Debt resembles fire. When utilized correctly, it prepares the dish. When mismanaged, it incinerates the home.

In Part 1: Embrace Company Debt: liquidity indicates whether a company can meet its obligations; leverage reveals how those obligations are financed.

Today, we’ll apply that strategy with four real-world examples—two with minimal or no debt, and two leveraging debt wisely for growth. As you proceed, remember the Dividend Triangle: revenue, earnings, and dividend growth advancing together.

Brief summary from Part 1:

-

Liquidity: Current, Quick, and Cash ratios illustrate short-term adaptability.

-

Leverage: Debt-to-Assets, Debt-to-Equity, and Financial Debt-to-EBITDA reflect long-term framework.

-

General guideline: Compare against competitors, track trends, and overlap with the Dividend Triangle.

Need a quick reference for the formulas and benchmarks? Check out the Debt Ratios Cheat Sheet.

Low or Minimal Debt

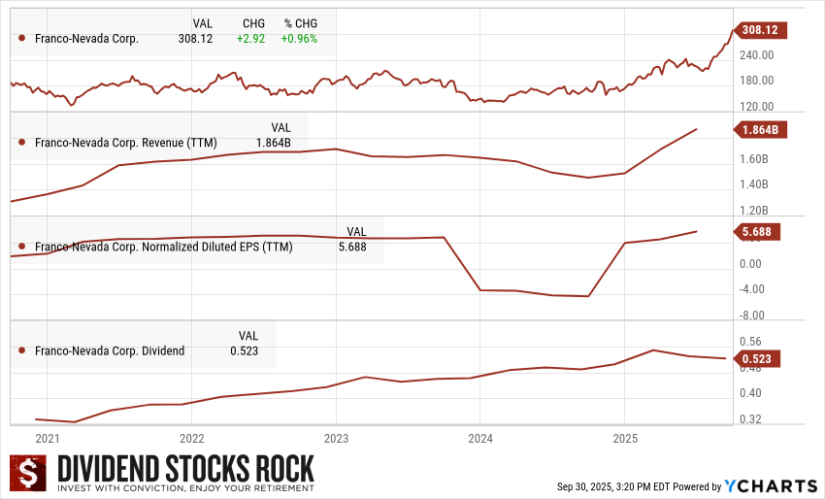

Franco-Nevada (FNV.TO)

- Yield: 0.95%

- Market Cap: $43B

- Total long-term debt: $0

Franco-Nevada functions as a royalty and streaming firm specializing in gold, precious metals, and energy assets.

Contrary to conventional mining firms, it refrains from direct operations but instead gathers royalties and streaming income from a varied array of projects. This business model enables it to profit from increasing commodity prices while sidestepping operational hazards.

The company possesses significant land holdings and collaborates with mining operators to ensure long-term income streams.

Why it succeeds: Diverse partners, long-lasting agreements, structurally high margins.

What to monitor: New contract pipeline, responsiveness to commodity changes, performance of partners.

Implications for your dividend: With minimal balance-sheet strain and consistent cash inflows, management has the capacity to elevate the dividend through economic cycles and still maintain reserves for appealing new investment opportunities.

Jack Henry & Associates (JKHY)

- Yield: 1.30%

- Market Cap: $13B

- Total long-term debt: $80M

Jack Henry stands out as a leading fintech provider for the banking industry, functioning through three primary divisions: core processing, payments, and supplementary services (digital banking, fraud prevention, treasury).

It caters to nearly 80% of U.S. credit unions and community banks. Its business framework generates robust recurring income from SaaS-like offerings and transaction fees. The company handles all technological aspects behind banking functions. It’s easy to see how dependable this business is!

Why it thrives: Essential systems, significant switching barriers.