**The Significance of Upgrading Online Payment Solutions for Small Enterprises in the Digital Era**

In the current rapidly changing digital environment, maintaining competitiveness requires more than merely providing quality products and services—it also necessitates the integration of contemporary solutions throughout various business operations. One of the vital sectors where numerous enterprises, particularly small businesses, are directing their focus is in enhancing their online payment systems.

Whether a business runs an e-commerce website, aims to execute a successful omnichannel strategy, or simply seeks to refine its financial management practices, integrating an efficient online payment system has become crucial. This technology not only enhances the consumer experience but also strengthens the internal efficiencies of the business, especially in financial management, expanding payment options, and simplifying tracking and reconciliation.

Let’s explore how implementing a seamless online payment platform can provide significant advantages to both business owners and clients:

1) Accelerating Transactions

In the fast-paced realm of contemporary business, customers demand transactions to be quick, seamless, and stress-free. The era where businesses could depend solely on traditional payment methods, such as checks or bank transfers—often characterized by prolonged processing times—is long gone. These antiquated methods can negatively affect customer satisfaction, with delays of several days serving as a major source of irritation.

This is where online payment systems—like the Philippines’ Maya Business—become vital. By facilitating instantaneous transaction processing, enterprises are better equipped to satisfy the requirements of modern, technology-oriented consumers. Rapid payments not only boost customer satisfaction but also promote repeat purchases. Most importantly, businesses gain quicker access to their funds, enhancing cash flow and enabling them to fulfill their financial responsibilities without delay.

Implementing an effective payment system lessens the administrative strain linked to manual payment processing, granting business owners the liberty to concentrate on value-enhancing activities like product development, customer service, or scaling operations. In essence, the smoother and quicker the payments, the more advantageous it is for both the business and its clientele.

2) Facilitating Support for Various Payment Methods

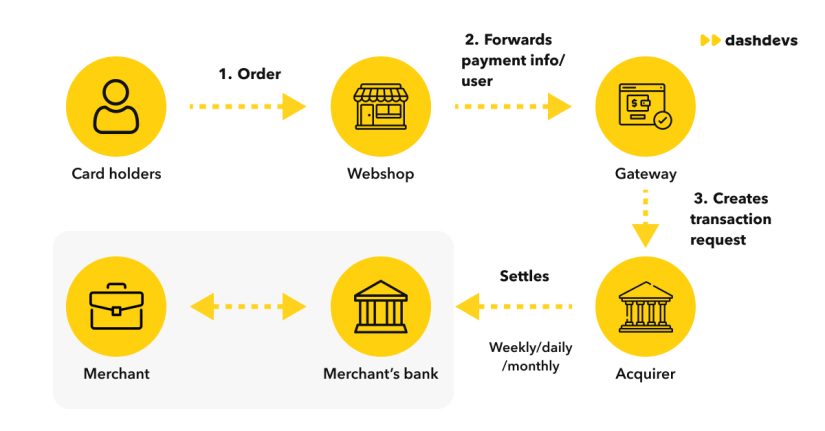

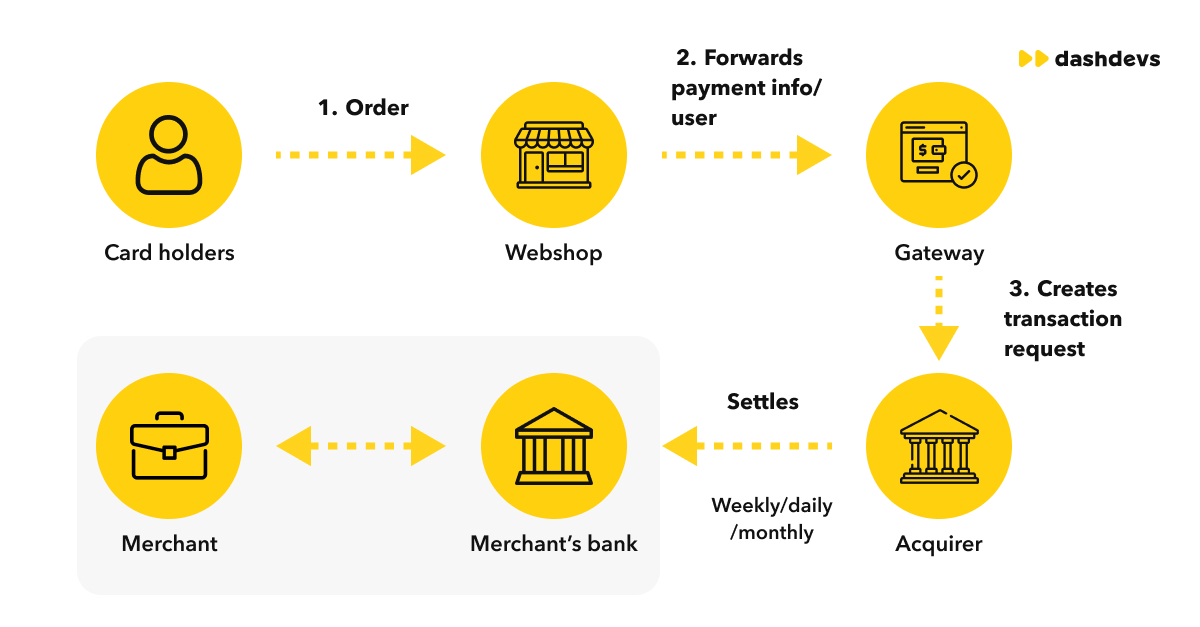

One of the most compelling benefits of transitioning to a digital payment system is the capability to support multiple payment methods (MOPs). Today’s consumers seek flexibility in their payment options. Some individuals prefer using credit or debit cards, while others might choose alternatives like digital wallets or QR codes. By providing multiple MOPs, businesses not only meet the varied preferences of their current customer base but also open avenues to new market segments.

For instance, payment gateways like Maya Checkout empower Filipino businesses to receive payments from various channels. Entrepreneurs opting for such solutions can offer their customers convenience, enhancing customer loyalty and boosting sales conversions. Furthermore, by presenting a more extensive array of payment options, businesses stand a better chance of drawing international customers, thus broadening their revenue potential.

In essence, the more options a business provides, the higher the likelihood of securing sales from a wide customer demographic, paving the path for increased overall success.

3) Enhancing Ease of Financial Activity Tracking

A frequently overlooked advantage of digital payment systems is the improved ease of financial tracking and reporting. Traditional payment methods are heavily reliant on manual processes, which are not only labor-intensive but also susceptible to errors. Manual entries can lead to inaccuracies that may cause financial discrepancies or reporting challenges.

The automation feature inherent in contemporary online payment platforms addresses this issue by automatically recording each transaction. Consequently, businesses can ensure that every payment is noted accurately and in real-time. This results in greater overall efficiency in managing revenue streams, budgeting, and forecasting. Additionally, it enables businesses to spot trends and make data-informed decisions, such as modifying marketing strategies or identifying cost-saving opportunities.

With automated tracking comes the benefit of generating detailed, comprehensible financial reports, which are invaluable during audits and when seeking business loans. The enhanced transparency into transaction histories promotes better decision-making, ultimately resulting in increased profitability and business growth.

4) Streamlining the Reconciliation Process

Reconciliation, the process of confirming that recorded transactions align with bank statements, can be a laborious and complex task when performed manually. Traditionally, business owners or finance teams would painstakingly match paper records with bank statements to identify any discrepancies—a method often tedious and prone to human error.

Today, online payment systems provide tools that dramatically streamline this procedure. Utilizing real-time tracking