### Empower App Review: A Versatile Financial Solution

The **Empower app** stands out in the **fintech sector**, delivering **versatile financial management** for gig economy workers and people with varying incomes. It offers **easy cash advances** without credit assessments or exploitative fees, positioning itself as a practical substitute for payday loans.

### What Is the Empower App?

Empower is a **mobile finance application** aimed at providing **cash advances**, budgeting help, and tools for credit enhancement. While cash advances generally cap at **$250**, Empower is recognized for its **quick fund access** and more relaxed eligibility requirements in comparison to conventional banks.

Additional features encompass:

– **Budget monitoring**

– **Credit score tracking**

– **Cashback incentives**

– **Automated savings support**

Empower does not function as a bank but collaborates with **NBKC Bank (FDIC Member)** for its mobile banking offerings, while **Empower Thrive** is provided through **FinWise Bank (FDIC Member)**.

—

## How Empower Operates

Empower presents three main services:

### 1. Cash Advances

– Access up to **$250** without **interest, fees, or credit assessments**.

– Funds are transferred to your **bank account or Empower debit card**.

### 2. Empower Thrive (Credit Building)

– A **credit line from $250 to $1,000**.

– No minimum credit score is required.

– **On-time payments are communicated to credit bureaus**, enhancing credit scores over time.

### 3. Empower Debit Card

– Allows **instant cash advance access**.

– **Early paycheck deposit** (up to **two days earlier**).

– **Up to 10% cashback** on spending.

—

## Fees & Repayment Conditions

### Monthly Subscription Cost

– **$8 monthly** (after a 14-day complimentary trial).

**Cash Advances:**

– No interest or late charges.

– Payable through **automated deduction on payday**.

**Empower Thrive Credit Line:**

– **0% APR** if settled before your next paycheck.

– Otherwise, a **35.99% APR** applies.

– Late payments may incur extra charges.

### Fund Transfer Alternatives

Empower provides **standard ACH transfers** (**complimentary**, taking up to 5 business days) as well as **instant delivery** (with applicable fees).

#### Instant Delivery Charges:

| Amount | Charge |

|———|——–|

| $0 – $10 | $1.00 |

| $10.01 – $49.99 | $2.00 |

| $50 – $74.99 | $3.00 |

| $75 – $99.99 | $4.00 |

| $100 – $149.99 | $5.00 |

| $150 – $199.99 | $6.00 |

| $200 – $249.99 | $7.00 |

| $250+ | $8.00 |

For **Empower Thrive**, fees range from **$1 to $8 for amounts up to $300**, with a **3% (maximum $20) fee** on amounts exceeding that threshold.

### Eligibility Criteria

– **No credit assessments** needed for cash advances.

– Linked bank account must be **30 days old or older**.

– Must be a U.S. resident, **18+ years old**, possessing a **valid Social Security number**.

—

## Additional Features

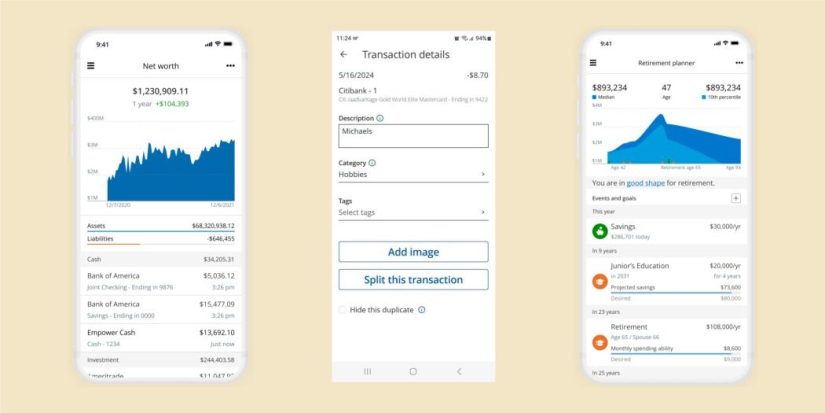

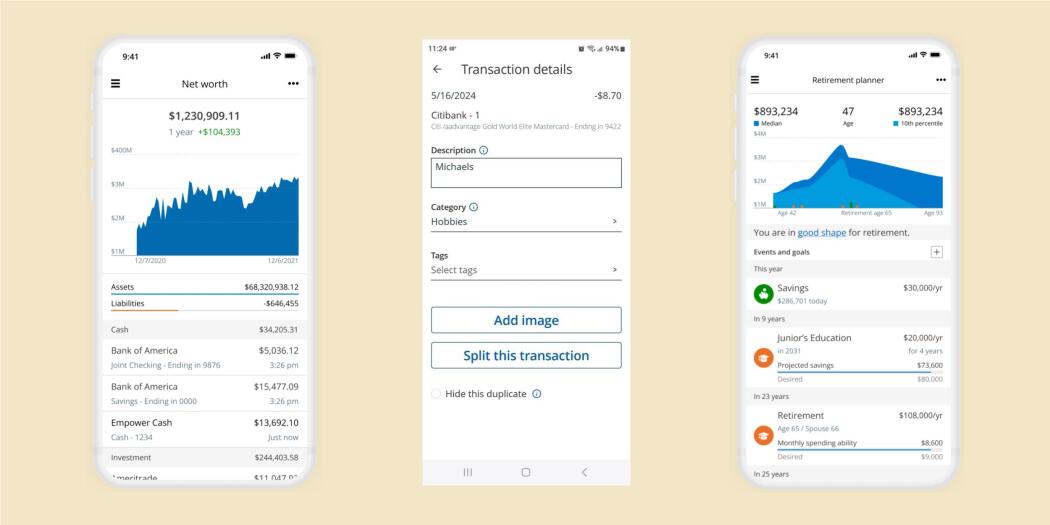

### **Credit Score Monitoring**

– Access **monthly insights** into credit aspects like payment history and utilization.

– Receive **tailored tips for credit improvement**.

### **Budgeting Instruments**

– Monitor **earnings and expenditures** in real-time.

– Create **budget categories** with personalized alerts.

### **Automated Savings**

– **Set aside funds manually or leverage AI** to automate savings without compromising necessary expenses.

—

## Getting Started

1. **Download the application** from [Google Play](https://play.google.com/) or [Apple App Store](https://apps.apple.com/).

2. **Register an account** (name, email, date of birth, phone number, and password).

3. **Connect a checking account** to obtain cash advances.

4. **Verify eligibility & submit a cash advance request**.

5. **Select a transfer method** (**instant or standard transfer**).

Empower will automatically **deduct repayment** on your payday.

**Note:** Some users might be required to present **additional identity verification documents** (e.g., driver’s license).

—

## Alternatives to Empower

Other cash advancement applications include:

### **1. Dave**

– Borrow **up