Streams of passive income are essential for enhancing your retirement savings, allowing you to relish your retirement period without financial stress. Given the volatility of the market, it becomes vital to broaden your income sources to fulfill financial requirements during retirement.

Here are 10 efficient methods to create passive income in retirement:

1. **Dividend Stocks**: These regularly provide dividends to shareholders, enriching monthly earnings. While they might not yield high returns, their steady dividends contribute to diversification.

2. **Interest-Bearing Accounts**: Savings instruments such as CDs and high-yield savings accounts deliver liquidity and predictable returns with lower risk. High-yield accounts feature appealing interest rates, whereas CDs necessitate committing to a fixed term.

3. **Bonds**: These stable investments enhance your portfolio by generating fixed interest earnings. Government bonds carry low risk, while corporate bonds can yield higher returns with increased risk levels.

4. **Annuities**: Put away a one-time investment for assured future earnings, with choices to account for inflation or add beneficiaries.

5. **Real Estate Investment**: Real estate can serve as a source of passive income with little capital or involvement through avenues like REITs, rentals, and crowdfunding.

6. **P2P Lending**: Participate in lending to consumers via platforms that oversee borrower evaluations, being aware of the risk-reward balance.

7. **Renting Property**: Renting out a vacation home or an extra room boosts income. Services like Airbnb, Neighbor, and Hipcamp provide flexible rental opportunities.

8. **Pursue Your Passions**: Monetize skills or hobbies by offering tutoring, photography, or crafts on sites like Etsy.

9. **Share Your Insights**: Launch a blog, YouTube channel, or podcast, using affiliate links or advertisements to earn money from sharing your expertise and interests.

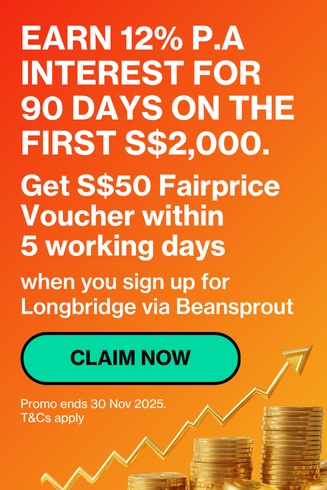

10. **Reward Accounts**: Investigate bank promotional offers or cashback credit and applications to gain bonuses and rewards.

Taxation on passive income can differ, with certain incomes such as long-term capital gains taxed at more favorable rates. Seek advice from a tax professional for strategies like tax-loss harvesting to handle liabilities.

Passive income acts as an extra financial resource during retirement, enabling you to withdraw less from retirement accounts or effectively tackle emergencies. Diversifying your approach while managing risks guarantees the enjoyment of your golden years.