### Comprehending the Santa Claus Rally: A Year-End Stock Market Event

As December draws near, festive decorations begin to adorn homes, heralding not just the holiday season but also a captivating trend in the stock market referred to as the **Santa Claus rally**. For investors, this phenomenon provides vital insights into strategies for year-end investments.

### What Does the Santa Claus Rally Entail?

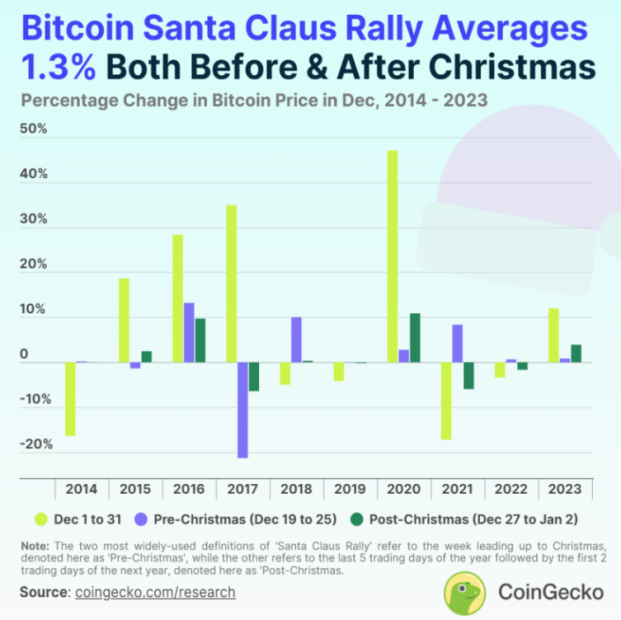

The Santa Claus rally denotes the stock market’s propensity to yield higher returns during the final five trading days of the year and the initial two trading days of the new year, often assessed through the S&P 500 index. Historically, the S&P 500 has demonstrated an average increase of around 1-1.5% during this period, a significant factor for strategic investors. Recognizing this trend aids in managing expectations and mitigating the urge to overtrade during the holiday season.

### What Causes the Santa Claus Rally?

Several theories propose explanations for the Santa Claus rally’s occurrence:

1. **Festive Optimism:** The positive mood during the holiday season may lead investors to purchase stocks, resulting in rising prices.

2. **Tax-Loss Selling:** Investors generally sell underperforming stocks in December to counterbalance capital gains, resulting in increased buying activity once this selling subsides.

3. **End-of-Year Portfolio Adjustments:** Institutional investors often reevaluate their portfolios at the end of the year, contributing to buying pressure within selected sectors.

4. **Reduced Trading Volume:** The holiday season typically sees lower trading volumes, which can amplify price fluctuations; even minor purchases can trigger significant price hikes.

5. **Expectational Psychology:** The seasonal trend might serve as a self-fulfilling prophecy, where buyer anticipation of a rally fuels its actual emergence.

### The Origin of the Term

The expression “Santa Claus rally” was coined in the 1970s by Yale Hirsch, the creator of the Stock Trader’s Almanac, who noted this recurring seasonal trend. This memorable term invites a comparison to Santa Claus, implying that the market dispenses year-end gifts—albeit the occurrence is based on a blend of psychological and technical elements.

### The Consistency of a Santa Claus Rally

Historical analysis shows that since 1950, the market has witnessed a Santa Claus rally **77.33% of the time**. Remarkably, there has not been a series of three consecutive years without one. Declines typically arise from economic recessions or major market disruptions. While the magnitude of the rally may differ—with certain years experiencing notable gains—historical data generally supports favorable outcomes.

For instance, in 2008, amid a financial crisis, the S&P 500 surged by 7.45% during this span, underscoring the potential for significant recoveries following downturns.

### How Investors Can Leverage This Information

Comprehending the Santa Claus rally can assist investors in making informed decisions at year-end, even without perfectly timing the market:

– **Avoid Panic:** If your portfolio struggles in December, keep in mind that past trends indicate a possible recovery.

– **Be Aware of Bias:** Knowledge of the rally’s historical frequency doesn’t ensure success; it’s merely a pattern, not a certainty.

– **Review Portfolio:** December can be an advantageous time to rebalance portfolios and recognize tax losses, with the rally serving as a potential advantage.

– **Confidence to Invest:** If the market has recently adjusted, it can empower investors to deploy their capital wisely.

### Believing in This Year’s Santa Claus Rally

Recognizing the pattern’s historical dependability, numerous investors, including prominent figures, have acted on the Santa Claus rally phenomenon. Following the latest market corrections, several have strategically positioned themselves in anticipation of rebounds, identifying possibilities within the seasonal trend.

### Maintain Control of Your Finances This Holiday Season

Proficient financial management is essential throughout the year, particularly during volatile market conditions. Utilizing financial resources, such as **Empower’s complimentary financial dashboard**, can improve your investment strategies and tracking abilities, ensuring you are ready to respond when opportunities emerge.

### Conclusion

Investing wisely, maintaining awareness of historical trends like the Santa Claus rally, and making strategic choices during year-end can profoundly affect long-term wealth growth. As the year concludes, allow your understanding of market trends to inform your strategy, offering both context and insight as you move forward in your financial journey.