How to Regularly Generate $500 Monthly in Passive Income

Creating passive income is an intelligent way to lessen your dependence on your full-time employment while enhancing financial independence. While achieving $500 monthly might seem daunting, it’s completely attainable with the proper tactics and a variety of efforts. Below are five practical approaches you can utilize to consistently generate $500 in passive income each month.

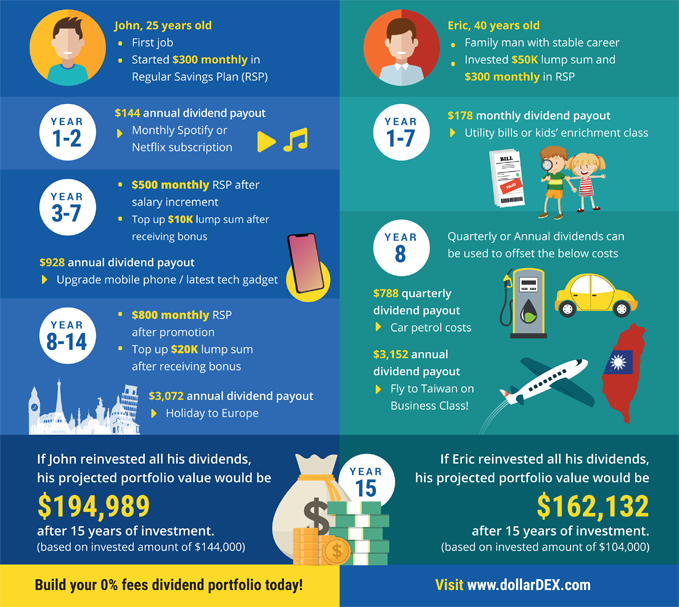

1. Invest in the Stock Market

The stock market provides a multitude of opportunities for wealth growth, even for novices. Various investment avenues can help you create passive income:

– Dividend Stocks: These distribute a fraction of the company’s earnings to shareholders, usually on a quarterly basis. Although they may not see fast growth, they tend to be more stable and reliable.

– Common Stocks: Interested in focusing on capital growth rather than dividends? Common stocks might be suitable. You can also employ robo-advisors like Robinhood to build a well-rounded investment portfolio.

– ETFs (Exchange-Traded Funds): Prefer a more hands-off method? Robo-advisors such as Acorns will automatically allocate your spare change into a diversified ETF portfolio, simplifying stock market investing.

2. Market Digital Products or Online Courses

If you excel at creating or instructing, digital products and online education can be profitable revenue sources:

– Digital Products: Create templates, planners, journals, or marketing resources to sell on platforms such as Etsy or eBay. After your products are listed, they can continue to generate sales with minimal involvement.

– Online Courses: Share your knowledge on subjects ranging from photography to personal finance. Platforms like Teachable enable you to host and sell your course, allowing you to earn money repeatedly from your initial effort.

Additionally, consider upselling options like memberships or personalized coaching to enhance your income further.

3. Invest in Real Estate

Real estate can serve as a significant wealth-building asset, and you don’t necessarily need to own physical properties to reap the benefits:

– Crowdfunding Platforms: Services like Fundrise enable you to invest in commercial real estate ventures with amounts as low as $10, making property investment more attainable and less risky.

– REITs (Real Estate Investment Trusts): These firms purchase and manage income-generating properties. You receive returns through dividends without the need to manage properties yourself.

– Real Estate Syndications: Collaborate with other investors to finance larger property projects. This collective approach allows pooling resources for shared passive income.

4. Accumulate Interest on Your Savings

Your money doesn’t have to remain dormant—make it work for you and increase your passive income:

– High-Yield Savings Accounts: Online banks provide savings accounts with interest rates of 5% or more. Ensure you select an account with no maintenance fees.

– Certificates of Deposit (CDs): Deposit your funds for a fixed period to achieve higher returns. Explore CD laddering—allocating funds across various terms—for increased flexibility.

– Government Bonds: Low-risk options like I Bonds can yield over 5%. While they necessitate holding periods, they are ideal for stable, long-term returns.

5. Launch a Scalable Side Business

Though not always entirely passive initially, side businesses can produce passive income over time once established. Here are a few to consider:

– Blogging: Create a blog centered around a subject you love or know well. After attracting traffic, you can earn through affiliate links, advertisements, and sponsorships.

– Stock Photography: If photography is your hobby, submit your images to platforms like Shutterstock or iStock. You’ll receive royalties each time someone downloads your photos.

– Write an eBook: Leverage your expertise to compose an eBook—then self-publish via Amazon to earn ongoing royalties.

– Start a YouTube Channel: Monetize your videos through YouTube ads, affiliate links, and sponsored content. As your content library expands, so can your earnings.

Advice for Maximizing Your $500 Investment

Before embarking on your initial passive income venture, consider these suggestions:

– Diversify: Avoid placing all your funds in one location. Distribute your investments across multiple income sources to mitigate risk and enhance the likelihood of steady returns.

– Seek Guidance: Even if your budget is limited, robo-advisors or financial consultants can aid you in devising a strategy tailored to your objectives.

– Minimize Expenses: Opt for investment choices that carry low or no fees, as high costs can substantially diminish your profits over time.

Conclusion

Building $500 per month in passive income is achievable—it requires a combination of thoughtful planning and consistent action. Whether investing in stocks, utilizing your savings, launching digital products, or exploring real estate, the essential elements are diversification and perseverance. Start small, test out different methods, and refine your strategies to discover what fits best with your lifestyle and financial aims.