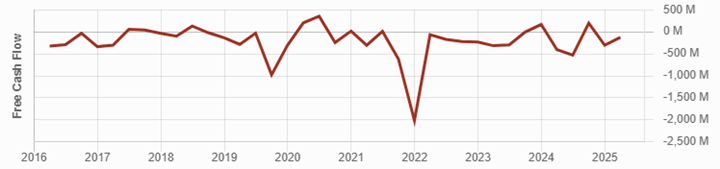

Cash flow holds significant influence—but as an initial assessment, it’s overly erratic.

I begin with the Dividend Triangle—multi-year patterns in revenue, EPS, and dividends—to identify consistent compounders throughout varying economic cycles.

Next, I include cash flow to support my analysis and check the dividend’s safety.

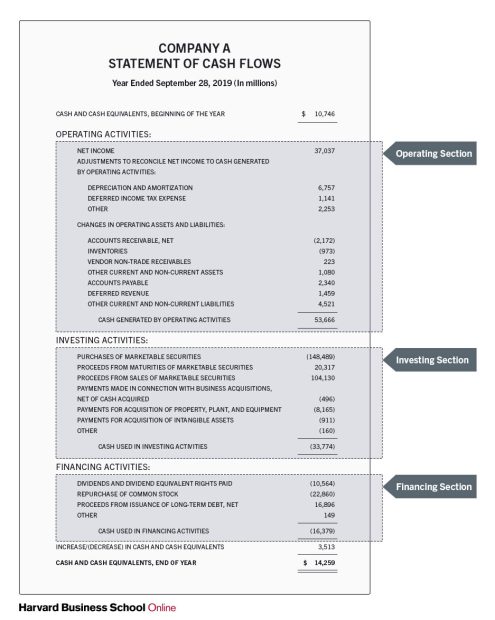

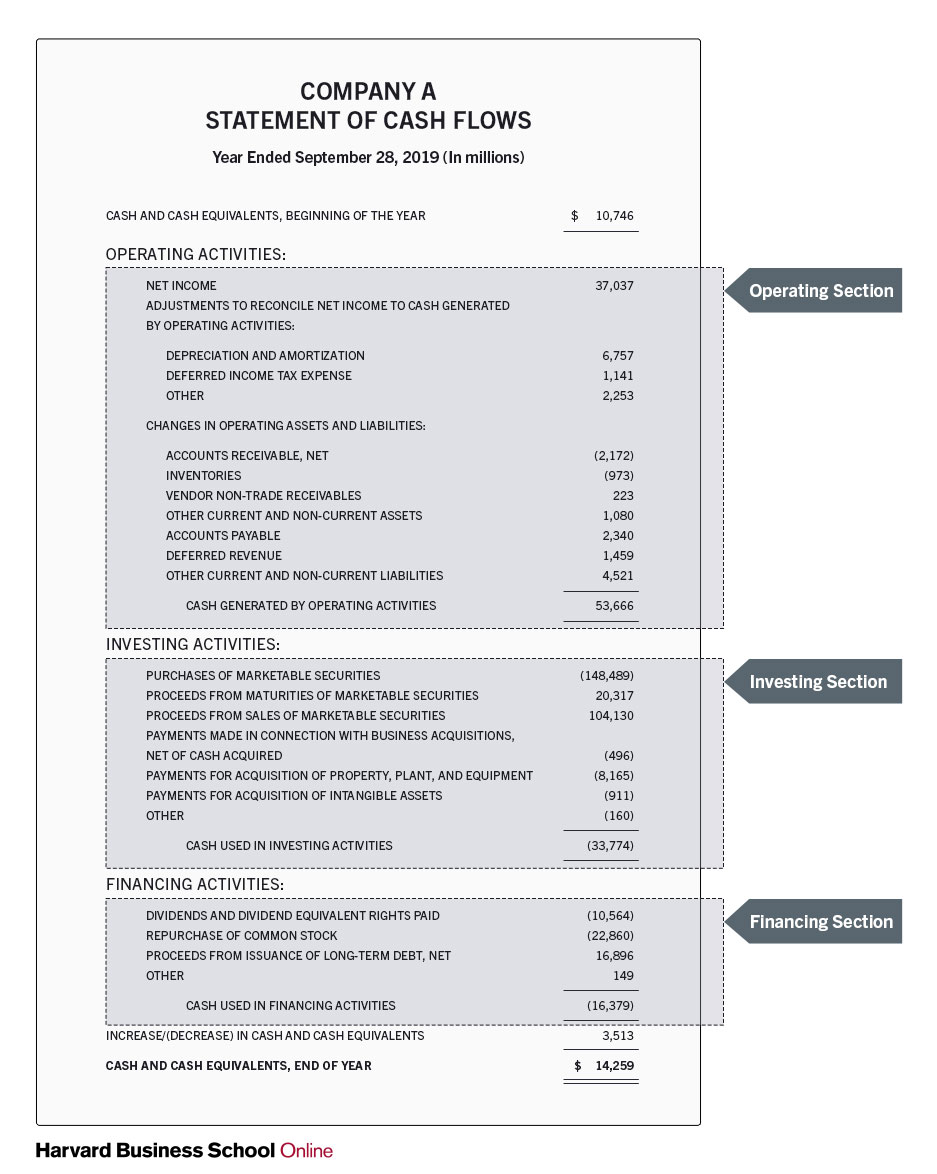

For insights on CFO mechanics and the BCE visuals, refer to Part 1: Operating Cash Flow vs Free Cash Flow: Follow the Cash (Case Study).

## The Dividend Triangle Comes First

EPS is essential: it indicates profitability, pricing authority, and capital management in a manner that’s broadly accessible and comparable across most industries. Entities that clear this threshold generally are those you can hold through various economic environments.

You can discover more about The Dividend Triangle here.

## Why Cash Flow Is Irregular (and Not an Initial Screening Tool)

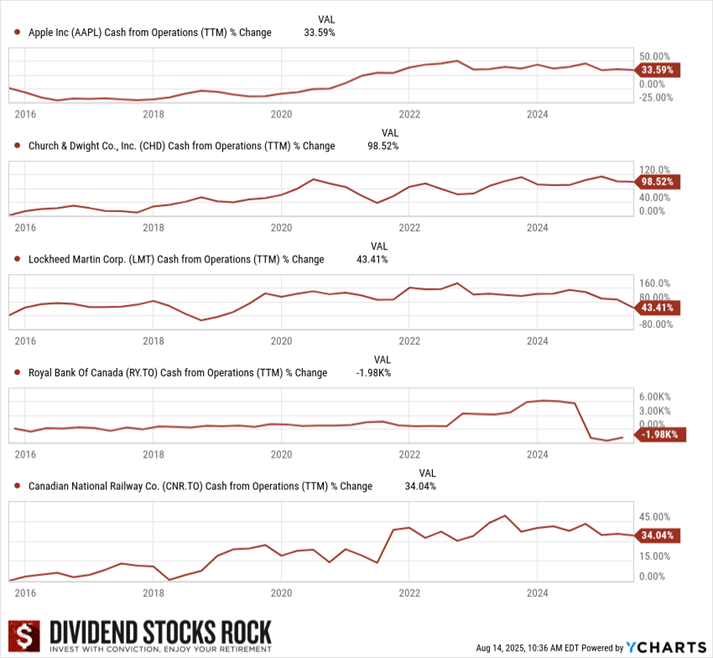

CFO can be inconsistent.

Timing of working capital, inventory fluctuations, and one-off events can make excellent companies appear weak for a quarter or two.

Examine decade-long cash charts for Apple, Lockheed Martin, Canadian National, or Royal Bank, and you’ll observe: robust long-term compounding with uneven year-to-year flows.

## Where Cash Flow Fits: The Second-Step Verification

After a company surpasses the Triangle, I pose three cash inquiries:

1. CFO vs. dividends: Does cash from operations adequately cover the payouts—over several years, not just one quarter?

2. FCF and financing: Is low FCF merely a build-out situation, or is the company borrowing to finance dividends?

3. Debt trend: Is leverage consistent or improving as the strategy unfolds?

This is where cash justifies its significance. It reveals if earnings convert into tangible funds and whether the balance sheet is being managed prudently.

## Use the List that Emphasizes What Matters

Utilize the Dividend Rock Star List to filter with the Dividend Triangle first and narrow down to roughly 300 quality names.

From there, explore cash flow from operations, free cash flow, and debt to arrive at a clear, confident conclusion.

## Telus: A Same-Sector Comparison That Survives the Cash Examination (with Cautions)

Since Telus and BCE have similar business models, Telus serves as a useful comparison. Telus increased its dividend in 2025, rather than reducing it.

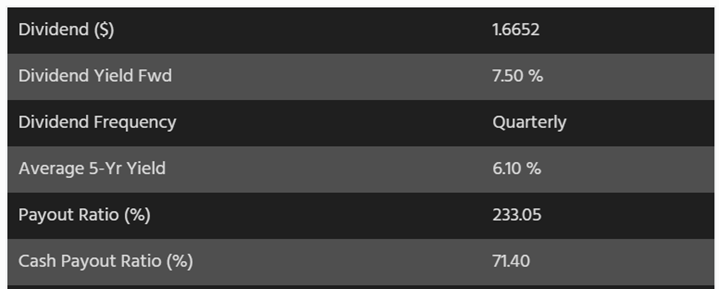

At first sight, payouts appear tight—but the cash payout ratio stands at a comfortable ~71%.