If you’re considering opening a new bank account or applying for a credit card, Truist Bank presents an array of attractive bonus offers that can provide you with extra cash or even travel benefits. These incentives encompass both personal and business banking solutions and are aligned with Truist’s continuous ambition to grow its clientele after the merger of SunTrust and BB&T.

Having opened Truist accounts myself in the past, I’ve engaged in several of their bonus initiatives and found them to be user-friendly with fairly simple requirements. Below is a guide detailing Truist’s current promotions, eligibility criteria, and key information to keep in mind before applying.

Current Truist Bank Promotions

Truist One Checking: Score a $400 Bonus

New clients who establish a Truist One Checking account can receive a $400 cash bonus. To qualify:

– Open your account online by April 30, 2025

– Your residence must be located in one of the following states: AL, AR, FL, GA, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV, or DC

This promotion aims to foster new relationships with personal banking customers and stands out as one of the more lucrative checking account bonuses currently available.

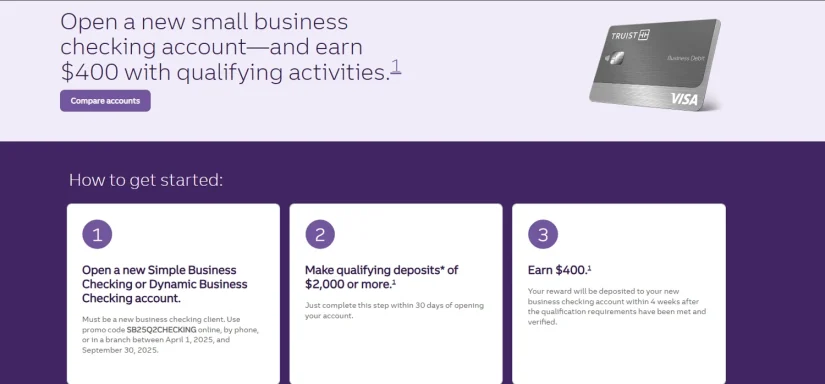

Truist Small Business Checking: Claim $400 Back

For entrepreneurs, Truist is providing a $400 bonus when you open either a Truist Simple Business Checking or Dynamic Business Checking account.

Requirements encompass:

– Being a new business checking customer

– Having your business physically situated in: AL, AR, FL, GA, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV, or DC

One of the appealing aspects is that the deposit requirement is relatively low compared to other banks’ business checking bonuses.

Truist Enjoy Travel Credit Card: Obtain 20,000 Bonus Miles

If you’re on the hunt for travel rewards, Truist’s Enjoy Travel credit card offers considerable value:

– No annual fee

– 20,000 bonus miles (equivalent to $200) after spending $1,500 within three months of account opening

Additional Perks:

– 2x miles for every $1 spent on airfare, hotel accommodations, and car rentals

– 1x miles on all other expenses

– 10%–50% Loyalty Travel Bonus when points are redeemed for travel via Truist’s rewards platform (dependent on Truist deposit account balances)

– Up to $85 credit for TSA PreCheck® or Global Entry every four years

– Points do not expire as long as your account is active

Understanding Bank Bonuses

What Are Bank Bonuses?

Bank promotions generally refer to cash rewards or benefits for new customers who meet specific conditions—like making qualifying direct deposits or sustaining a minimum balance for a set duration. They’re promotional strategies to attract new clientele or reward long-standing customers.

What to Be Cautious About

While these offers are appealing, it’s essential to scrutinize the fine print. Most bonuses come with explicit requirements such as:

– Setting up qualifying direct deposits (typically from employers or government sources)

– Maintaining a certain account balance for several months

– Timing: many offers are time-sensitive

– Possible monthly account maintenance fees (although these are often waived under specific circumstances)

– Eligibility: most Truist bonuses are exclusively for new clients

Review the terms on Truist’s official website or consult with a representative prior to opening any account to confirm your eligibility.

Is a Truist Bank Bonus Right for You?

If you’re seeking a dependable bank with competitive reward promotions, Truist is a commendable choice—especially if you plan on opening a new account soon. Just ensure you satisfy the eligibility criteria before applying.

As a prudent measure, compare offers from multiple banks, analyze the complete terms and conditions, and evaluate whether the bonuses align with your financial practices and objectives.

For residents and businesses in Truist’s designated states, these promotions can yield a significant return just for switching banks or exploring a new card.

Final Tip: Always stay alert for modifications, as bank promotions may expire or undergo updates frequently. Set a reminder to check back regularly or subscribe to promotion updates from your favored financial platform.

Happy banking—and bonus collecting!