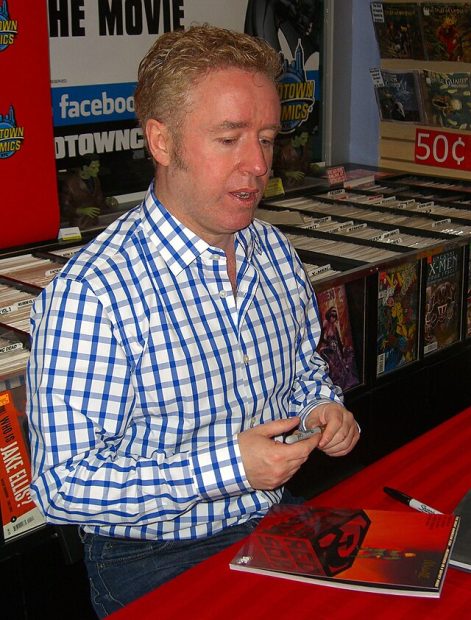

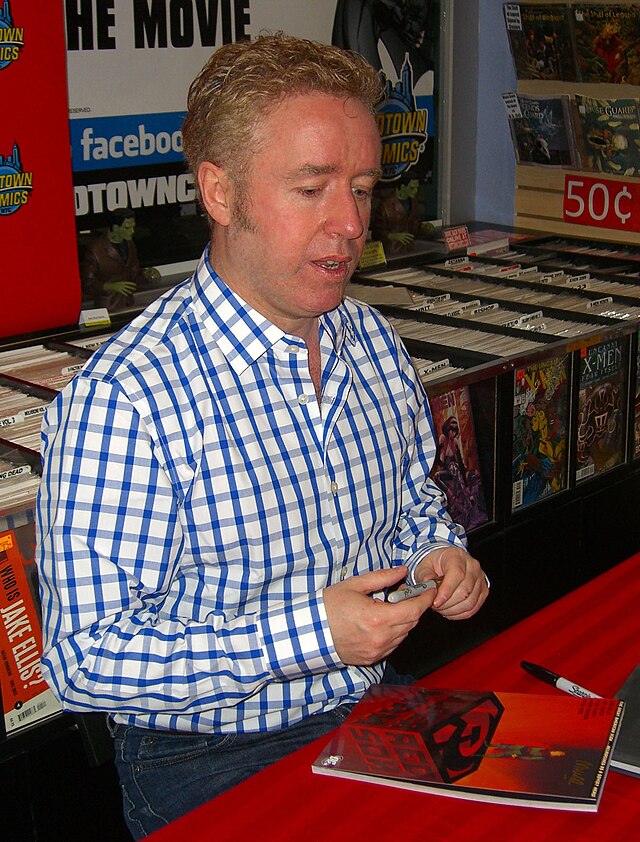

**Episode #576: Unveiling How the Wealthy Utilize Distinctive Traits, with William Green**

In Episode #576 of the podcast series exploring the perspectives and practices of the world’s most achievers, esteemed author and financial visionary William Green imparts extensive knowledge on how the wealthiest individuals harness and apply unique traits to create, safeguard, and expand their wealth. Green, acclaimed for his notable book *”Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life”*, offers an unprecedented look into the mentality and practices of financial luminaries.

Through years of investigation, conversations, and research, William Green has pinpointed pivotal traits and methodologies that set apart the ultra-rich. This episode delivers an engrossing exploration of these qualities, presenting actionable insights for anyone aspiring to mirror their accomplishments—not only in financial aspects but also in personal development and satisfaction.

—

### **The Exponential Impact of Unique Traits**

A significant insight from the episode is Green’s belief that real wealth encompasses more than just financial resources: it weaves together mindset, emotional intelligence, and discipline. The wealthiest individuals often display a collection of uncommon yet teachable traits that differentiate them, enhancing their potential to seize opportunities. He refers to these traits as instances of “mental compounding,” where gradual, consistent improvements yield remarkable outcomes over time.

Below are the remarkable traits discussed in the episode:

—

### **1. Long-Term Vision: The “Temporal Advantage”**

Several of the most affluent individuals contemplate decades rather than mere months or years. Green describes this approach as “temporal advantage,” emphasizing that most people fixate on short-term victories or immediate results. Conversely, eminent investors and entrepreneurs such as Warren Buffett, Charlie Munger, and Jeff Bezos adopt a long-term strategy.

Green presents real-world instances of this mindset. For example, Buffett’s investment strategy revolves around acquiring businesses with substantial intrinsic value and retaining them for extended periods, letting compound growth work effectively. Bezos is known for allowing Amazon a decade-long period to lead in e-commerce before expecting major profits.

The takeaway is evident: By changing your outlook to favor long-term benefits over instant rewards, you can achieve significantly better outcomes in both business and life.

—

### **2. Steadfast Discipline: Achieving Emotional Mastery**

A prominent characteristic among ultra-successful individuals is their capacity for discipline, even amid extreme fluctuations or uncertainty. Whether regarding stock market dynamics, real estate ventures, or entrepreneurial efforts, emotions such as fear and greed can derail long-term success.

In the episode, Green underscores Ray Dalio’s idea of “transcending emotions”—transforming high-pressure environments into chances for growth and learning through established principles. For instance, Dalio’s use of algorithms at Bridgewater Associates eliminates emotional bias in investment decisions. This strategic detachment empowers him and his team to make logical, data-driven decisions.

According to Green, cultivating emotional discipline is a skill that can be developed through self-awareness, meditation, journaling, and learning from prior experiences. The wealthiest individuals often possess a near-Zen-like tranquility amidst adversity, acknowledging that volatility frequently presents opportunities.

—

### **3. Commitment to Lifelong Learning: Energizing the Intellectual Engine**

“If you’re not learning, you’re falling behind,” asserts Green. One of the most notable traits of the wealthiest individuals is their relentless curiosity and dedication to lifelong education. From avid reading to seeking mentors and constantly questioning their own beliefs, they are tireless in their quest for knowledge.

Green shares stories of figures like Elon Musk, who famously self-educated in rocket science through intense study, or Bill Gates, who dedicates his annual “Think Weeks” to focused reading and contemplation. This intellectual diligence keeps them ahead in rapidly evolving fields.

—

### **4. Utilizing Their Network: The Strength of Connections**

Another essential theme throughout the discussion is the significance of relationships. Green highlights that wealthy individuals seldom achieve success alone. They cultivate robust networks of peers and mentors who challenge, encourage, and support them in their pursuits.

The affluent also excel in building trust and establishing reputational capital. Green cites examples such as Richard Branson, who constructed his Virgin empire on genuine relationships and a readiness to collaborate with those who possess greater expertise in specific domains.

For listeners, the message is clear: Dedicate time and resources to nurturing valuable connections, and surround yourself with individuals who uplift your mindset and goals.

—

### **5. Flexibility and Resilience: Flourishing Amid Uncertainty**

Green wraps up the episode by emphasizing the adaptability of the world’s wealthiest individuals. Change and disruption are constants, whether in technology, geopolitics, or