A few days back, I shared my **Top 3 Canadian Dividend Stocks for 2026**, accompanied by a market overview detailing how the TSX surpassed the S&P 500 in 2025. If you haven’t seen it, [check it out here](https://thedividendguyblog.com/top-canadian-dividend-stocks/).

Today, let’s explore **my Top 3 U.S. Dividend Stocks for 2026**—providing durability, growth, and structural advantages for long-term investors.

Similar to the Canadian listing, these are **core holdings** or **informed estimates** boasting robust metrics, powerful dividend triangles, and significant long-term business relevance.

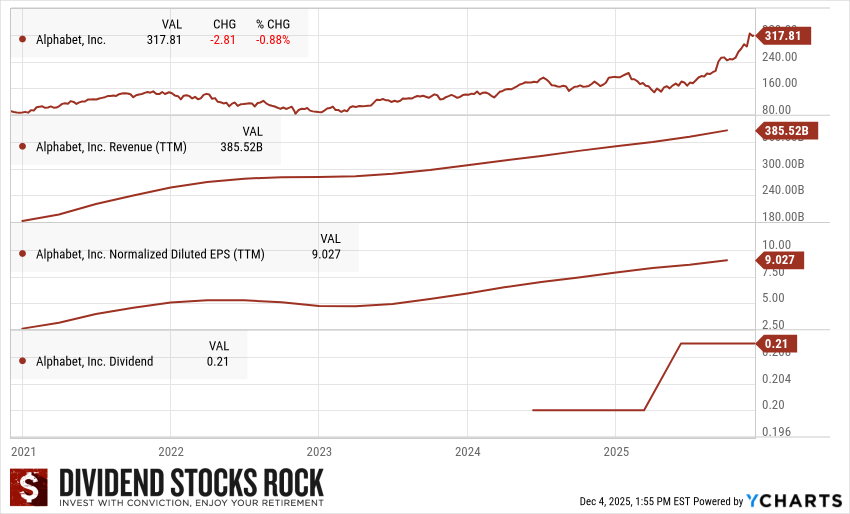

### Alphabet (GOOG) — Core Holding

*A cash-generating entity thriving on digital ads + AI.*

Alphabet, an established narrative, continues to evolve favorably. Google’s search engine remains dominant, YouTube is expanding, and Google Cloud is effectively scaling.

Its true advantage: an increasing user base generates more data, enhancing products, attracting even more users—exemplifying a quintessential network effect.

Concerns regarding AI competition have not impeded Alphabet. It has woven AI into its search, ads, cloud services, YouTube, and Android, providing stability, scalability, and growth.

**Reasons GOOG will remain robust in 2026:**

– A strong balance sheet with substantial free cash flow.

– Steady revenue from worldwide advertising and cloud services.

– An expanding new dividend.

– AI is a driver, not a deterrent.

Alphabet consistently builds wealth while others debate AI achievements. Alphabet is already ahead.

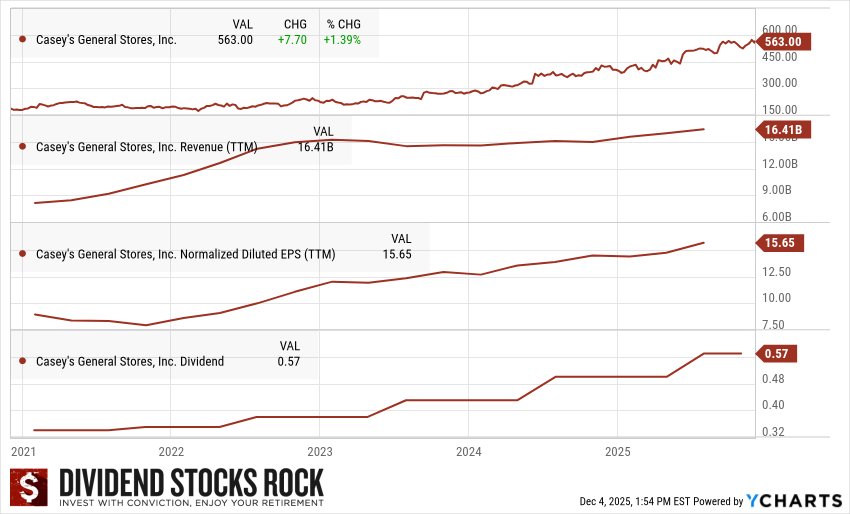

### Casey’s General Stores (CASY) — Core Holding

*The continuously accelerating convenience-store flywheel.*

If you value Alimentation Couche-Tard (ATD), you’ll find Casey’s appealing. ATD previously attempted to acquire Casey’s—a missed chance.

Casey’s manages **2,800+ stores** in rural and suburban locales, where customer loyalty is stronger, and competition is less fierce. Their effective model includes:

– Fuel

– Convenience retail

– **High-margin food** (a leading pizza chain in the U.S.)

The food segment is a hidden asset, enhancing traffic and margins, with Casey’s enjoying a strategic advantage. They are continually opening new locations, unlike Couche-Tard, providing growth prospects.

**Reasons CASY belongs in a 2026 portfolio:**

– Management intends to open **270 stores in 2026**—approximately 10% growth.

– Revenue, EPS, and dividend growth align with Dividend Triangle standards.

– A customer base resilient to recession.

– A decade of impeccable execution.

Casey’s expands by adhering to a straightforward formula, delivering the compounding desired in a long-term investment strategy.

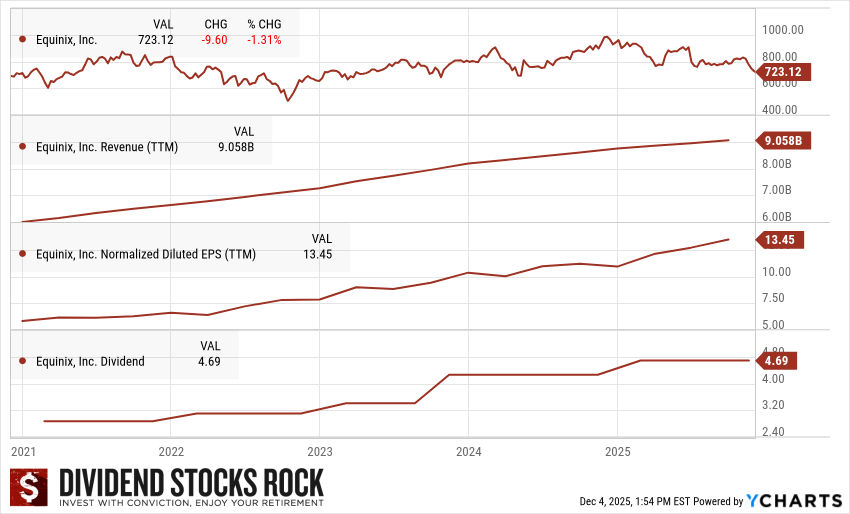

### Equinix (EQIX) — Educated Guess

*The backbone of global data traffic—a silent winner in AI infrastructure.*

Should AI be the engine of the future, data centers serve as the highways, and **Equinix** operates the toll booths.

Investors concentrate on AI’s chips (NVIDIA), cloud services (Amazon, Microsoft, Google), and power. What often gets overlooked is **interconnection**—rapid links between cloud platforms, enterprises, networks, and servers.

Equinix specializes in this area, boasting **240+ data centers worldwide**, creating a footprint that is difficult to duplicate. Clients tend to stay long-term, finding switching to alternative providers costly and disruptive.

Revenue is stable, cash flows are dependable, and growth is bolstered by demand in AI training, cloud computing, streaming, and connectivity. The dividend increases at a slow, steady, and sustainable rate.

**Reasons EQIX has promise in the AI age:**

– AI requires compute → servers → data centers → Equinix.

– Interconnection operates as a high-margin, high-retention business.

– Global expansion initiatives are primed.

– A “picks and shovels” strategy for the digital gold rush.

This stock isn’t inexpensive—exceptional assets seldom are. EQIX is closely aligned with the AI trend.

### A Brief Note Before You Create Your 2026 Watchlist

The diversity in these stocks is intentional. A mix of:

– A megacap wealth-generating entity (GOOG)

– A retail operator with a proven growth strategy (CASY)

– An AI infrastructure backbone (EQIX)

Together, they establish a diversified base for long-term dividend expansion, even amid modest current yields.

The broader narrative of 2026 surpasses any single stock…