## 1999 is Back: The Charm and Perils of Contemporary Investing

Since 1999, I have embarked on a journey to discover the next great investment, the elusive “50-bagger” that once provided me with the down payment for my first home. The recollection is clear: I was in the trading room at Goldman Sachs, observing the explosive growth of internet stocks like Yahoo! and Commerce One. The thrill was unmistakable, as optimism filled the air, particularly since my own firm had just gone public.

### The Excitement of the Market

Fast forward to the present, and the tech industry is once more at the forefront. The environment is alive with cryptocurrency investments, advancements in artificial intelligence (AI), and a rejuvenated startup culture in San Francisco. The possibility of extraordinary wealth feels almost within reach, rekindling hope and enthusiasm for numerous investors.

However, alongside the excitement comes an essential lesson from history: euphoria may seem logical until it no longer does. The dot-com crash revealed a harsh reality – markets can shift unexpectedly, erasing vast amounts of wealth.

### The Revival of a 1999-like Atmosphere

The current climate echoes that thrilling time, encouraging many to re-engage with investments. I’m concentrating on public technology stocks, private enterprises, and real estate, sensing that considerable growth awaits. The pressing question is: how do we strike a balance between ambition and caution to sidestep the mistakes of the past?

#### What Distinguishes This Moment

While investors are rushing into tech with the same zeal as in the late ’90s, several notable differences exist:

1. **AI Productivity**: Unlike many dot-com enterprises that found it hard to monetize, AI technologies show evident productivity gains and cost efficiencies.

2. **Robust Corporate Financials**: Today’s companies generally boast more substantial balance sheets compared to those in 1999 and 2007, with lower debt levels and higher cash reserves.

3. **Strong Cash Flow**: Major tech firms are generating significant free cash flow, establishing a robust financial base.

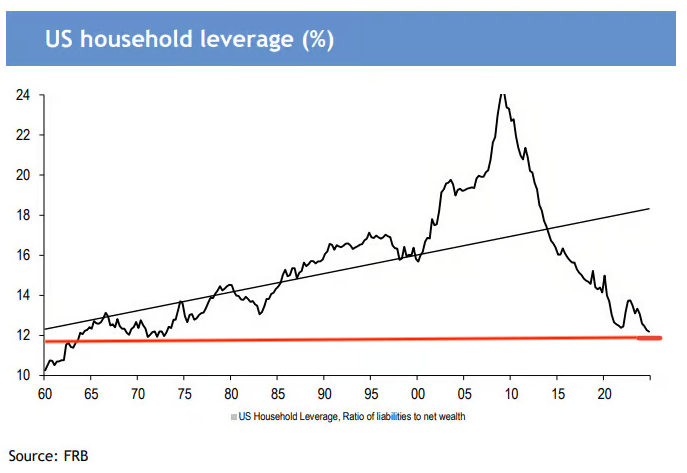

4. **Consumer Resilience**: Today’s households are less indebted, reflecting greater financial stability.

5. **Encouraging Monetary Policy**: The Federal Reserve’s shift towards interest rate cuts and quantitative easing is injecting energy into risk assets.

Despite these distinctions, the fundamental psychology of market manias remains unchanged. Investors frequently disregard long-term risks for immediate gains.

### My Investment Approach for This New Epoch

As we navigate this potential bubble, here are the tactics I’m employing:

1. **Remain Invested, But Manage Exposure**: I engage in this bullish market actively, choosing to reduce positions that surpass 10% of my portfolio. This strategy aids in effective diversification while controlling risk.

2. **Invest in Tangible Assets**: Lessons from previous downturns have shown me that real estate offers both value growth and tangible advantages. I’m heavily invested in San Francisco real estate, serving as a hedge against market volatility.

3. **Broaden Investments in Private Firms**: I’m increasing my stakes in private AI companies through dedicated venture funds, seeking substantial growth opportunities while recognizing the inherent risks.

4. **Keep Liquidity**: Maintaining adequate cash reserves allows for strategy adjustments during downturns, while current treasury yields present an attractive risk-free return.

5. **Steer Clear of Margin Investing**: Leverage can significantly magnify losses, as demonstrated in past market collapses. I advise strict controls on any leveraged investments to prevent potential wipeouts.

6. **Implement a Dumbbell Approach**: Balancing high-risk ventures with safe assets can capture market upside while protecting against downturns.

7. **Reap Tangible Rewards**: Realizing profits to fund meaningful experiences or investments ensures that you gain value from your achievements.

8. **Anticipate Possible Losses**: Understanding market cycles helps mitigate emotional reactions during downturns. Acknowledging the reality of market corrections can facilitate planning and preparation.

9. **Diversifying Income Sources**: Cultivating a variety of reliable income streams is paramount, especially in light of potential market volatility. Understanding your income stability bolsters riskier investments.

10. **Prioritize Health and Lifestyle**: Personal wellness is often neglected in the pursuit of wealth, yet it is crucial for long-term happiness and productivity.

### The Path Forward

As the market evolves, it’s vital to stay cognizant of the risks, even amid excitement. Past experiences remind us that bull markets can conclude abruptly, and readiness is essential. Diversification, vigilance, and a balanced outlook will be the foundation of a responsible investment strategy.

Embracing the present flourishing market can lead to significant wealth accumulation, but it’s essential to proceed with caution. Investors should celebrate accomplishments while remaining grounded in strategic financial planning.

In conclusion, let’s relish this thrilling phase while being aware of the lessons learned from the past, prepared to handle whatever comes next.