### Have You Come Across the No-Spend Challenge?

The no-spend challenge is a popular idea adopted by finance-conscious and minimalist bloggers urging people to save more while simplifying their lives. The concept is simple: during a set timeframe, participants cease spending on non-essentials and concentrate on saving money. As you accumulate savings and make wise investments, you progress towards attaining financial independence.

For some, such as the author of this viewpoint, joining the no-spend challenge may not seem crucial due to their already economical habits. With a remarkable saving rate of around 50% since 1999, and an even higher 80% as they prepare for retirement, this author has yet to participate in an official no-spend challenge. Nevertheless, the current economic situation makes a strong argument for attempting one.

### Let’s Try the No-Spend Challenge

Here are several valid reasons to think about taking part in a no-spend challenge:

– **Rising Inflation**: With inflation on the rise, goods and services are getting more expensive, making it vital to adjust now.

– **Economic Instability**: There’s a considerable risk of recession or stagflation next year due to trade disputes and geopolitical tensions, leading to possible job instability.

– **Stock Market Sensitivity**: With the market approximately 22 times forward earnings, there is a vulnerability to corrections, making cash reserves crucial.

– **Future Investment Possibilities**: Saving now positions participants to take advantage of ‘buy the dip’ opportunities in the market.

– **Redirecting Money for Children**: A no-spend challenge can help generate extra savings for children’s financial futures, such as Roth IRAs or 529 plans.

– **Local Housing Market Slowdown**: With high mortgage rates and excess building, increasing down payments can result in better property deals.

– **Resetting Financial Practices**: If you’re struggling to manage expenses on a paycheck-to-paycheck basis, a no-spend challenge can aid in restoring financial stability.

### Additional Reasons to Attempt a No-Spend Challenge

If the practical reasons don’t resonate, think about these extra incentives:

– **Assess Your Financial Fortitude**: Prepare for potential life events that could strain your finances.

– **Boost Financial Discipline**: Similar to physical strength building, financial discipline can improve with repeated practice.

– **Reassess Happiness Metrics**: You may realize that the pleasures of life aren’t reliant on spending.

– **Minimize Decision Fatigue**: Fewer purchases lead to fewer decisions, freeing up mental energy for other priorities.

– **Reconsider Income Necessity**: You might discover contentment in a lower income if you’ve been savvy with your savings.

### Challenge Length: Minimum 3 Months

While anyone can engage in a challenge for a short duration, a sustained commitment of at least three months is crucial for fostering lasting behavior changes and forming new habits. Here are examples of spending reductions to consider during this timeframe:

– Indulgences like cheeseburgers and snacks.

– Non-essential apparel acquisitions.

– Haircuts, opting for do-it-yourself instead.

– Upgrading to more expensive flight classes.

– High-cost vacation rentals.

– Latest electronics.

– Costs associated with household services, like cleaning.

– In-game purchases.

While necessary expenses (housing, insurance, education, basic food) are to remain, the aim is to redirect saved funds into investments such as stocks, bonds, or real estate, progressively working towards reducing discretionary spending by at least $1,500 each month.

### If You’re Saving Less Than 20% Of Your Income…

This is a fantastic chance to boost financial security. Aim to maximize tax-advantaged accounts and save an additional 20% or more. Even if your annual income is under $100,000, you may discover that substantial savings are feasible.

For individuals already saving a small amount, consider challenging yourself to elevate that rate during the no-spend challenge; an annual savings rate of 25%–30% can significantly impact your long-term financial independence.

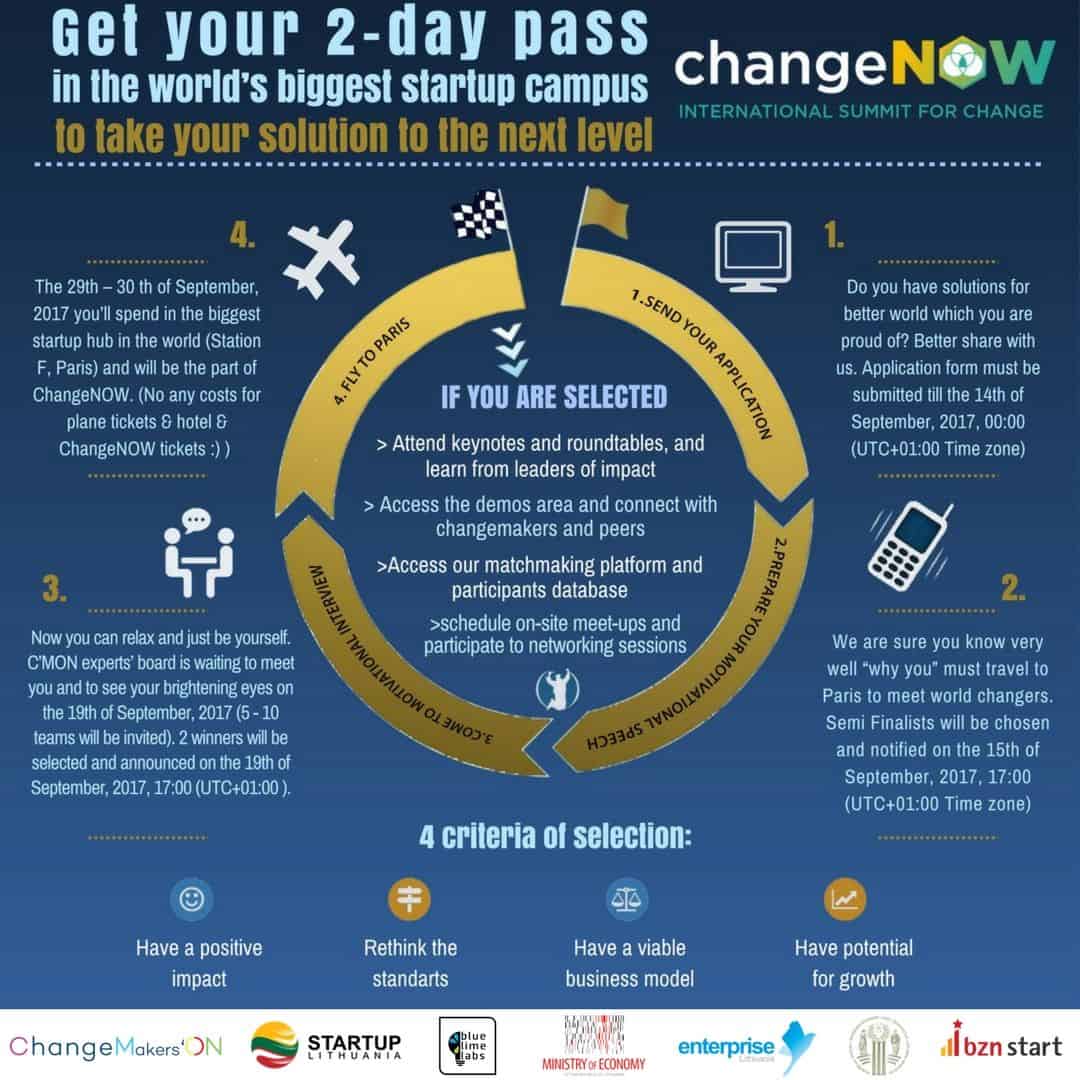

### Savings Rate Chart For Financial Independence

By just increasing your savings rate by 5%, you can potentially cut years off your working life. A savings rate of 50% or greater can enable you to retire within 20 years of beginning your career, or even sooner.

Transitioning to a life with reduced spending directly contributes to future financial autonomy. Although it demands some difficult choices, the trade-offs often lead to greater long-term happiness and fulfillment.

Will you accept the no-spend challenge? What areas will you commit to reducing? Engaging in this challenge could reveal a new path toward financial well-being.