# How to Generate $500 a Month in Passive Income

Creating passive income is a fantastic method to augment your earnings and lessen reliance on a conventional 9-to-5 job. If you’re curious about how to secure an additional $500 monthly without incessantly working for it, the endeavor may not be as daunting as it appears.

By diversifying your initiatives, you can establish dependable income sources that accumulate over time. Below are five impactful strategies to assist you in achieving your financial target.

—

## 5 Methods to Earn $500 a Month in Passive Income

### 1. Invest in the Stock Market

The stock market provides numerous avenues for passive income, even for novices:

– **Dividend Stocks:** Firms that issue dividends share a portion of their earnings with shareholders on a regular basis. While they might not always be high-growth stocks, they deliver consistent returns.

– **Common Stocks:** If your goal is capital growth rather than dividends, investing in common stocks lets you profit from increases in stock prices over time. Robo-advisors such as Robinhood offer zero-commission investing along with automated support.

– **ETFs (Exchange-Traded Funds):** A hands-off approach to investing, ETFs consist of a group of stocks spanning a specific market index, helping mitigate risk. Services like Acorns automatically invest leftover change into ETFs for effortless portfolio expansion.

By investing wisely, you can steadily create a portfolio that yields $500 monthly in passive income.

—

### 2. Sell Digital Goods or Online Courses

If you possess a creative or teaching talent, selling digital goods or online courses can produce passive income:

– **Digital Goods:** Develop items such as planners, templates, journals, greeting cards, or marketing tools. Platforms like Etsy or eBay enable you to showcase your products to a wide audience.

– **Online Courses:** If you’re well-versed in a specific area, create and offer an online course through platforms like Teachable. Subjects can vary from photography and personal finance to programming and self-improvement.

Once developed, digital products and courses can be sold repeatedly with minimal exertion, providing a profitable passive income avenue.

—

### 3. Invest in Real Estate

Investing in real estate is another means to produce consistent passive income. You don’t necessarily have to purchase physical property—there are various investment methods:

– **Crowdfunding Platforms:** Real estate crowdfunding enables you to invest in commercial properties with minimal initial capital. Platforms like Fundrise allow you to start with as little as $10.

– **REITs (Real Estate Investment Trusts):** REITs manage and sell commercial properties on behalf of investors. These publicly traded funds distribute profits without necessitating direct property oversight.

– **Real Estate Syndication:** This approach involves pooling efforts with other investors to acquire and manage properties, leading to shared earnings.

With the right investment strategy, real estate can effortlessly yield $500 a month or more.

—

### 4. Accumulate Interest on Your Funds

You can enhance your cash passively by depositing it in accounts and investments that generate interest:

– **High-Yield Savings Accounts:** Online banks frequently offer savings accounts with interest rates exceeding 5%. Evade accounts with significant maintenance fees to optimize your earnings.

– **Certificates of Deposit (CDs):** CDs assure returns over a specified period. By constructing a CD ladder with various maturity dates, you can retain liquidity while obtaining favorable interest rates.

– **Government Bonds:** Bonds issued by the U.S. government, including I Bonds, provide reliable, low-risk returns. I Bonds are currently yielding 5.27% annual interest through April 2024, making them an appealing choice.

These conservative investment options yield steady returns devoid of requiring active management.

—

### 5. Initiate a Side Venture with Passive Prospects

Certain side ventures demand initial effort but can ultimately evolve into passive income:

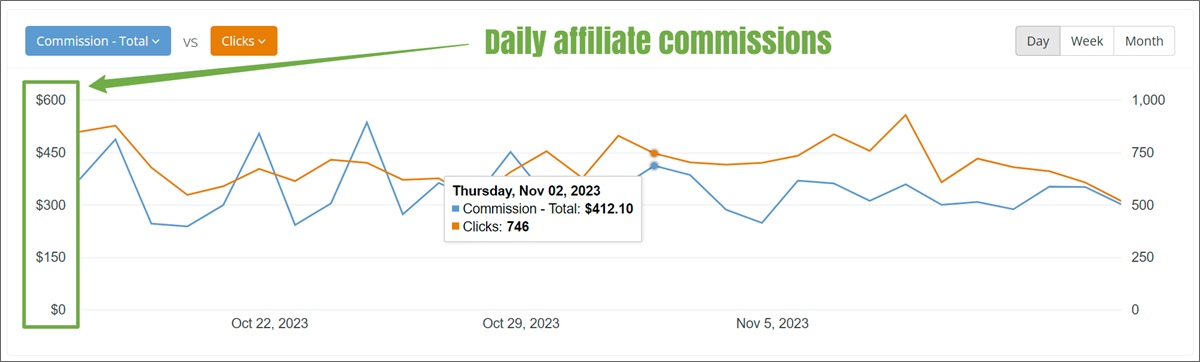

– **Blogging:** Share your expertise and incorporate affiliate marketing links. Once your blog achieves good rankings on Google, it can earn revenue through ads and sponsored content.

– **Stock Photography:** If you have a knack for photography, market your images on Shutterstock or iStock. Each download generates you a commission.

– **Self-Published eBooks:** Platforms like Kindle Direct Publishing (KDP) allow you to sell eBooks independently of traditional publishers.

– **YouTube Channel:** Similar to blogging, a YouTube channel can create passive income via ad revenue, affiliate promotions, and sponsored posts.

While these side ventures require initial content creation, they can yield an ongoing revenue stream with minimal effort once set up.

—

## Strategies for Investing $500 Wisely

Before investing your money into any passive income initiative, reflect on these essential tips:

– **Diversify Your Investments:** Distribute your funds across multiple income sources to mitigate risk and enhance returns.

– **Leverage Robo-Advisors or Financial Experts:** Free or low-cost robo