Let’s be honest — one of the most challenging aspects of finances is figuring out how to manage it effectively.

Whether we acknowledge it or not, money influences every facet of our existence. From providing meals to experiencing thrilling adventures, the manner in which we handle our finances shapes the quality of our lives. Many individuals believe that financial achievements stem solely from increasing income, but that’s just part of the narrative. Genuine financial independence arises from mastering the management of what you already possess.

In this article, we’ll delve into three essential financial actions that can assist you in transitioning from monetary hardships to enduring wealth — regardless of your present earnings.

1. Control What You Have — Even If It’s Only a Little

A prevalent financial misconception is the belief that you must possess more money before learning to manage it. But here’s the reality:

If you can’t handle a little money, you won’t be able to handle a lot.

Consider it like grocery shopping. Suppose you spend $200 on groceries for the week. Once you return home, do you consume all the food in one go? Certainly not. You distribute it so it lasts. The same concept applies to your finances — you must allocate your income so it meets your needs, obligations, and future ambitions.

The main point: financial discipline is not about the amount of money you possess, but how you manage it.

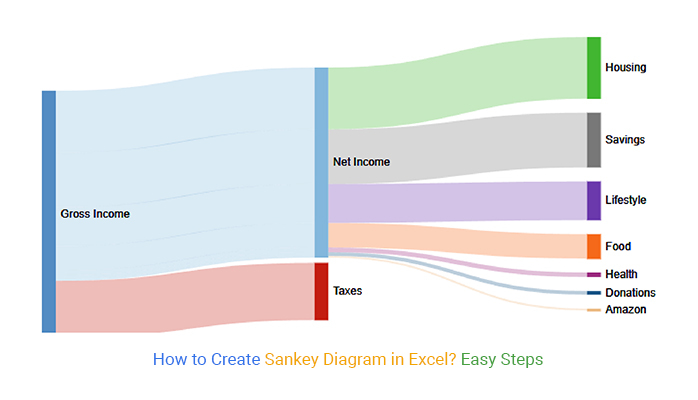

This is where effective money management systems come into play, such as the popular JARS Money Management System. This straightforward approach involves dividing your income into six categories (or “jars”) such as essentials, savings, education, and leisure. By consistently designating percentages of your income to each jar, you establish a habit of balanced money management — regardless of your income level. Whether you earn $100 or $100,000, the percentage-based strategy makes this system adaptable and enduring.

Why is this so crucial?

Because managing money is a habit, and habits remain unchanged even if your paycheck does. If you learn to manage your funds when you have a small amount, you’ll be equipped to manage a much larger sum as your income increases. This habit is the cornerstone of wealth-building — and achieving liberation.

2. Increase Your Earnings By Tackling Larger (or More) Challenges

After you’ve grasped how to manage your finances, the next phase is to strategically boost your earnings.

A substantial income doesn’t just materialize. It’s typically generated by providing value to others. In today’s environment, that value lies in addressing problems.

Simply put:

– Resolve an issue for one person → Receive a modest amount of money

– Resolve an issue for a group → Receive a moderate amount

– Resolve an issue for a large audience → Receive a significant amount of money

The concept is clear — the more individuals you assist, or the larger the issue you address, the more income you’re likely to generate.

How can you identify these chances?

Begin by pinpointing common issues that people face. Seek out pain points. Whether it’s a product that saves time, a service that offers comfort, or a tool that helps others achieve their goals — your business or career can flourish by delivering effective solutions.

You don’t need to be exceptionally clever or possess revolutionary ideas. Everyday solutions to common problems can be incredibly effective. From apps and content generation to coaching, consulting, or simple physical goods — the secret lies in focusing on providing real value to others.

In summary: if you wish to increase your earnings, serve more people.

3. Make Your Money Work for You

The third pivotal financial move on your journey to wealth is discovering how to make your money work for you — commonly known as creating passive income.

Most individuals invest their entire lives working for money. Financial freedom entails reversing that process — allowing your money to create income, even while you rest.

That’s the advantage of passive income.

Passive income is derived from investments or systems that do not necessitate your active involvement once they’re established. Examples include:

– Rental income from properties

– Earnings from a business that runs independently of your daily efforts

– Dividends from shares or mutual funds

– Interest from savings and bonds

– Licensing or royalties for creative endeavors

– Digital products, affiliate marketing, or automated online courses

When your passive income equals or surpasses your monthly expenses, you attain financial freedom — because your lifestyle is supported without needing to exchange time for money.

However, developing streams of passive income starts with financial education and self-discipline. You can take your managed income (from the first step) and reinvest it into assets and projects that yield ongoing returns.

Start small, nurturing your passive income sources over time. The emphasis should be on sustainability and automation — establishing smart systems that amplify your efforts.

Bringing It All Together

Achieving financial freedom is not beyond reach. In fact, it’s possible for anyone willing to cultivate the right habits and make deliberate choices. Here’s a brief summary of the three financial strategies you