In 2016, I made a transformative choice: I took a sabbatical, placed my family in a compact RV, and drove to Costa Rica.

Upon my return in 2017, I formally resigned from my position as a private banker at National Bank and began dedicating my time fully to my project: Dividend Stocks Rock. I also opted to oversee my pension account held at the National Bank. I have openly constructed this portfolio since 2017 to serve as a genuine case study. I decided to allocate 100% of this funds into dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This indicates that I’m unable to contribute additional capital to the account, and growth is solely produced via capital gains and dividends. I don’t disclose this portfolio’s outcomes to flaunt my returns or to encourage you to mimic my strategy. I merely wish to illustrate how I manage my portfolio each month, encompassing both the positives and negatives. I hope my experiences can provide some insights.

While I Was Away…

One of the primary benefits of adhering to a simple strategy is the freedom to go on vacation, take hikes for several days, and entirely disconnect from the stock market without the anxiety of potential issues arising.

I’ve been away for three consecutive weeks from stock market activities. I didn’t monitor my portfolio or the companies’ earnings announcements. By common standards, I may be seen as late to the game. You might think that, or you could find that you can hardly recall what transpired in July of 2024.

I will elaborate more on this later, but first, let’s go over my portfolio results.

Performance in Review

Let’s begin with the figures as of August 8th, 2025 (prior to the bell):

Initial investment made in September 2017 (no extra capital added): $108,760.02.

Current portfolio valuation: $310,234.85

Dividends received: $5,260.53 (TTM)

Average yield: 1.70%

2024 performance: +26.00%

VFV.TO= +35.24%, XIU.TO = +20.72%

Dividend growth: +12.22%

Total return since inception (Sep 2017 – August 2025): 185.25%

Annualized return (since September 2017 – 92 months): 14.48%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 15.99% (total return 215.70%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 11.70% (total return 135.70%)

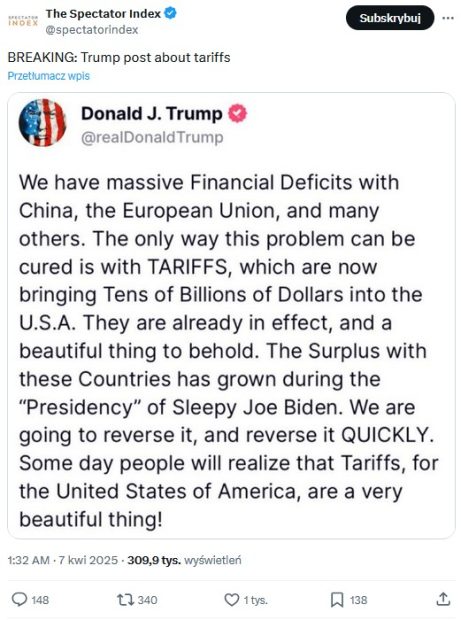

Trump Wins… So Far

One of the primary benefits of adhering to a straightforward strategy is the freedom to go on vacation, take hikes for several days, and completely disconnect from the stock market without the worry of something going wrong.

I’ve missed three complete weeks of stock market movements. I didn’t track my portfolio or the companies’ earnings announcements. By the majority’s assessment, I may currently be seen as late to the game. You can make that assertion, or perhaps you’ll find that you can hardly recall what happened in July of 2024.

What “just occurred” won’t hold significance in a few months, let alone in a year or beyond. A stock might rise 5% in a single day, another may fall 15%, and five years down the line, no one remembers.

So, during my time away, earnings reports surfaced, Apple announced another $100B investment in the U.S., and the market responded positively.

Telus separated its wireless tower infrastructure operations and formed Terrion, now Canada’s largest dedicated wireless tower operator. Shortly after the establishment of this company, Telus sold 49.9% of its equity stake to La Caisse de Dépôt et Placements du Quebec for $1.26B. This action was taken with two objectives in mind:

Reducing some debt (I appreciate that).

Facilitating wholesale access and third-party co-location.

In theory, this strategy appears sound. I appreciate that Telus is reducing its debt, and I will be observing how much revenue the co-location of cell towers could yield now that Telus’s tower network is partially owned by a third party. However, let’s return to the significant updates I missed while I was away.

After 52 different tariff regulations and 178 deadlines, we have finally arrived at the official date of August 1st, when everything has been discussed, executed, and approved – supposedly.

This poor performance (that earned Trump’s nickname TACO for Trump Always Chickens Out) is not yet concluded, but numerous trade agreements are in the process of being finalized.

To cut a long story short, most countries that came to a “deal” are now paying higher tariffs than in 2024.