**Small-Cap Investment Discussion: Paul Merriman vs. Dr. Karsten Jeske – Contrasting High-Stakes Strategies**

In the realm of asset allocation and long-term investment, few subjects elicit as much spirited discussion as small-cap investing. Prominent figures in this space include Paul Merriman and Dr. Karsten Jeske — both presenting persuasive, data-driven philosophies, yet differing markedly in their views on risk and reward. This article explores their divergent perspectives, investment strategies, and the implications for your portfolio.

—

### Who Are the Authorities?

**Paul Merriman** is a renowned financial educator, founder of Merriman Wealth Management, and the host of the “Sound Investing” podcast. He champions a diversified buy-and-hold approach that stresses broad market exposure, particularly favoring small-cap and value investments.

**Dr. Karsten Jeske**, known as “Big ERN” from the widely-read financial independence blog *Early Retirement Now*, is an economist and former quantitative analyst on Wall Street. His influence is notably felt within the FIRE (Financial Independence, Retire Early) community, where he adopts a data-centric and risk management perspective to investing. Jeske’s rigorous approach often includes in-depth Monte Carlo simulations.

—

### The Core of the Discussion: Is Emphasizing Small-Caps Beneficial?

#### **Paul Merriman’s Viewpoint: Prioritizing Small and Value**

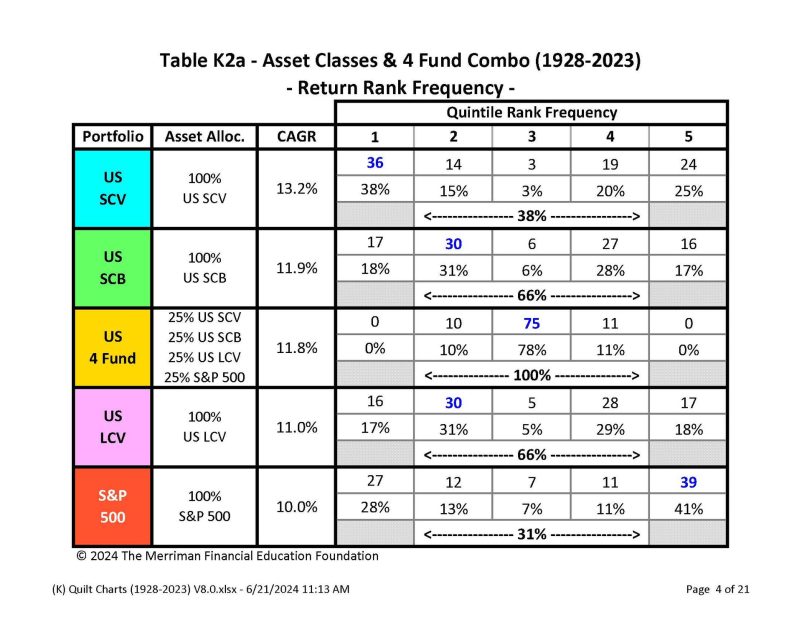

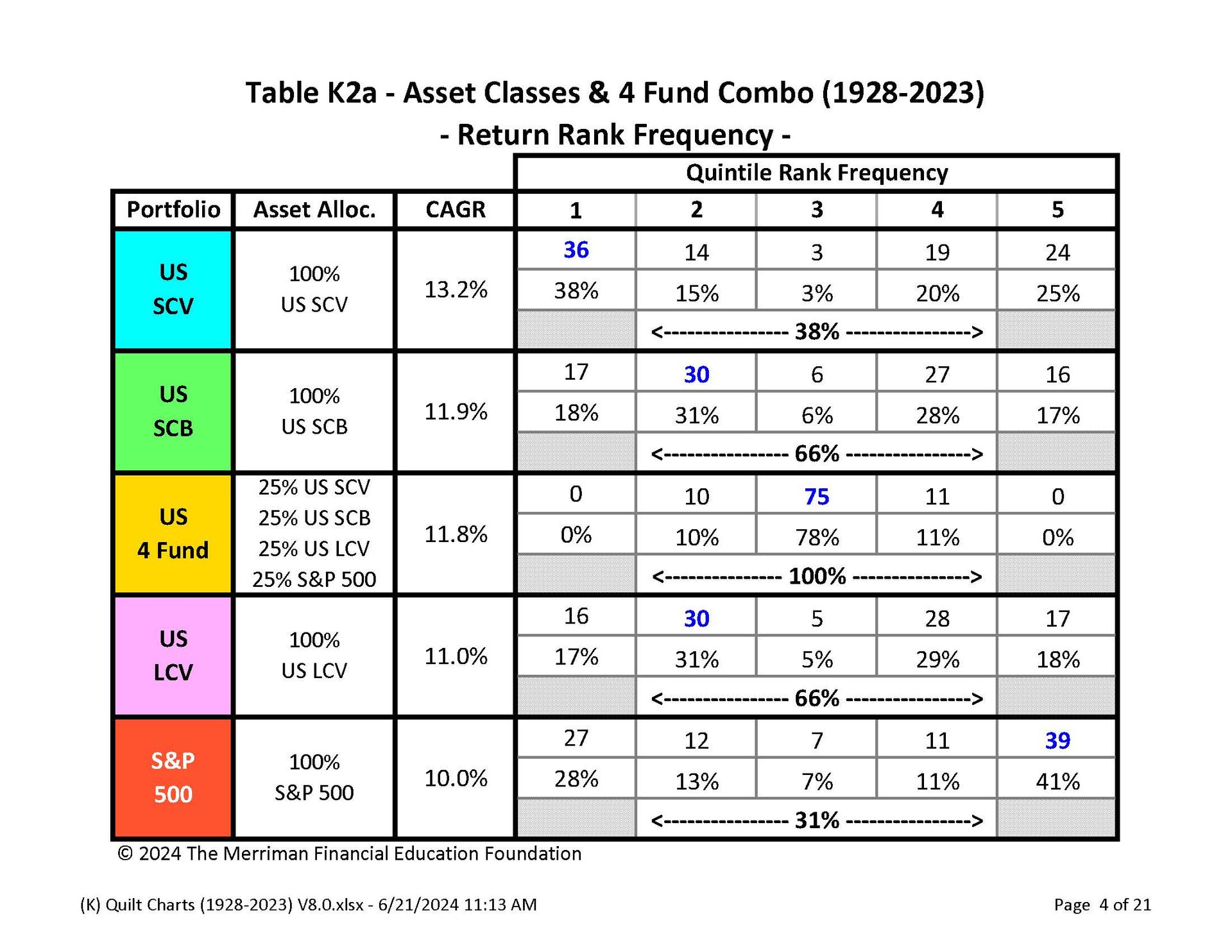

Merriman firmly supports increasing allocations to small-cap and value equities within one’s investment portfolio. His extensive research indicates that these asset classes tend to outperform the overall market over extended periods.

##### Key Insights from Merriman:

– **Superiority of Small-Cap Value**: Research from sources such as the Ibbotson SBBI Yearbook and Fama-French portfolios indicates that small-cap value equities generally outperform large-cap growth stocks in the long run.

– **Importance of Diversification**: Merriman doesn’t propose a 100% small-cap allocation; instead, he advocates for a diversified mix where small-cap value constitutes a notable portion (around 10–20%) of the total.

– **Dependence on Time Horizon**: He points out that investors with longer time frames (20+ years) are better equipped to manage the volatility associated with small-cap investments.

#### Sample Portfolio (Merriman-style):

– 60% Stocks, 40% Bonds

– Within equities:

– 10% U.S. Large-Cap Blend

– 10% U.S. Large-Cap Value

– 10% U.S. Small-Cap Blend

– 10% U.S. Small-Cap Value

– 10% International Value

– 10% Emerging Markets

#### **Dr. Karsten Jeske’s Viewpoint: Risks of Tail and Sequence of Returns**

Although Jeske doesn’t entirely discount the long-term performance potential of small-cap and value equities, he is cautious regarding their real-life implications—particularly for retirees and those nearing retirement who are withdrawing from their investments.

##### Key Insights from Jeske:

– **Sequence of Return Risk (SORR)**: The heightened volatility of small-cap stocks can pose significant risks during the initial years of retirement, where subpar returns can have lasting negative effects on a portfolio.

– **Increased Drawdown Risks**: Jeske highlights that small-cap stocks often experience steeper declines during market downturns and take more time to recover compared to large-cap stocks or diversified indexes.

– **More Conservative Glide Paths**: For individuals adopting FIRE principles or those close to retirement, Jeske suggests a more conservative allocation, which may heavily favor large-cap blends, bonds, or even cash in the short term.

#### Sample Portfolio (Jeske-style for early retirees):

– Glide Path Allocation:

– Initial Portfolio: 60% Equities, 40% Bonds/Cash

– Strong emphasis on large-cap U.S. index funds (e.g., S&P 500)

– Minimal or no small-cap exposure early in retirement

– Gradual increase in equity allocation as retirement progresses, deviating from conventional glide paths

—

### Balancing Performance and Risk: The Dichotomy of Two Metrics

While Merriman is optimistic about small-cap and value investments from a long-term perspective, Jeske offers a meticulous examination of portfolio drawdowns and sequence risks. For instance:

– From 2000 to 2010, small-cap value assets performed better than the S&P 500, corroborating Merriman’s approach.

– However, during the 2008 Global Financial Crisis, small-cap indices faced more severe losses, which underscores Jeske’s reservations about such allocations for retirees.

—

### Tax Efficiency and Practical Considerations

Merriman’s strategy may present complexities for the typical DIY investor. It requires access to targeted asset classes through low-cost index funds or ETFs and may necessitate rebalancing across more than 10 funds, potentially resulting in tax implications in taxable accounts.

Conversely, Jeske generally prefers simplicity and tax efficiency, leaning toward more straightforward strategies.