Each retirement strategy has its shortcomings. Here’s how to spot them before they lead to expenses.

“Everyone has a strategy until they take a hit.”

— Mike Tyson

This statement applies beyond boxing. It also reflects retirement planning.

You can be systematic, tactical, and assured—until life presents an unexpected challenge. Surging inflation, necessary roof repairs, or an adult child needing financial help can suddenly complicate your neatly arranged figures.

However, this doesn’t imply that your strategy is inadequate. It indicates its adaptability. Like anything adaptable, it requires periodic evaluations, attention, and occasional adjustments to stay effective. Here’s how to uncover the weaknesses in your strategy before they develop into major problems.

When the Market Strikes Back

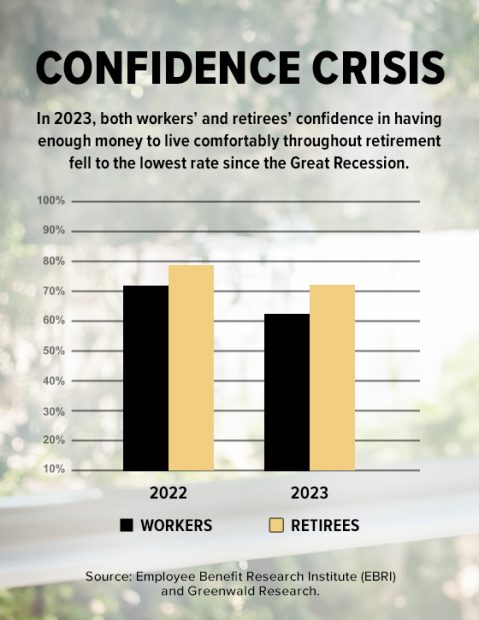

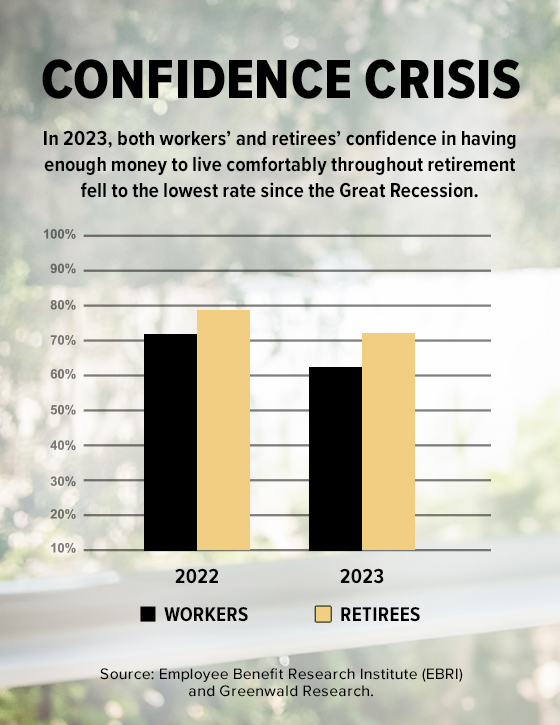

The anxiety of outliving one’s savings is a prominent worry for retirees. After a lifetime of dedication, the last thing you desire is to be 82—well, but financially burdened.

Market fluctuations, inflation, and overly optimistic forecasts can threaten that security. Altering your expected return by just 1%—upwards or downwards—can greatly influence a two-decade plan.

Many opt for conservative estimates to feel “secure,” but this can be excessive. Being overly cautious can lead to missing out on experiences—and happiness.

Instead, consider adaptability. Develop an elastic budget that evolves with the economic environment:

- Increase spending when your portfolio surpasses expectations.

- Implement modest reductions after a tough year.

This flexible approach ensures the soundness of your strategy without the perpetual anxiety of declines.

And concerning downturns—it’s not “if,” it’s when. Bear markets are a standard part of investing, and it’s likely you’ll face several during retirement. The emphasis should be on readiness, not distress.

Maintaining a cash wedge—keeping several years’ worth of spending funds in high-yield accounts or short-term bonds—allows you to endure tough times without selling investments at a loss. Meanwhile, a clear, consistent investment approach offers a framework you can depend on.

The market will sometimes strike back. The real question is whether your strategy can withstand the effects—and continue moving forward.

Outliving Your Plans

Fifteen years ago, when I started crafting retirement plans, most individuals expected to live into their early 90s. Now, reaching 100 seems increasingly plausible. That’s fantastic—if your strategy can accommodate it.

Longevity is a gift—and a challenge. You might require your savings to extend longer than anticipated or deal with escalating healthcare expenses as you age.

Think about this: your retirement expenses may not significantly decrease between ages 75 and 89—it’ll simply change focus. Funds once allocated for leisure and dining will eventually shift towards healthcare and assistance.

Get ready by gradually revising your spending forecasts, or establish a healthcare reserve for upcoming needs.

Another frequently overlooked risk is cognitive decline. While you manage your investments today, it’s prudent to simplify assets for easy oversight by a spouse or family later. Options like all-in-one ETFs or simple, rules-based portfolios can facilitate this transition.