Here’s our most recent conversation with a millionaire as we aim to gain insights from those who have elevated their wealth to impressive levels.

If you wish to be considered for an interview, send me a message and we can discuss details.

This conversation occurred in August.

My questions are formatted in bold italics, followed by their answers in black.

Let’s begin…

#### OVERVIEW

**_What is your age (and your spouse’s, if relevant, as well as the duration of your marriage)?_**

I am 52 years old, and my wife is 45.

We have been together for 17 years.

_Do you have any children/family (if yes, what are their ages)?_

We have 4 kids – a 14-year-old daughter, an 11-year-old son, a 7-year-old daughter, and a 2-year-old daughter.

**_In which part of the country do you reside (urban or rural)?_**

We reside in the suburbs of Chicago. Our area is situated within a nature conservancy.

It’s remarkable because looking out of our back windows, it appears as if we live secluded in a forest, yet we are just a brief 15-minute stroll from our local downtown and train station to the city.

_What is your present net worth?_

Our current net worth is just above $3 million.

**_What are the primary assets comprising your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any liabilities that counterbalance these?_**

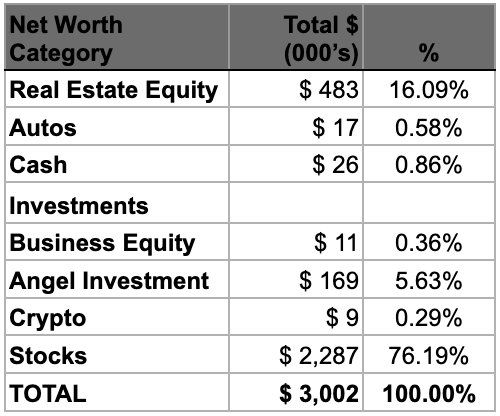

Our net worth is divided into these categories:

Regarding real estate, the equity exists in our primary home, which is estimated at $1.06 million with $580k in mortgage debt at an interest rate of 3.125%. I would love to be entirely debt-free, but we aren’t rushing to pay off the mortgage due to the favorable interest rate.

Our vehicles include a 16-year-old BMW 3 series (purchased used for cash 12 years ago) and a 10-year-old Honda Odyssey (bought new and settled within 3 years). The kids are tough on them, so there’s no intention to upgrade until they grow older.

Currently, we appreciate having a minimal percentage of our net worth tied up in vehicles!

Cash is somewhat low at the moment. Eventually, we plan to replenish this amount to cover 6 months of expenses in our high-yield savings account.

Business equity reflects the valuation of my consulting firm (where I am the sole employee), which represents merely the cash remaining should I decide to liquidate and close down.

The angel investment began as a single $10k investment in an AI startup in 2020. I have served on the advisory board ever since and received several additional shares/options for my contributions over time.

The stock value has increased substantially, but I am ready for this figure to potentially drop to zero at any moment (given the company’s early stage and lack of revenue generation).

Our crypto holdings consist of some complimentary Bitcoin received 11 years ago, alongside a $3k investment in a few other cryptocurrencies made in 2021. It constitutes a minuscule part of our net worth by design and is maintained strictly for monitoring purposes.

Stocks are categorized as follows:

– $123k in a brokerage account split between Shopify (an original $5k investment from years ago) and VTSAX.

– $1.69 million of VTSAX in tax-deferred accounts.

– $470k of VTSAX in tax-free (Roth) accounts.

#### EARN

**_What is your occupation?_**

I am the founder and president of my own consulting firm, where I offer product management/digital strategy/marketing/sales/and operational assistance to firms of various sizes.

My wife currently works as a Salesforce analyst at a global publishing and information enterprise and is about to transition into a strategic sales position.

**_What is your yearly income?_**

Our income for 2024 totaled $295k.

$82k of that was earned by my wife, and the remainder came from my consulting firm.

_Describe your income performance over time. What was your initial salary at your first job, how did it increase from there (and what actions did you take to facilitate this growth), and where do you stand now?_

I don’t have precise figures for