**Q&A: Handling Finances Following the Arrival of a Baby and a 50% Drop in Income**

The arrival of a new baby brings immense joy and excitement, yet it can also introduce considerable financial adjustments. This effect is heightened if you are facing a major income drop concurrently. Here, we address some frequently asked questions and provide solutions to efficiently manage your finances in this difficult scenario.

**Q1: What adjustments should I make to my budget after a 50% income drop and the arrival of a new baby?**

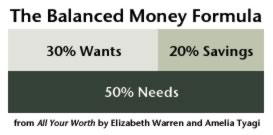

A: Start by reassessing your existing budget to pinpoint essential versus non-essential expenses. Focus on necessities such as housing, utilities, groceries, and baby-related costs. Think about minimizing or cutting discretionary spending, like dining out or entertainment. Formulate a streamlined budget that emphasizes meeting critical needs first.

**Q2: Are there financial aid programs available for new parents facing income loss?**

A: Indeed, various programs can provide assistance. Consider applying for government aid programs such as Supplemental Nutrition Assistance Program (SNAP), Women, Infants, and Children (WIC), or Temporary Assistance for Needy Families (TANF), which can help alleviate financial pressures. Investigate eligibility for local community resources or non-profits that support families in need.

**Q3: What strategies can I use to cut costs related to childcare and baby necessities?**

A: To decrease childcare expenses, consider options like family support or local co-op babysitting networks. For baby necessities, think about purchasing gently used items, utilizing hand-me-downs, or seeking discounts on essential products. Breastfeeding, when feasible, can also save costs compared to formula feeding.

**Q4: Is it advisable to tap into our savings or retirement funds?**

A: Although accessing savings may occasionally be necessary, try to restrict withdrawals to safeguard long-term financial stability. Utilize funds from an emergency savings account if available, but avoid withdrawing from retirement accounts unless absolutely essential due to possible tax implications and repercussions on future savings.

**Q5: How do we manage debt with decreased income and baby-related expenses?**

A: Focus on high-interest debts like credit cards to avert accumulating more interest. Consider negotiating lower interest rates or payment terms with creditors. If feasible, make minimum payments to preserve credit scores while prioritizing essential expenses.

**Q6: Are there opportunities to increase income during this time?**

A: Look into flexible avenues to boost income, such as freelancing, remote part-time jobs, or utilizing your skills for a side business. Think about sharing income-generating responsibilities with your partner. Ensure to maintain a healthy work-life balance.

**Q7: What should our long-term financial plan be after adjusting to the income drop and welcoming the baby?**

A: Once your financial situation is more stable, slowly rebuild your emergency savings in preparation for future uncertainties. Reassess financial objectives, including retirement savings and future educational funds for your child. Consider consulting a financial planner to create a detailed strategy tailored to your present situation and long-term goals.

Navigating finances after a baby’s arrival and a significant income decline can be daunting, but with prudent budgeting, exploring assistance options, and making educated financial choices, it is feasible to successfully manage this transition.