**Title: Jobs Report Shock: Effects of Decreasing Yields and Fed Rate Reductions on Finances**

In an unforeseen development, the latest jobs report uncovers unexpected figures that have created waves in financial markets, highlighting the cascading effects of decreasing yields and prospective Federal Reserve rate reductions on both personal and national finances.

**Jobs Report Highlights:**

The latest jobs report indicates job growth that surpassed expectations, showcasing resilience in labor markets amid impending economic uncertainties. This has fostered optimism but also speculation concerning adjustments to monetary policy.

**The Connection Between Employment Data and Financial Markets:**

The job market serves as a vital barometer of economic vitality. When job figures surpass forecasts, it denotes economic strength, which can sway the Federal Reserve’s interest rate decisions. An unanticipated uptick in employment may lessen the probability of aggressive rate reductions by the Fed intended to invigorate a faltering economy.

**Decreasing Yields:**

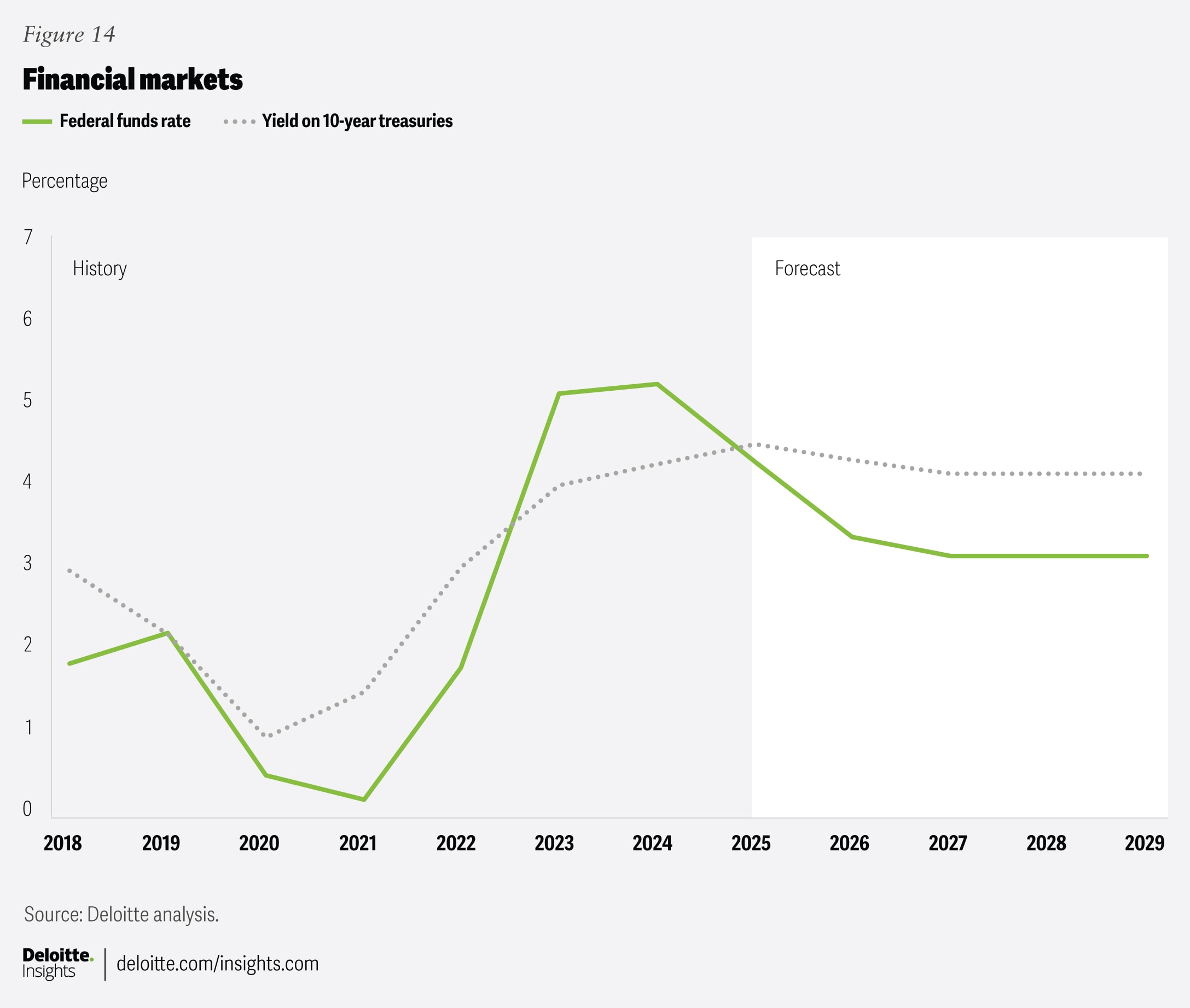

In response to the jobs report, government bond yields have witnessed a fall. Yields, which inversely correlate with bond prices, are influenced by changes in interest rate anticipations. Falling yields signify market expectations of stable or lowered interest rates, commonly enacted by the Fed to stimulate borrowing and investment.

1. **Effect on Mortgages and Loans:**

Diminished yields generally result in lower mortgage rates. This benefits prospective homebuyers and those considering refinancing, as borrowing expenses decline. Likewise, consumers and enterprises may find it beneficial to secure loans for significant purchases and investments.

2. **Investment Consequences:**

For investors, declining yields often redirect attention towards equities, due to the lesser returns from bonds. This may trigger a surge in stock markets, drawing additional capital into equities because of their comparatively greater potential returns.

**Federal Reserve Rate Reductions:**

The jobs report, while positive, does not entirely rule out the possibility of Federal Reserve rate reductions, particularly in the context of global uncertainties or if inflation remains below target. Here’s how prospective Fed policy changes might affect finances:

1. **Consumer Expenditure:**

Rate reductions generally lower lending rates, promoting consumer spending and enhancing economic activity. This can positively influence sectors dependent on consumer expenditure, like retail and automotive industries.

2. **Savings Accounts and Fixed Income:**

Savers may experience diminished interest income from bank deposits and fixed-income assets, perhaps exploring alternative paths for improved yields.

3. **Currency Value:**

Lower interest rates could result in a decline in the national currency’s value, impacting import costs and potentially boosting export competitiveness.

**Conclusion:**

The surprise within the jobs report presents a complicated landscape for investors, consumers, and policymakers. Although the immediate response has been a drop in yields and conjecture about Fed rate cuts, the overarching economic narrative remains intricate. Individuals and businesses need to remain informed and adaptable, responding to changing market dynamics to effectively manage and position their finances.