**Commercial Real Estate: From Survive to Thrive**

Since 2022, those engaged in commercial real estate (CRE) have faced a severe downturn marked by soaring mortgage rates, inflation, and decreasing asset values. The dominant mindset became clear: “Survive until 2025.” Now, as we approach the latter part of 2025, indications suggest that the CRE recession may be concluding, with fresh opportunities beginning to arise.

### A Challenging Few Years for Commercial Real Estate

The decline commenced in 2022 when the Federal Reserve embarked on an aggressive cycle of rate hikes, which significantly impacted the CRE sector. As borrowing costs surged, property values swiftly followed, especially as the 10-year Treasury yield rose from about 1.5% pre-pandemic to roughly 5% at its peak in 2023. Demand for office space collapsed as hybrid work models remained prevalent, while apartment developers faced challenges from escalating construction costs and stagnant rent growth. The previously favored industrial sector also encountered issues as supply chains adjusted post-pandemic.

With financing costs climbing and net operating income (NOI) growth stalling, CRE investors were compelled to take a defensive stance, resulting in a spike in reports of defaults and distressed sales.

### Indicators the Commercial Real Estate Recession Is Concluding

The present environment in CRE exhibits signs of recovery, bolstered by several critical developments:

1. **Inflation Rates Have Stabilized**

Inflation rates have fallen from nearly 9% in mid-2022 to under 3%. This easing allows the Federal Reserve the opportunity to relax monetary policy, reinstating investor confidence in long-term underwriting. Price stability is vital for the CRE sector, and its return is a positive omen for the market.

2. **The 10-Year Yield Has Declined**

A notable decrease in the 10-year Treasury yield from around 5% to 4% benefits CRE investors. Lower borrowing costs frequently align with heightened property values, as reduced interest rates can improve affordability and demand for investment.

3. **The Fed Has Changed Direction**

After an extended period of consistent rates, the Fed is now reducing rates, fostering a psychological shift among investors who believe that the tightening phase is over. This change could create a more favorable atmosphere for CRE.

4. **Distress Levels Are Peaking**

The frequency of forced sales and loan modifications has significantly diminished the quantity of distressed properties available. This purging of less resilient players often signifies the market reaching its nadir, clearing the path for new capital to enter.

5. **Capital Is Flowing Back**

Following a prolonged absence, institutional and other investment capital are returning. Many investors are aware that real estate allocations are currently lower than optimal, prompting renewed investments in the CRE sector that promote liquidity and stability.

### Identifying Opportunities in CRE

As conditions improve, specific property types are set to outshine others:

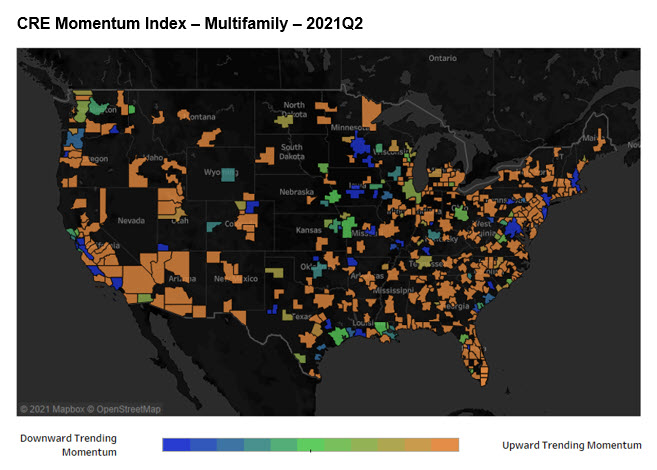

– **Multifamily:** While rent growth may have decelerated, it has not collapsed. The limited new construction since 2022 indicates possible upward pressure on rents in the years ahead.

– **Industrial:** Although growth has slowed, warehousing and logistics remain essential sectors driven by ongoing demand for effective supply chains.

– **Retail:** Contrary to the idea of a retail apocalypse, well-located, grocery-anchored centers are flourishing, and experiential retail continues to attract customers.

– **Specialty:** Specialized sectors such as data centers, senior housing, and medical offices are expected to see increased investment, with data centers particularly thriving due to the ongoing AI boom.

### Differentiate Commercial Real Estate from Your Home

It’s crucial to understand that investing in commercial real estate is distinct from buying a primary residence. CRE emphasizes metrics like yields, cap rates, and financial returns, while homebuyers typically prioritize lifestyle and emotional factors. For investors, the focus remains on cash flow and market performance metrics.

### Ongoing Risks in CRE

Despite the favorable trends, investors should be wary of several potential risks:

– **Office Overcapacity:** A significant number of office spaces, particularly in central business districts, may find it difficult to bounce back due to evolving work patterns.

– **Debt Expirations:** A substantial volume of loans maturing in 2026-2027 presents possible challenges for the market.

– **Policy Risks:** Changes in taxation, zoning laws, or a resurgence of inflation could hinder progress.

– **Global Instability:** Geopolitical tensions and slowing international growth could negatively impact CRE demand.

### My Optimism for CRE

Holding a significant share of wealth connected to real estate, I have felt the impact of this downturn personally. However, examining historical data shows trends of panic selling followed by opportunity buying and a gradual return to investment activity from institutions.

Recent conversations with industry leaders reinforce this optimism, indicating an overall positive shift in the macroeconomic landscape and a belief that the CRE market is on the verge of a resurgence.

### Conclusion

Having