# How to Regain Control Over Your Debt: Essential Approaches and Insights Gained

If you’re feeling disheartened by the revenue large banks and government bodies accrue from student loans and credit card debts, you’re definitely not alone. The fight against these financial weights can seem daunting, especially when the system appears geared towards perpetual indebtedness. Nonetheless, amid these obstacles, there is a glimmer of optimism. The secret to empowering yourself lies in taking charge of your financial affairs—one effective means to achieve this is by creating and sticking to a budget.

Allow me to recount my experience. Like many others, I faced student loans and credit card debts that often seemed unmanageable. Yet, by December 2015, I hit a turning point and chose to take control of my financial situation. The transformative change? Regular budgeting and deliberate financial oversight.

Here’s what I discovered and the approaches that proved successful for me. Whether you’re just starting to sort through your finances or seeking extra strategies to handle your debt, this guide will serve you well.

—

## Step 1: Monitor EVERY Cent You Spend

The initial and most vital step towards financial recovery is comprehending where your money is flowing. Prior to restructuring our finances, my wife and I set up a basic budget, yet we seldom followed it. The outcome? Although we weren’t sinking deeper into debt, we also struggled to make substantial headway in eliminating it. A passive approach alone won’t suffice—you must actively track your expenditures.

For me, this required spending nearly 15 hours each week analyzing my statements and expenses. Initially, it was tedious, but over time, it became instinctual—and even enjoyable. Tracking your spending can turn into a liberating activity once patterns start to emerge.

Here are several methods to track your expenditures:

– **Apps like Mint.com**: This free service links to your bank accounts and credit cards, automatically categorizing and managing your spending. (The budgeting features are helpful, though not flawless.)

– **Manual Tracking**: Gather your receipts or keep a spreadsheet of all your expenses. This approach allows for greater oversight and meticulousness.

– **Monthly Statement Reviews**: Examine your bank and credit card statements to pinpoint unnecessary expenditures. This habit alone can be enlightening.

Upon finally reviewing our spending in 2015, I was taken aback. How were we spending over $1,000 a month on dining out? By monitoring every expense, I gained a clearer understanding of where I needed to make adjustments.

—

## Step 2: Establish a Budget and a Savings Strategy

After gaining a thorough insight into your spending, it’s time to create a practical budget. The crucial term here is *practical*. Ensure your budget mirrors your genuine lifestyle rather than an idealized version—failing to do so will make adherence feel unattainable.

Essential elements of a functional budget:

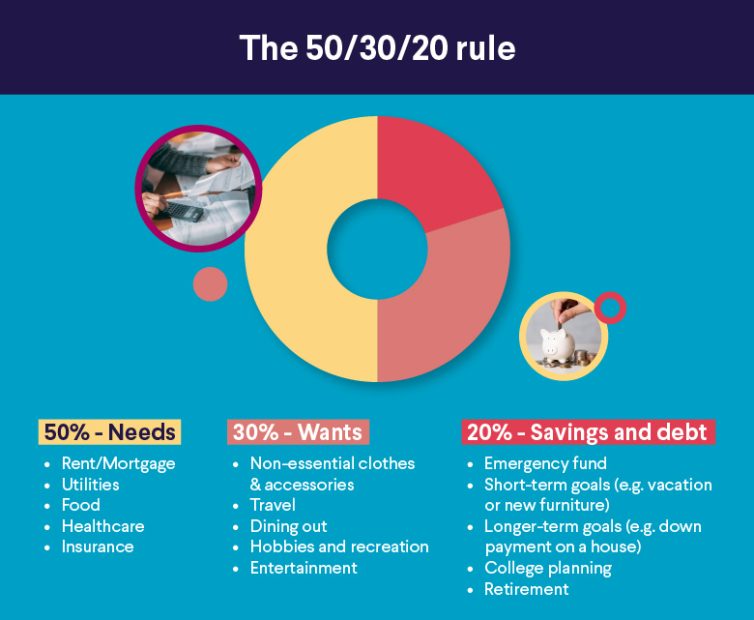

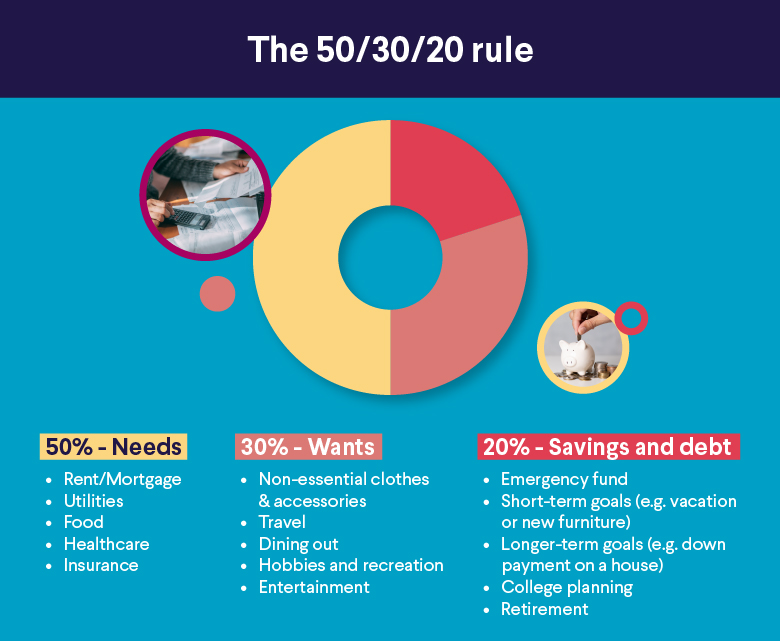

1. **Categorize Expenses**: Sort your spending into categories like groceries, dining, transportation, utilities, entertainment, savings, debt repayment, etc.

2. **Set Limits**: Based on your earnings, assign spending ceilings to each category. Focus on essentials such as housing, utilities, and food, and direct as much as possible towards debt repayment.

3. **Include Savings**: Even if it’s a modest sum each month, don’t overlook your savings. An emergency fund is crucial for warding off future debt.

4. **Prepare for Fluctuations**: Life is unpredictable. Unexpected costs will arise, so maintain flexibility. Revise your budget as required.

For some, sticking to a budget proves challenging since credit cards make overspending too simple. If this resonates with you, consider adopting a **cash-only budget.** Using this method, withdraw cash for each category at the start of the month. Once the cash runs out, refrain from further spending in that category until the following month. It’s straightforward, efficient, and curtails overspending.

—

## The Significance of Regular Budget Reviews

Merely creating a budget isn’t sufficient—you MUST frequently check in to evaluate your performance. This was the primary error I made initially. My wife and I would establish budget targets but seldom revisited them to evaluate our progress. The outcome? Overspending in certain areas and slow advancement on debt elimination.

Now, I dedicate time each week to assess our budget. Here’s my guidance for turning weekly budget reviews into a routine:

– Allocate 30–60 minutes on a consistent day each week to review your finances.

– Update your expenditure tracking tools or spreadsheets with any recent spending.

– Compare your actual spending with your budget categories.

– Discuss necessary modifications with your budgeting partner, if you have one.

This routine not only aids you in remaining aligned with your goals, but also cultivates financial awareness and confidence.

—

## Budgeting to Conquer Debt: A Three-Part Strategy

If your primary focus is on eliminating student loans or credit card debt, consider this approach:

### 1