“If investing were solely a matter of revenue subtracting costs equating to profit, we’d all be Warren Buffett by now, wouldn’t we?”

Yet here we find ourselves, examining firms like Broadcom or Brookfield, puzzled. Sales are surging. Dividends are consistently paid. But… EPS (earnings per share) is declining? What’s the story?

Today, we explore an essential (and often misinterpreted) component of the dividend triangle: Earnings Per Share.

Spoiler alert: EPS isn’t nearly as clear-cut—or as valuable on its own—as many investors presume.

What is EPS (And Why It’s Insufficient)?

Let’s begin with the fundamentals. EPS represents the profit a company generates per share of stock. Seems straightforward, right?

EPS = (Net Income – Preferred Dividends) ÷ Average Outstanding Shares

EPS is integral to several popular investing ratios:

To determine if a company can sustain its dividend payments, one examines the payout ratio: Payout ratio: Dividend per share/Earnings per share

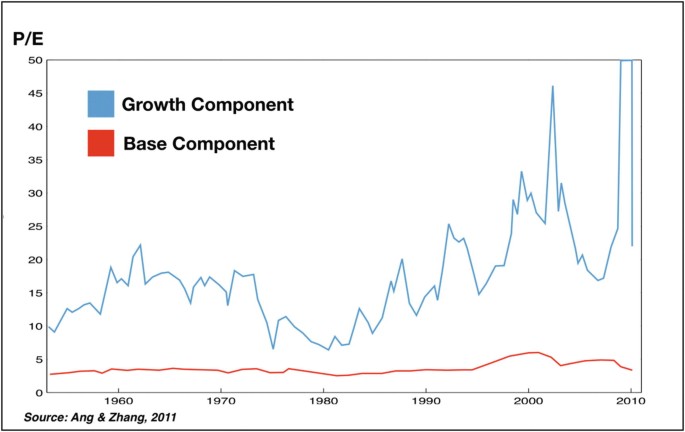

For assessing whether a company is valued fairly, the Price to Earnings (PE) ratio can be analyzed: Price to earnings (PE): Stock price/Earnings per share

Thus, if a company increases its earnings, everything seems promising—dividend payouts are viable, the valuation appears just, and the stock may be worth buying.

But here’s the catch: EPS can be easily misleading.

Why EPS Gets Odd (Even When the Company is Thriving)

There are numerous instances where a company’s EPS fails to mirror its true performance. Major contributors include:

Amortization & depreciation: Non-cash deductions that lower earnings but don’t impair the company’s capacity to distribute dividends.

One-off gains or losses: Selling an asset, legal settlements, restructuring expenses—these can dramatically inflate or deflate earnings for a particular quarter or year.

Foreign exchange shifts or investment profits can also create fluctuations.

Consider Broadcom as an illustration. Its revenue grew consistently year after year, yet EPS fell in 2017, 2020, and 2024. That doesn’t imply management has lost its way—it signals the necessity to investigate further into the underlying factors.

What to Monitor Instead (Depending on the Industry)

Here lies the true challenge: various sectors report earnings differently. EPS can be a good starting point, though it often isn’t the most effective metric.

Capital-intensive sectors can be complicated, as capital expenditures (CAPEX) will significantly influence how earnings are represented.

Here’s what to focus on instead:

Pipelines

A notable example for unusual EPS is Enbridge’s (ENB.TO) dividend relative to its EPS. The firm displays a significant payout ratio that could soar to 200% or 300%! Pipelines are recognized for heavily investing in their infrastructure. This leads to substantial depreciation figures on their income statements.

Many energy firms allocate funds for their infrastructure development and exploration of new resources.

What to monitor: Funds from operations (FFO), cash flow per share, or free cash flow.

Utilities

Similar to pipelines, utilities generally invest heavily in new projects, resulting in considerable depreciation. Include mergers and acquisitions, and many adjustments are required to determine if a company can support a dividend.

Frequently, the payout ratio may appear illogical, necessitating the combination of free cash flow and new debts (which aren’t used for dividend payments, but rather for CAPEX or acquisitions).

What to monitor: Funds from operations (FFO) and FFO per share are often pertinent metrics to observe.

Big Pharma

Firms such as AbbVie (ABBV) or Johnson & Johnson (JNJ) invest substantial resources in Research and Development (R&D) to create new drugs protected by patents. These business models are also more prone to legal challenges compared to others.

The R&D expenditures are integral to their model and diminish the company’s capability to issue dividends. However, the declining value of a patent impacts earnings but doesn’t limit the firm’s capacity to offer a higher dividend.

These companies are also recognized for significant mergers (or spin-offs like Kenvue from JNJ). Major transactions will influence EPS.

What to monitor: EPS can still be utilized, but attention should be given to lawsuits and patent expiration announcements.

Telcos

When examining major players like AT&T, Verizon, BCE, Telus, and Rogers, they often discuss their cash flow in conjunction with earnings. This makes sense, as earnings are significantly influenced by amortization and depreciation.

These companies typically present a target payout ratio along with their adjusted version of ratio calculations (which are based more on cash flow).

The drawback is that in most instances mentioned here, one must rely on management’s figures. Earnings fall under Generally Accepted Accounting Principles (GAAP) presented in financial reports.