# Comprehending Stagflation: A Multifaceted Economic Issue

Stagflation is a distinct and concerning economic occurrence distinguished by the concurrent presence of sluggish or stagnant growth, elevated unemployment, and ongoing inflation. Typically, inflation escalates alongside robust economic expansion and substantial demand, whereas recessions generally bring about decreased inflation due to weakened demand. Stagflation contradicts these conventional economic trends, posing a multifaceted challenge for both policymakers and society.

## The Stagflation Quandary

The mixture of stagnant economic progress and increasing prices generates a considerable policy quandary for governments and central banks. During a standard recession, decision-makers can adopt stimulus tactics—like reducing interest rates or boosting government expenditure—to encourage economic activity when inflation is low. However, in a stagflation phase, inflation stays high even as growth declines. This complicates the approach, as invigorating the economy through heightened spending or lowered interest rates risks aggravating inflation.

Consequently, stagflation imposes a dual burden: individuals and families confront escalating living expenses while facing a decline in job prospects and wages. This combined strain reduces purchasing power and contributes to a feeling of prolonged economic difficulty for many.

## A Notable Instance: The Stagflation of the 1970s

One of the most recognized occurrences of stagflation happened in the 1970s, primarily driven by disruptions in oil supply and insufficient monetary strategies. The swift rise in oil prices significantly impacted manufacturing and transportation expenses, resulting in high inflation rates, joblessness, and overall economic stagnation in the United States.

Despite the Federal Reserve’s efforts to tackle inflation through aggressive interest rate increases, the initial actions led to a severe recession, illustrating the complex challenges associated with addressing stagflation. Current global conditions, such as escalating tariffs and economic uncertainties, indicate a possible resurgence of stagflation in the near future, prompting many to reassess their financial tactics.

## Key Characteristics of Stagflation

1. **Limited or Negative Economic Expansion**: The economy undergoes minimal growth or GDP contractions.

2. **Elevated Unemployment**: Joblessness continues, with a sluggish job market even as prices rise.

3. **Ongoing Inflation**: Costs for essential goods and services keep increasing, diminishing consumer purchasing power.

## Approaches for Coping with Stagflation

As we brace for potential stagflation, it is vital to implement strategies that can assist individuals and families in navigating this intricate economic landscape.

### 1) Address All Delayed Repairs Immediately

With rising inflation, it’s wise to tackle necessary repairs on crucial assets, like vehicles and homes, to avoid higher costs in the future. Proactively managing maintenance will alleviate financial pressure when critical repairs become pricier.

### 2) Preserve Cash Reserves

Having 6 to 12 months’ worth of living expenses in liquid funds can offer a financial safety net during uncertain times. High-yield saving accounts and Treasury securities can help keep pace with inflation while ensuring liquidity.

### 3) Revise Your Investment Allocation

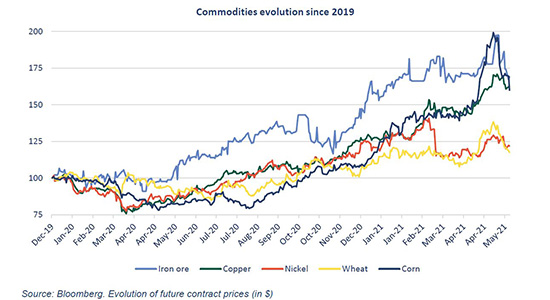

Standard investment methods may be less effective during stagflation. Increasing investment in inflation-hedged assets, like real estate, commodities, or dividend stocks, can help protect against rising expenses and economic stagnation.

### 4) Clearly Articulate Your Investment Goals

Recognizing your risk appetite and establishing your investment objectives is crucial. Aligning your portfolio with your financial aspirations can help you stay focused amidst market volatility.

### 5) Fortify Workplace Connections

The mix of stagflation and increasing layoffs highlights the necessity of nurturing solid workplace relationships. Remaining flexible and showcasing your value can boost job security.

### 6) Broaden Income Sources

Given the risk of high unemployment, developing alternative revenue streams—such as side ventures or freelance opportunities—will reduce reliance on a single income.

### 7) Prioritize Debt Collection

As defaults may become more probable in a stagnant economy, focusing on collecting overdue debts can safeguard financial stability.

### 8) Proactively Address Tenant Concerns

If you are a landlord, cultivating good relations with tenants and maintaining property upkeep can avoid costly vacancies and ensure steady rental revenue.

### 9) Reconsider Your Safe Withdrawal Rate

For retirees, reassessing your withdrawal methods is vital. A more adaptable withdrawal strategy can help sustain your lifestyle without rapidly depleting your savings.

### 10) Explore Early Retirement Options

In some situations, a stagnant job market may make early retirement a viable option, provided that finances are appropriately managed. This can prepare retirees for a rebound as asset values increase after stagflation.

### 11) Pursue Robust Employment Prospects

Now is an opportune time to seek and chase stronger job opportunities, particularly in sectors that may show resilience during economic downturns.

## Preparing for Economic Recovery

Navigating stagflation necessitates a more nuanced strategy compared to traditional recessions. By diversifying investments, bolstering financial security, and proactively gearing up for potential economic trials,