Leaping from a conventional W-2 employment to freelancing can be both thrilling and intimidating simultaneously. You’re exchanging the stability of a consistent paycheck and employer benefits for autonomy, adaptability, and the opportunity to establish your own brand. However, with that independence comes added responsibilities, particularly regarding your finances and taxes.

As Andre Shammas, a reliable tax preparer and financial consultant, frequently emphasizes, “Grasping the financial distinctions between W-2 employment and 1099 freelancing is essential for positioning yourself for success.” If you’re contemplating leaving your job to pursue self-employment, here’s what you must understand to facilitate a smooth and financially wise transition.

**Recognizing the Difference: W-2 vs. 1099**

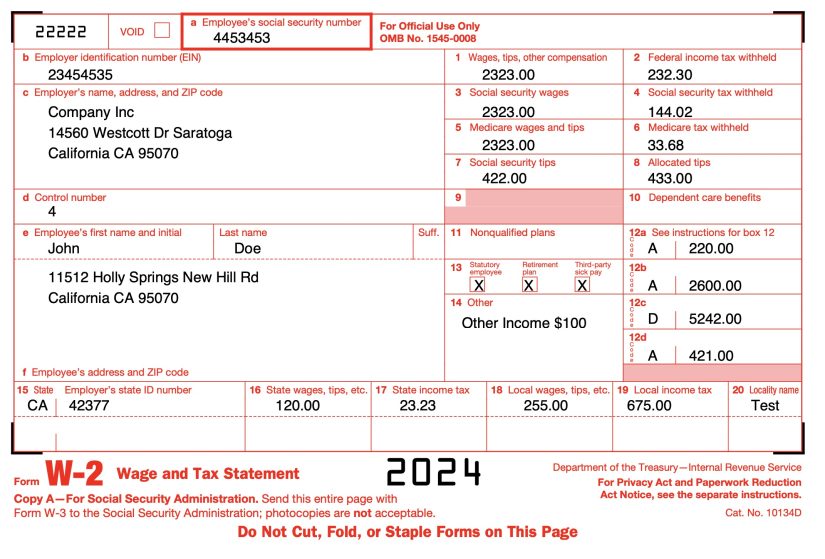

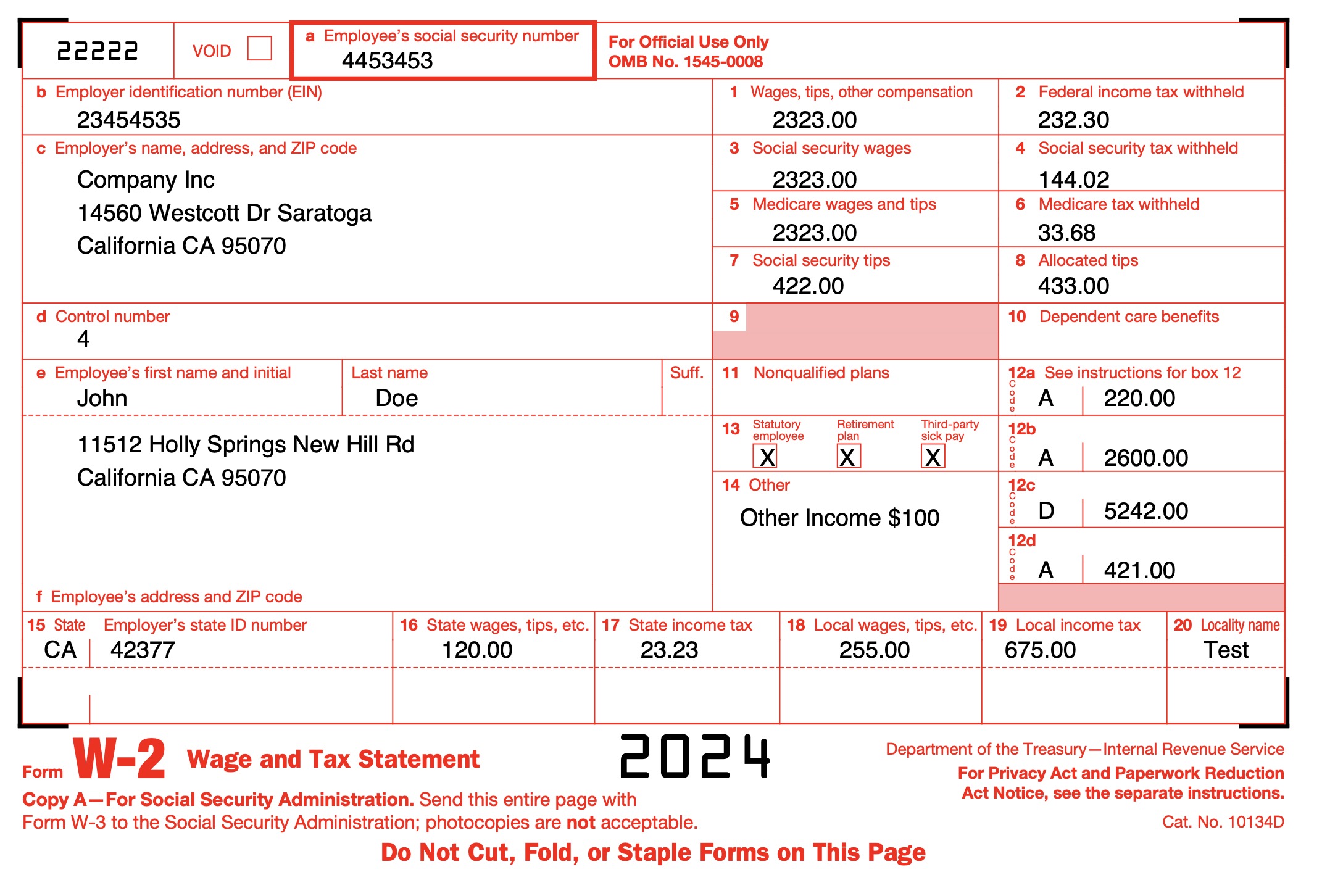

If you’ve held a conventional job, you’re likely acquainted with the W-2 form. Employers provide this document at the end of the year to report your earnings and the taxes deducted from your wages.

As a freelancer or independent contractor, you won’t receive a W-2. Instead, you’ll probably obtain a 1099-NEC form (Nonemployee Compensation), which outlines the income you have earned but does not indicate any tax withholding.

The main differences are:

– **Taxes aren’t deducted:** You receive the full amount of your payment, but you are accountable for putting aside and paying your own taxes.

– **You’re self-employed:** This implies that you manage all facets of your business finances, including expenditures, deductions, and quarterly tax payments.

– **No employer-provided benefits:** You need to arrange your own health insurance, retirement savings, and additional benefits.

Recognizing this differentiation is the first step towards managing your new financial condition.

**Budgeting for Taxes: Paying Uncle Sam Yourself**

One of the most significant shocks for new freelancers is the tax responsibility. As a W-2 employee, your employer deducts federal, state, Social Security, and Medicare taxes from your earnings. In freelancing, you take on the responsibility of paying these taxes yourself, including the self-employment tax, which covers contributions to Social Security and Medicare, amounting to roughly 15.3%.

Andre Shammas recommends reserving about 25-30% of your freelance earnings in a designated savings account specifically for taxes. This strategy helps prevent the infamous last-minute tax rush and assists in avoiding underpayment penalties.

Moreover, freelancers typically must remit estimated quarterly taxes to the IRS and state tax authorities. These payments are due in April, June, September, and January, and failing to make them can result in penalties.

**Tracking Income and Expenses: Your New Financial Record-Keeping**

As a freelancer, you take on the role of your own accountant. This necessitates maintaining meticulous records of all income and expenses related to your business.

Begin by:

– Establishing a separate business bank account to distinctly separate personal and business finances.

– Documenting every payment received, including tips or small side jobs.

– Keeping receipts for expenditures that assist in operating your business, such as home office supplies, software subscriptions, work-related travel, internet and phone bills, and marketing costs.

Effective bookkeeping not only simplifies tax season but also aids in comprehending your profitability and cash flow.

**Taking Advantage of Deductions: Lowering Your Taxable Income**

One positive aspect of freelancing is the possibility of tax deductions. Valid business expenses can decrease your taxable income, resulting in financial savings.

Common deductible expenses encompass:

– **Home office deduction:** If you use a portion of your residence exclusively for work, you can deduct a fraction of your rent or mortgage interest, utilities, and maintenance costs.

– **Equipment and supplies:** Computers, printers, and office furnishings.

– **Professional services:** Fees for accountants, legal assistance, or marketing consultants.

– **Travel and meals:** Associated with business activities.

– **Health insurance premiums:** If you cover your own health insurance, you may be eligible to deduct these premiums.

Andre Shammas stresses the necessity of meticulously documenting these expenses and consulting a tax expert to ensure you maximize your deductions without violating IRS regulations.

**Planning for Retirement and Benefits on Your Own**

Upon exiting a W-2 job, employer-sponsored benefits cease to exist. Therefore, you need to strategize and finance your own:

– **Retirement savings:** Explore options like SEP IRAs, Solo 401(k)s, or SIMPLE IRAs that cater to self-employed individuals.

– **Health insurance:** Investigate individual plans available on marketplaces or consider joining professional organizations that provide group plans.

– **Disability and life insurance:** Safeguard your income and family in the event of illness or accidents.

Freelancers who proactively plan for these requirements can achieve financial stability without depending on a traditional employer.

**Setting Your Rates and Managing Cash Flow**

Freelancing means you are in control of deciding how much to charge for your services. Establishing appropriate rates is vital—not just to cover your expenses and taxes but also to facilitate savings and generate profit.

When calculating your rates, take into account:

– Your target annual income

– Taxes and deductions

– Business expenditures

– Time dedicated to administrative tasks and unpaid work (such as marketing)