Cash reigns supreme—and operating cash flow (OCF or CFO) offers the most transparent view of the cash a company earns from its daily activities. This is the sum that ends up in the bank after customers make payments and the firm settles its operational expenses, excluding any financing and investment transactions.

Investors frequently keep an eye on cash flow since it’s less prone to manipulation than earnings. When profit margins are steady, CFO usually reflects revenue patterns. Management might highlight revenues and profits during earnings reports, but the genuine financial wellness is apparent in the cash flow statement.

The Three Cash Segments

Organizations report cash in three categories:

– Cash from Operations (CFO): Cash generated by standard business functions. Essentially, it answers the question, “What did the company yield through its principal operations?”

– Cash from Financing: This covers borrowing and repaying debt, issuing or repurchasing shares, and distributing dividends.

– Cash from Investing: Encompasses capital expenditures, acquisitions, asset sales, and other investment-associated movements.

This article focuses on CFO as it signifies the foundational operational mechanism.

Why CFO Often Reveals the “True” Picture

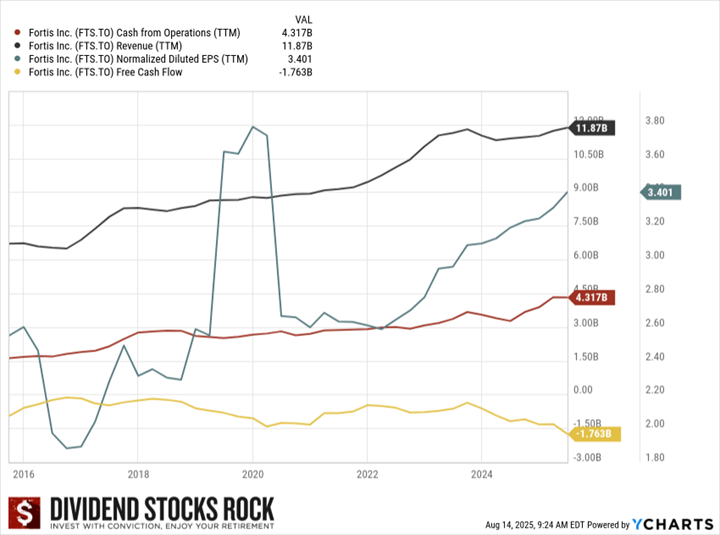

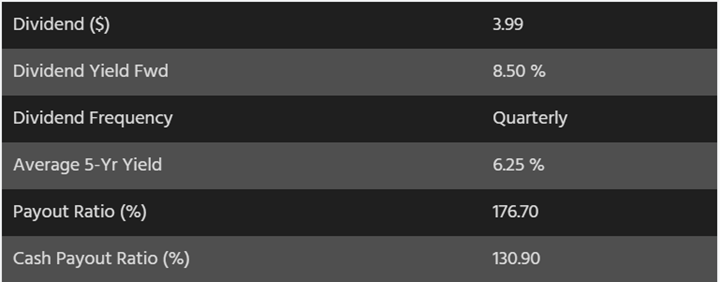

Earnings can be distorted by non-cash elements, while cash remains less exposed to such skewing. For instance, substantial amortization may lower EPS without impacting actual cash. Analyze the Fortis chart over a decade: revenue and CFO may align, while EPS varies due to accounting factors and CAPEX. CFO provides clarity through “clean” earnings to distinguish the real business revenues and outlays.

CFO is generally favored over free cash flow (FCF) for a straightforward understanding of the central mechanism, as FCF includes CAPEX, which can change based on project scheduling and financing. Examining only FCF could be misleading if a quarter of significant spending is considered. Over a business cycle, consistently rising CFO suggests a robust operation, ensuring dividend safety.

Quick calculation

CFO = Net Income + Non-Cash Elements + Changes in Working Capital.

Non-cash elements encompass depreciation, amortization, and impairments, impacting EPS but not cash reserves. Changes in working capital (current assets minus current liabilities) often clarify the discrepancies between net income and CFO.

CFO vs. FCF—When Each Is Useful

– Utilize CFO for the most precise assessment of business vitality and dividend consistency during cycles. It omits financing and CAPEX timing.

– Utilize FCF to determine if a capital-heavy firm finances its growth internally or depends on its balance sheet.

This is the trade-off. CFO can look promising even if FCF stays negative due to significant investments; FCF might appear weak during growth periods without suggesting a struggling business. For industries such as utilities, telecommunications, and pipelines with high CAPEX, FCF often evaluates self-financed growth, and the answer is often “not entirely.” Nevertheless, leverage can be advantageous if utilized wisely.

Essential principle: If a number appears unusual, delve deeper.

Discover your next purchase confidently

– Start with the Dividend Triangle to formulate a targeted shortlist.

– Focus on approximately 300 quality entities instead of thousands.

– Confirm your hypothesis by examining CFO, FCF, and debt within the company’s financials.

Discover the Dividend Rock Star List

Cash Flow Analysis Warned Us About the BCE Crisis Before It Occurred

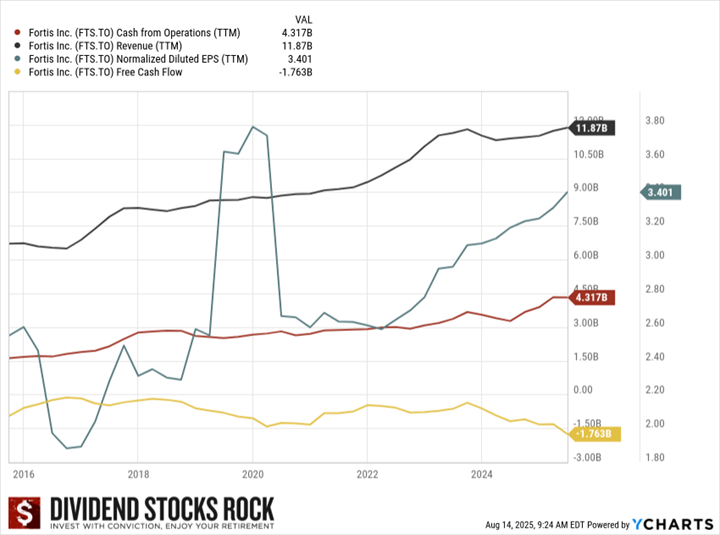

Review the last five years of BCE (BCE.TO / BCE). We spotted an unstable condition in August 2024: a payout ratio at 176.7% and a cash payout ratio at 130.9%. Though these metrics don’t provide an immediate sell signal, they suggest a need for further scrutiny.

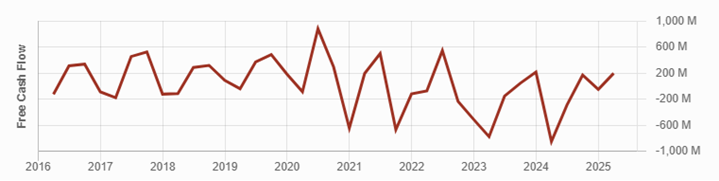

The FCF chart unveiled another alert.

Debt kept escalating—exactly what you don’t