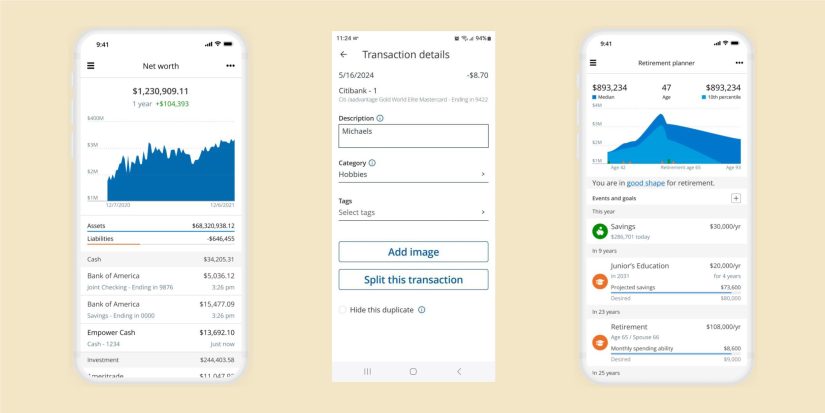

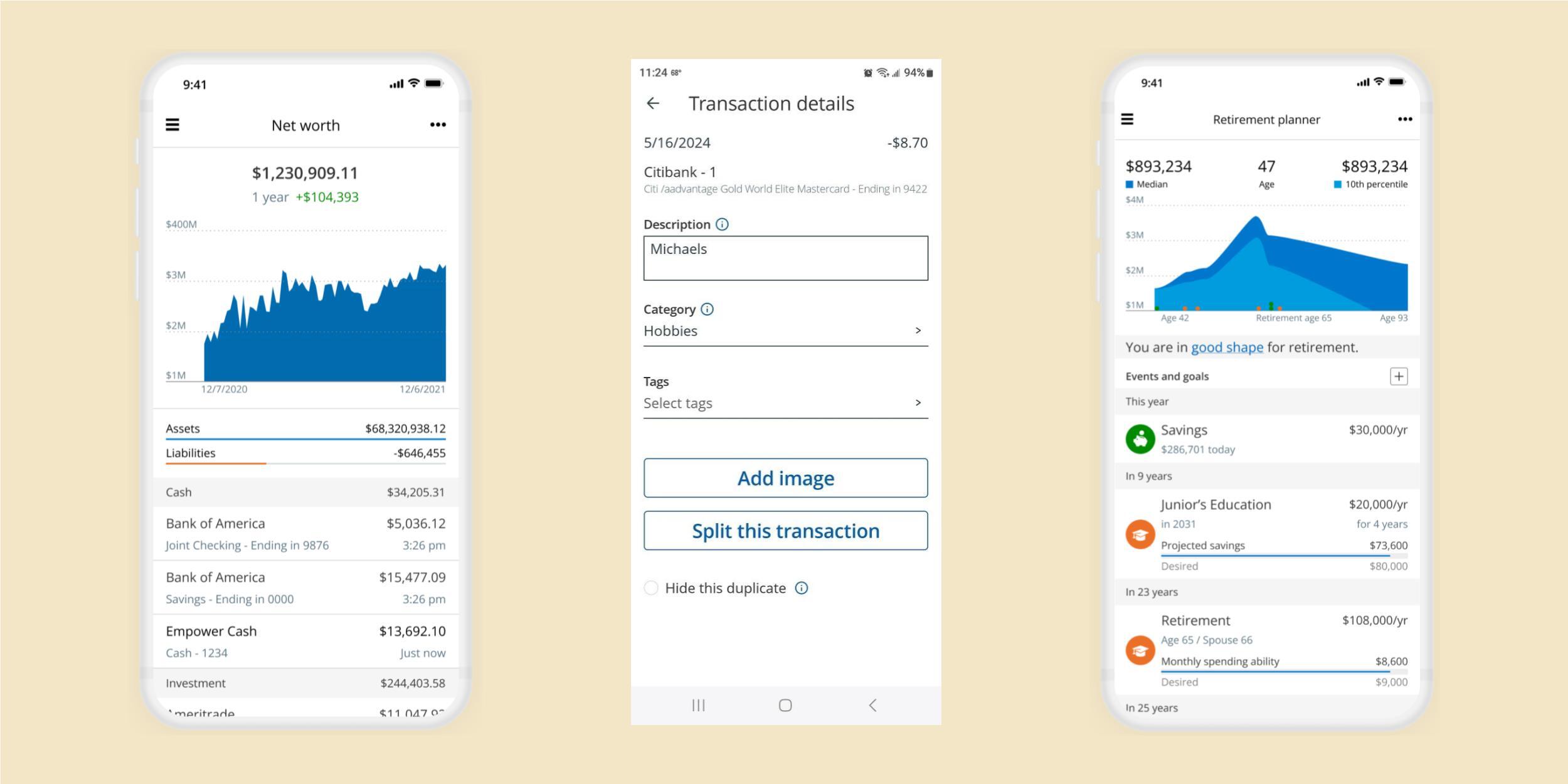

You may be familiar with Empower, the application that offers fee-free cash advances of up to $250 without requiring a credit check. For a nominal fee, you can obtain immediate cash instead of waiting several business days for regular processing.

The Empower app is especially attractive to gig workers, as freelancers, contractors, and other non-traditional employees can obtain an Empower cash advance.

While Empower serves as a favorable choice for quick cash needs, there are various other apps similar to Empower that might provide larger loans, more adaptable terms, or other valuable budgeting features.

7 Top Apps Like Empower for Small Cash Advances

Here are our leading recommendations for apps akin to Empower that you can explore today:

1. Chime

Best for: Instant Access

Chime is recognized as a robust checking account alternative, but it can also offer account holders up to $200 through the Chime SpotMe feature.

SpotMe enables you to overdraw your account by up to $200 on debit card transactions without incurring any overdraft fees.

Chime cardholders also benefit from no monthly service fees, no minimum balance fees, no foreign transaction fees, and no ATM fees at over 60,000 ATMs across the country.

Account holders can access their salaries up to two days ahead of schedule if they set up direct deposit.

Chime collaborates with The Bancorp Bank, N.A., and Stride Bank, N.A., members of the FDIC.

2. Dave

Best for: Minimal Fees

Dave grants users an advance of up to $500 without charging interest or conducting a credit check, with repayment due on your next payday.

In addition to providing access to emergency funds, Dave offers budgeting tools, overdraft protection notifications, credit monitoring, and automated bill payments.

Dave links to your external bank account to facilitate cash advances and other financial tools, with a monthly subscription fee of only $1.

3. Varo

Best for: Adaptable Repayment Terms

Varo provides banking services such as checking and high-yield savings accounts, along with tools for automating savings.

Varo Advance allows for up to $250 before your upcoming paycheck, offering amounts ranging from $20 to $250 without interest, with repayment due within 30 days.

Advances of up to $20 are complimentary, while advances of $50 or more attract a fee between $4 and $15, with no extra fees or tips necessary.

Varo clients may qualify for cash advances up to $500 based on a positive repayment record.

4. Cleo App

Best for: AI Assistance

Cleo acts as a financial voice assistant, assisting users in budgeting, saving, tracking expenditures, monitoring credit scores, and providing advances when necessary.

You can pose financial queries to Cleo and receive recommendations based on your financial data and insights.

Cleo Plus subscribers pay a monthly fee of $5.99 to obtain cash advances of up to $250 with no credit check or additional fees.

5. MoneyLion

Best for: Significant Cash Advance Amounts

MoneyLion provides payday-like advances reaching up to $1,000 through Instacash for debit card holders, alongside features for budgeting assistance and credit monitoring.

To qualify for advances, you must be a MoneyLion member, utilize direct deposits, and meet other eligibility requirements.

6. EarnIn

Best for: Early Access to Earnings

EarnIn enables access to your earned wages prior to payday, allowing cash advances of up to $750 per pay period without a credit check or fees.

Funds can be accessed within three days, with an option to tip or pay for Lightning Speed service for immediate access.

7. Brigit Loan App

Best for: Preventing Overdraft Charges

Brigit offers up to $250 in interest-free advances, with proactive account monitoring to avert overdraft charges.

Brigit delivers a straightforward user experience, collaborating with major financial institutions, with subscription options for expedited cash delivery.

Pros and Cons of Cash Advance Apps

Pros

– Instant access to funds without interest

– No credit check necessary

– Avoids high-interest payday loans

– Aids in preventing overdraft charges

Cons

– Requires a subscription fee for cash advances

– Charges for immediate funds access

– May create reliance on cash advances

– Eligibility may fluctuate, even with a subscription

– Limited advance amounts for certain credit profiles

Alternatives

– Salary advance from your employer

– Utilizing credit cards for unplanned expenses

– Peer-to-peer loans with variable interest rates

– Community Development Financial Institutions (CDFI) loans

– Selling unused belongings for quick cash

FAQs

Do You Need to Pay Interest on Cash Advances?

No, apps similar to Empower do not charge interest on cash advances but do require a monthly subscription fee.

What is the Easiest Loan to Obtain Immediately?

Payday loans and car title loans are simple to secure but come with high interest rates. Cash advances from apps necessitate verified income and active bank accounts.

What Are the Quickest Apps like Empower for Small Cash Advances?

Apps like Chime can disburse funds instantly, while other applications provide same-day advances with fees.