**Q&A: Is It Wise to Purchase a Home After Accumulating $1.2 Million While Still Renting?**

*Introduction:*

Choosing to buy a home is a major financial choice that can influence personal wealth and lifestyle for years to come. For those who have successfully saved a considerable sum, such as $1.2 million, the decision becomes even more complex. In this discussion, we analyze the elements involved in determining whether to buy a home after achieving this financial milestone while remaining renters.

*Q: What advantages come with purchasing a home using the saved funds?*

A: Acquiring a home can offer multiple advantages, such as creating equity, the potential for property value appreciation, and ensuring a stable living arrangement without worries about escalating rent prices. Homeownership can also provide tax benefits, including deductions for mortgage interest and property taxes. Furthermore, buying a home can satisfy personal aspirations related to establishing a stable base for family life or experiencing the pride of ownership.

*Q: What could be the benefits of continuing to rent despite having $1.2 million saved?*

A: Renting can allow for greater flexibility regarding relocation for job prospects or personal preferences. This option might also be financially prudent if the local housing market is inflated or if property prices are anticipated to decline. Moreover, renters do not face the obligations of home maintenance and repairs, leading to savings in both time and finances.

*Q: How should current market trends affect the decision-making process?*

A: Market trends are a vital consideration in making this choice. If interest rates are favorable, it may be a good time to secure a mortgage with beneficial terms. Conversely, if property values are inflated or the market is unstable, it may be advisable to wait for conditions to improve. Prospective buyers should also reflect on the economic forecast, including job security and inflation expectations, which can influence affordability and long-term financial objectives.

*Q: What financial aspects must be considered?*

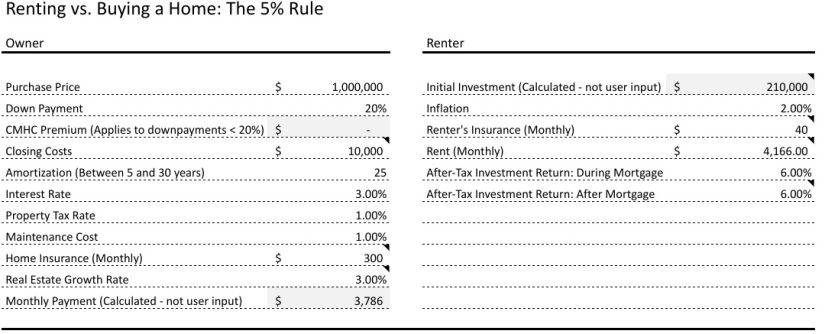

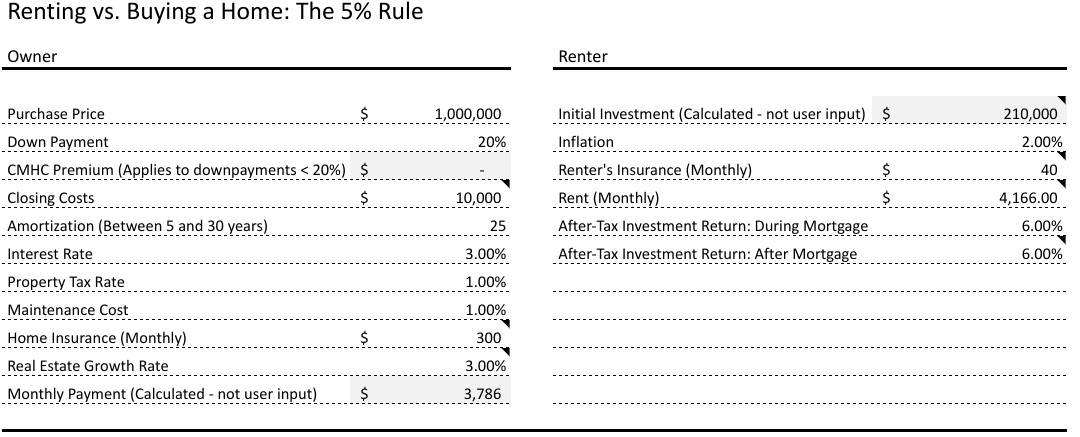

A: In deciding whether to purchase a home, it’s crucial to evaluate the full cost of homeownership, which includes the down payment, closing costs, property taxes, insurance, and maintenance. Considering the opportunity cost of locking away a significant amount of savings in real estate versus other investment options is also vital. A diversified investment portfolio may yield better returns compared to real estate, especially if the housing market is not showing strong appreciation.

*Q: How do personal lifestyle and future goals impact the decision?*

A: Personal lifestyle and long-term objectives are important considerations. For instance, if priorities include stability, community engagement, or the ability to customize living areas, homeownership may resonate more closely with those values. However, for individuals who prioritize flexibility and have careers requiring frequent moves, renting might be more appropriate for their lifestyle.

*Q: Is it a sound financial decision to invest in real estate at this time?*

A: With $1.2 million saved, potential buyers must deliberate the choice carefully. If they can purchase a home outright, they eliminate interest payments, yet they might opt to leverage low interest rates and invest a portion of their savings elsewhere. Reviewing long-term financial goals, such as retirement plans and various investment strategies, is crucial in determining whether real estate fits into a balanced financial approach.

*Conclusion:*

In the end, the choice to buy a home after accumulating $1.2 million depends on a combination of financial evaluation, market circumstances, and personal lifestyle preferences. Future homeowners are advised to conduct a comprehensive review of their financial conditions, consider seeking guidance from financial experts, and relate their decision to both current needs and long-term aspirations to ensure a choice that promotes both financial wellness and personal fulfillment.