**Grasping Estate Tax and the Step-Up in Basis: A Resource for Wealth Creators**

Envision committing your life to amass wealth via investments in real estate, stocks, or a business, all with the goal of leaving a significant inheritance for your children. Yet, questions often arise: will the government take a large part of this inheritance through taxation?

With the federal estate tax exemption threshold projected to hit $30 million for married couples in 2026 under the One Big Beautiful Bill Act (OBBBA), it’s crucial to clarify the ramifications of the estate tax and the notion of the step-up in basis, two vital elements in estate planning.

### The Fundamentals: Estate Tax vs. Step-Up in Basis

There are two main taxes that come into play after an individual’s passing:

1. **Estate Tax**: This is a tax applied to the overall value of the estate at death if it exceeds the federal exemption limit. The estate holds the obligation to pay this tax.

2. **Capital Gains Tax**: This tax is levied on the increase in asset value; however, it only takes effect when those assets are sold. This tax falls on the heirs.

Upon an individual’s death, their heirs benefit from a step-up in cost basis for inherited assets, which essentially resets the basis of the asset to its fair market value at the time of passing. This modification eliminates the capital gains accrued during the life of the decedent.

### Step-Up in Basis vs. Estate Tax Example 1: A $50 Million House

Picture a couple that possesses a house valued at $50 million, originally acquired for $1 million. After their passing, they bequeath the home to their two children:

– **Capital Gains Tax**: Without the step-up in basis, if the children sell the home right away, they would incur capital gains tax on the $49 million profit, leading to an estimated tax bill of $11 million.

– **Estate Tax**: Nevertheless, with the federal exemption, the taxable estate is assessed at $22 million, resulting in an estate tax bill of $8.8 million. This tax must be settled from the estate before the children can inherit the home.

Without the step-up, the total tax burden for the heirs could near $20.5 million. The step-up effectively alleviates their tax responsibility considerably by removing capital gains tax on inherited assets.

### Step-Up in Basis vs. Estate Tax Example 2: A $40 Million Stock Portfolio

Envision an estate largely consisting of a stock portfolio that has risen from a $2 million basis to $40 million:

– If the total assets amount to $45 million, with a federal exemption of $25 million, the estate tax would total $8 million.

– The step-up enables the heirs to bypass capital gains tax on the $38 million increase, which would typically lead to additional taxes of around $9 million.

### Step-Up in Basis Example 3: A $4 Million Rental Property

Consider a rental property that was acquired for $400,000, now valued at $4 million. The total estate is beneath the federal exemption limit, thus no estate tax is required.

Without the step-up, if gifted during the owner’s lifetime, the heirs would face taxation upon selling the asset. The step-up allows them to sell immediately without tax liabilities, highlighting the clear benefits of retaining appreciated assets until death.

### The Step-Up: A Mechanism, Not a Barrier

The step-up acts as a tool to reduce capital gains tax but does not abolish the estate tax. For affluent families, the advantage lies in lessening the total tax consequences for heirs, potentially avoiding a combined tax responsibility exceeding 60%. Even for estates below the exemption threshold, the step-up significantly assists heirs in terms of capital gains tax issues.

### Mitigating Estate Tax: Strategic Measures

For estates surpassing federal exemptions, proactive steps are essential:

1. **Grantor Retained Annuity Trust (GRAT)**: Effective for relocating appreciating assets outside the estate.

2. **Charitable Contributions**: Gifts can lower the taxable estate while benefiting favored causes.

3. **Life Insurance within an Irrevocable Life Insurance Trust (ILIT)**: Offers liquidity to manage estate taxes without being included in the taxable estate.

4. **Annual Gifting**: Facilitates the systematic transfer of wealth without touching lifetime exemptions.

5. **Family Limited Partnerships (FLP)**: May allow for discounts on asset valuations for tax purposes.

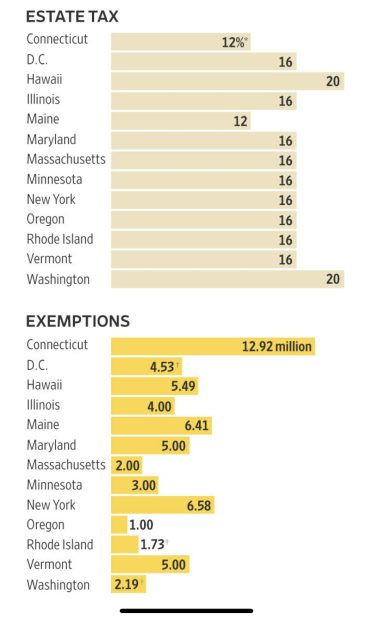

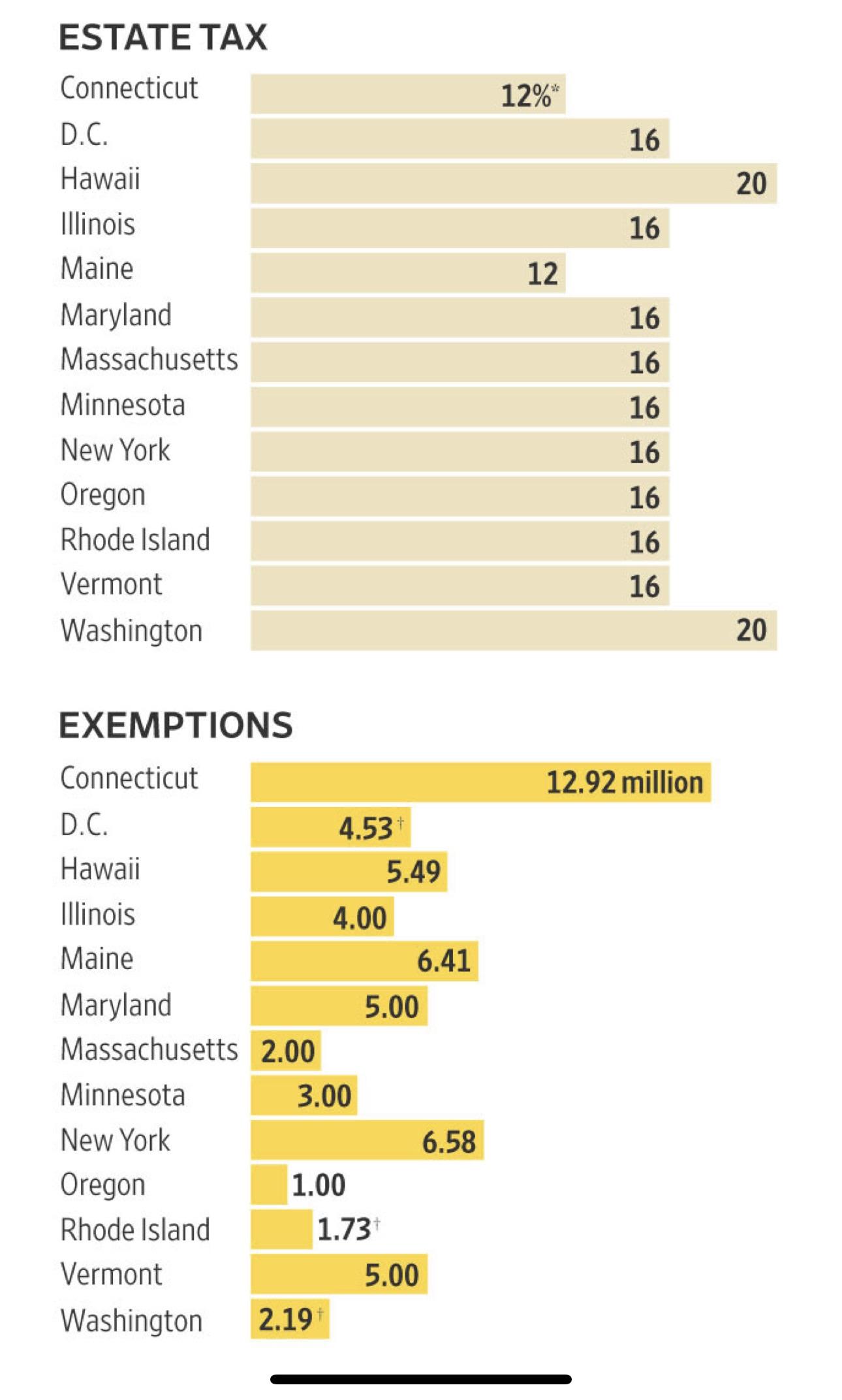

6. **Relocation to Lower Tax Jurisdictions**: Moving to states or nations with no estate taxes can be advantageous.

### Concluding Remarks

The step-up in basis provides a significant benefit for heirs, particularly for estates under the federal exemption limit. However, as the estate expands, anticipating and preparing for the estate tax becomes crucial. Engaging with an estate planning attorney is recommended to navigate the intricacies of these tax ramifications efficiently. By taking this step, individuals can safeguard their legacies for future generations, lowering their heirs’ tax obligations through thoughtful estate management.