at a potential recession, with numerous companies reporting stagnated sales growth as consumers tighten their spending.

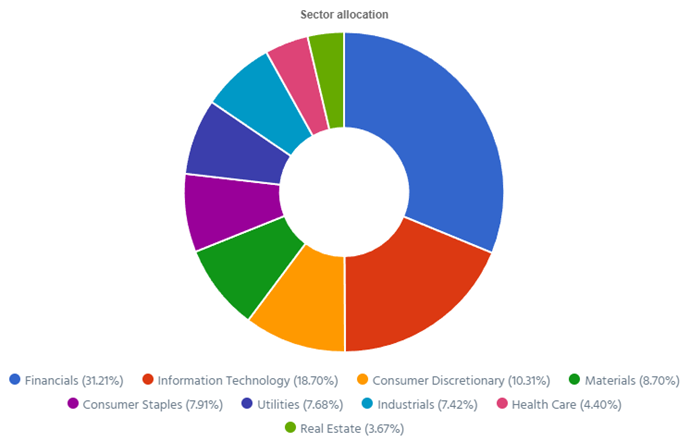

Observing BMO ETFs that reflect a blend of Canadian and U.S. stocks, I notice a similar pattern in the consumer discretionary sector. It’s been a precarious path for those exposed to this area. However, even in this challenging environment, the energy and communications sectors are leading the way, with Canadian banks performing fairly well—notably