**Investing in a 20-Year Treasury Bond: A Knowledgeable Outlook**

Recently, the redemption of a zero-coupon Treasury Bill amounting to $102,000 has led to a thorough examination of investment possibilities, particularly in terms of a balanced portfolio. With an aim to uphold a ratio of roughly 60/40 to 70/30 in favor of stocks, this evaluation will delve into the attractiveness of a 20-year Treasury Bond yielding 5% in light of the current market situation.

### Analyzing the Market Environment

The performance of the S&P 500, with a forward price-to-earnings (P/E) ratio of 23, indicates potentially diminished expected returns due to valuation mean reversion. Historically, the average forward P/E since 1989 is around 18.5. This raises essential questions regarding the future performance of stocks, prompting the consideration of risk-free assets like Treasury Bonds.

JP Morgan’s analysis reveals that investing in the S&P at such high valuations has typically resulted in annualized returns ranging from +2% to -2% over the following decade. Therefore, the opportunity to secure a risk-free return of about 5% becomes increasingly appealing, especially for investors keen on preserving purchasing power and ensuring financial stability.

### The Attraction of a 5% Ensured Return

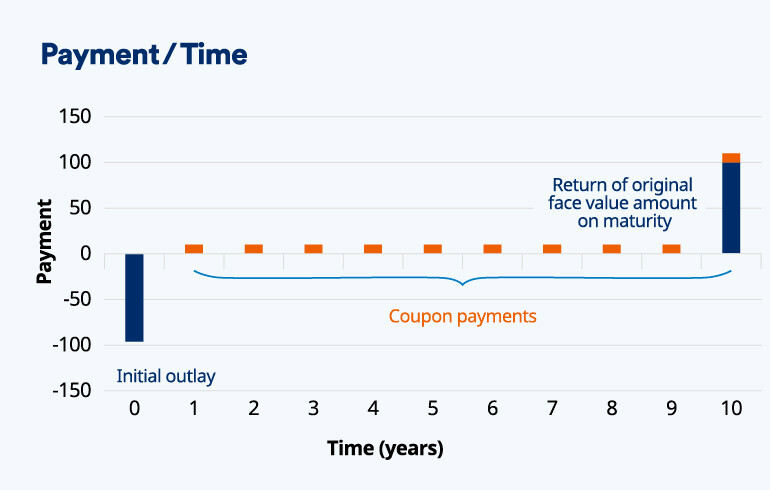

For younger investors, a guaranteed return of 5% may not appear exciting, particularly during eras characterized by tech booms and high growth expectations. Nonetheless, as one ages and accumulates wealth, the reliability of securing a 5% yield for a prolonged duration can be seen as a considerable benefit.

Allocating capital into 20-year Treasuries can offer a significant cushion against market fluctuations and bolster long-term financial security, particularly for those nearing retirement age.

### Designing an Optimal FIRE Scenario

Take the example of an individual who has been consistent in saving and investing, accumulating a $3 million portfolio by their late 30s. As they move towards retirement or implement Financial Independence, Retire Early (FIRE) strategies, one can take advantage of the benefits of a low capital gains tax bracket and standard deductions to withdraw funds without tax implications. By redistributing assets into 20-year Treasuries, the individual ensures a reliable income stream that can adequately support their lifestyle without compromising their financial future.

This guarantees that even during retirement, they can maintain a pleasant standard of living while minimizing investment risks.

### Balancing Risk and Reward

Despite the definitive benefits of Treasury Bonds, many investors exhibit a natural inclination towards higher-risk, higher-reward opportunities. With changing family obligations, such as supporting children, the drive to seek growth can emerge from a wish to establish lasting financial legacies.

In this scenario, combining part of the $102,000 redemption into higher-risk ventures—such as emerging tech stocks or other speculative investments—while preserving a core position in Treasuries can exemplify the notion of the “dumbbell investing strategy.” This strategy allows one to reap the advantages of low-risk investments while actively pursuing growth opportunities.

### Conclusion: Treasury Bonds as a Financial Bedrock

In conclusion, a 5% yield on Treasury bonds can act as a fundamental foundation for many investors, particularly those concentrating on securing their lifestyles in retirement. While the allure of growth persists, balancing risk with a robust financial underpinning is vital for attaining long-term stability.

Given the current market conditions promoting secure income streams, the inquiry persists: is the stability provided by a 20-year Treasury bond yielding 5% a prudent addition to a diversified investment approach? The potential for both security and growth presents an enticing perspective for investors, especially regarding their long-term financial welfare.