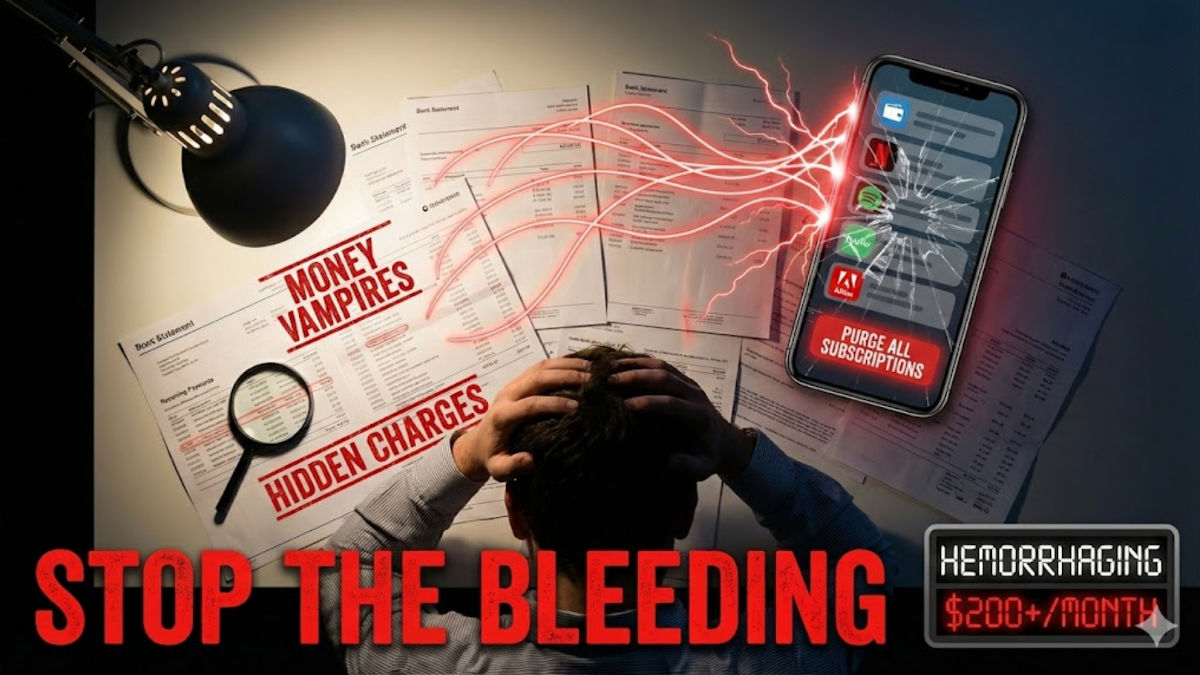

**The Concealed Expenses Draining Your Wallet: Greatest Hits Edition**

In our current society, astute shoppers are perpetually searching for opportunities to conserve their funds. Nevertheless, numerous individuals remain oblivious to the concealed details that may be subtly depleting their resources. Here are some of the notable “hits” regarding overlooked expenses and insights that could help you save:

1. **Bank Charges: The Quiet Underminer**

– Unseen charges from checking accounts, ATM transactions, and overdraft fees can pile up rapidly. It’s essential to examine your bank’s fee outline and pursue accounts that provide lower fees or none at all.

2. **Subscription Saturation: More Than You Anticipated**

– A lot of individuals enroll in trials or reduced-cost subscriptions and forget to cancel them. These recurring payments can really accumulate. Utilize applications to monitor subscriptions or regularly check bank statements to spot unnecessary expenses.

3. **Insurance Shortfalls: Spending More on Less**

– Not shopping around for insurance can result in higher premiums. Regularly compare estimates from various providers. Assessing your coverage requirements can also ward off excessive coverage, saving a considerable amount.

4. **Utility Expenses: Energy Thieves on the Loose**

– Hidden energy consumption from devices left plugged in can escalate utility bills. Employ smart power strips and energy-efficient devices to diminish waste. Remember to compare utility provider prices every few years.

5. **Credit Card Charges: The Pricey Offender**

– Carrying debts on credit cards incurs steep interest fees. Strive to pay off balances monthly to sidestep interest, and contemplate balance transfer options with lower rates if necessary.

6. **Loyalty without Gain: Remaining with Costly Providers**

– Remaining loyal to the same cable, internet, or phone service may not always yield benefits. Regularly renegotiate or evaluate offers from rivals to ensure competitive pricing.

7. **Grocery Strategy: Paying for Name Brands**

– Loyalty to brands can result in over-expenditure. Store labels frequently provide equivalent quality at a reduced price. Moreover, plan meals and buy in bulk whenever feasible to significantly lower costs.

8. **Healthcare Charges: The Bill Beyond the Bill**

– Errors in medical billing are frequent. Always ask for detailed bills and verify them. Negotiate charges when possible, or arrange payment plans to ease financial pressure.

9. **Buying Without Insight: Neglecting the Fine Print**

– Not scrutinizing contracts, warranties, and purchase agreements can lead to unexpected costs. Always examine terms and conditions to avert surprises.

10. **FOMO Expenses: The Impact of Social Media**

– Social media can shape spending behaviors, prompting impulsive purchases. Unfollow accounts that trigger unnecessary buying and practice conscious spending.

By recognizing these concealed costs and searching for informed options, consumers can protect their finances and diminish unwarranted expenses. Harness the strength of knowledge, as understanding where your funds are allocated is the initial step toward commanding your financial destiny.