### Top Canadian Dividend Stocks for 2025: Key Insights and Reasons

Which Canadian dividend stocks should you consider for investment in 2025? Will the market keep rising, or will the ever-anticipated crash finally take place?

To be frank, I don’t worry excessively about market forecasts. My primary concern is the growth of my dividend income over the coming year. I am confident that it will exceed last year’s figures. Although stock market movements can be as unpredictable as a bouncing ball, concentrating on increasing dividends simplifies matters and alleviates the anxiety associated with market fluctuations.

### A Shift in Perspective: Emphasizing Dividend Growth

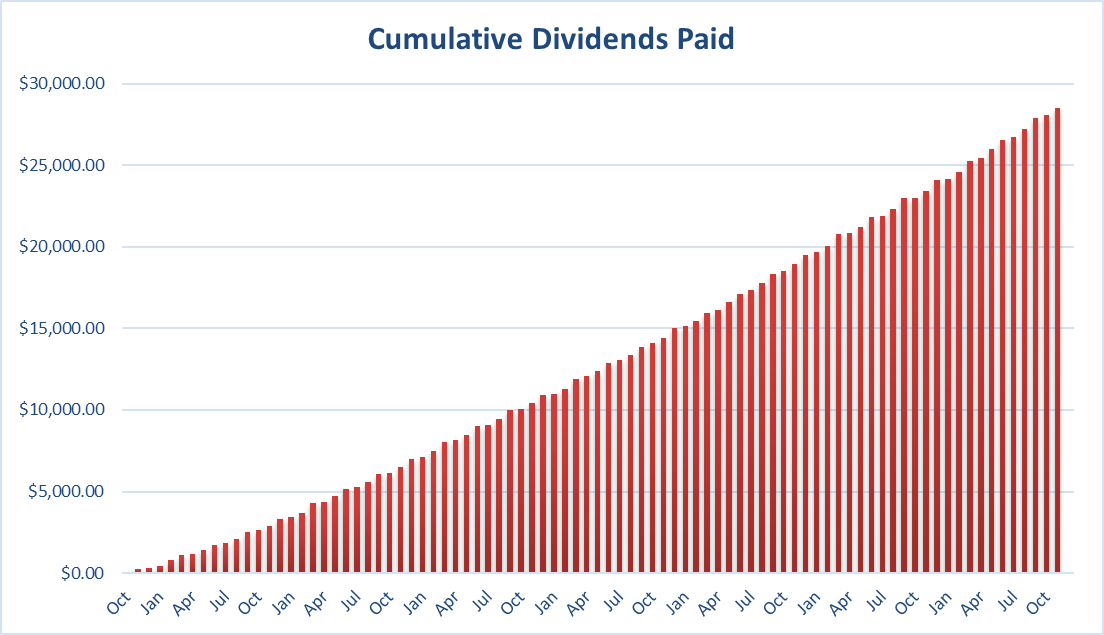

Rather than concentrating on the everyday market shifts, why not redirect your focus to the dividends you collect? Whether on a monthly or quarterly basis, monitoring your dividend progress can be significantly more gratifying and stable over time.

*Monitoring cumulative dividend distributions illustrates the impact of compounding over time.*

### Which Canadian Dividend Stocks Are Worth Buying in 2025?

For a robust portfolio in 2025, it’s vital to choose companies that have consistently paid and raised dividends. Besides dividend distributions, well-chosen stocks often offer the potential for capital appreciation. I detail my selection criteria for these companies [here](https://thedividendguyblog.com/dividend-growth-investing/).

Here are my top three Canadian dividend stock selections for 2025:

—

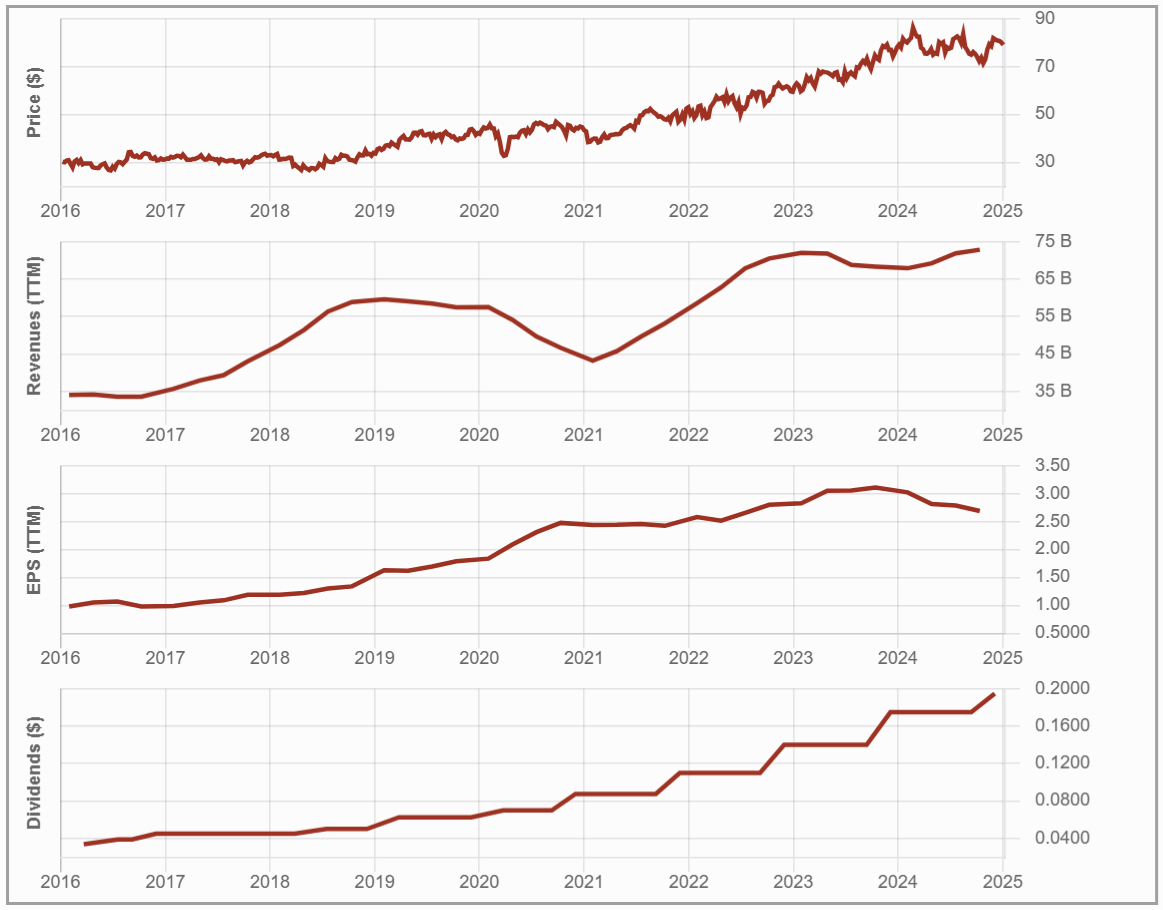

### 1. **Alimentation Couche-Tard (ATD.TO)**

**Business Model:**

Alimentation Couche-Tard is a worldwide leader in the convenience and mobility industry, functioning in about 29 countries and territories. With more than 16,700 outlets—13,100 of which provide road transport fuel—the company operates well-known brands like Couche-Tard and Circle K. Their reach extends across the United States, Canada, Scandinavia, the Baltics, and Ireland, along with nations such as Poland, Belgium, and the Netherlands.

**Recent Developments:**

To be clear, 2024 wasn’t Couche-Tard’s brightest year, yet that presents an opportunity for investors. Developments regarding ATD’s quest to acquire 7-Eleven have intensified. Although the corporate structure of 7-Eleven has complicated discussions, recent optimism about the possible acquisition has lifted Couche-Tard’s stock price.

Should the 7-Eleven transaction not go through, ATD is set to chase other acquisition opportunities—it’s part of their strategy. One option could be revisiting their earlier attempt to acquire Casey’s General Stores. Looking toward the future, ATD must prioritize organic growth by enhancing their offerings of ready-to-eat meals and fresh produce to address declining fuel and tobacco revenues.

*Alimentation Couche-Tard’s reliable dividend triangle over the last five years.*

—

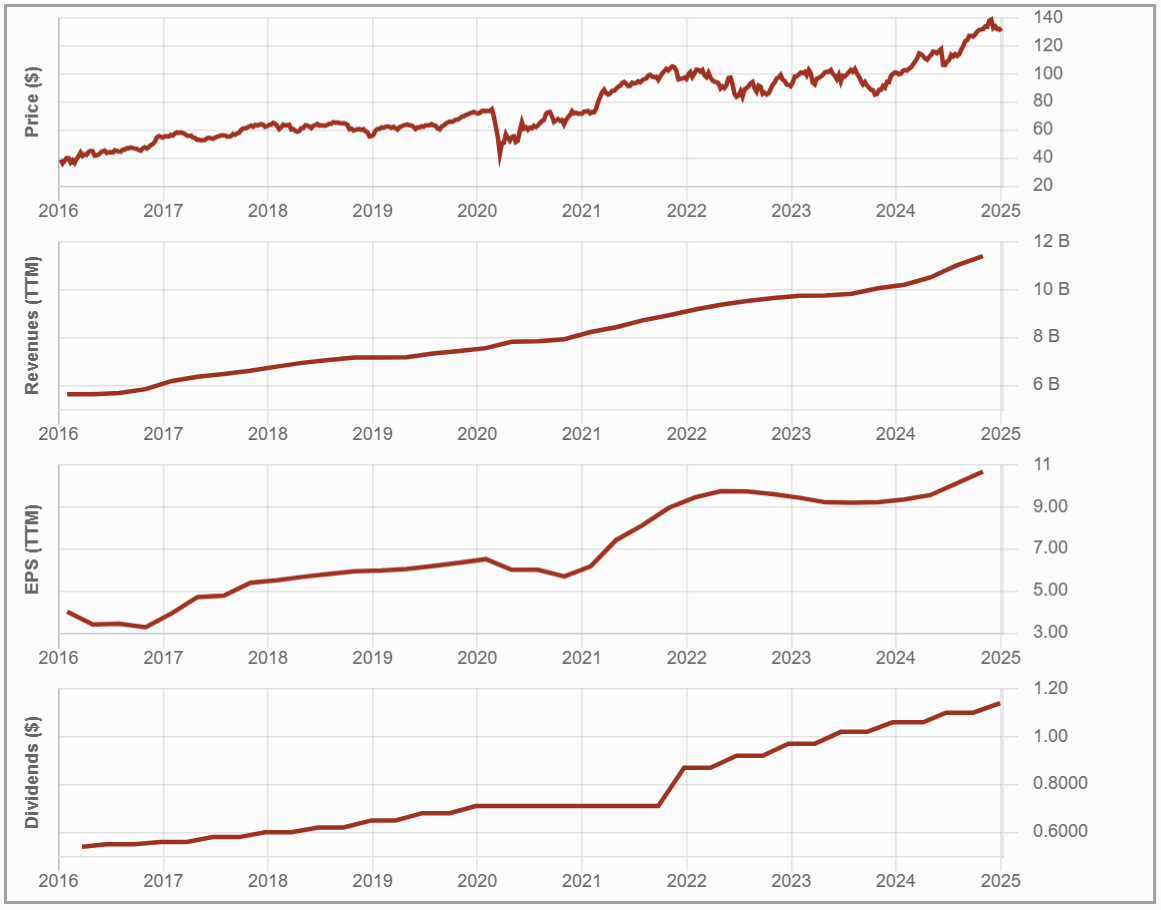

### 2. **National Bank (NA.TO)**

**Business Model:**

National Bank functions as a fully integrated financial entity with four main segments:

– **Personal and Commercial:** Banking, financing, and investment services for customers, businesses, and advisors.

– **Wealth Management:** Investment and trust services provided through extensive distribution channels.

– **Financial Markets:** Corporate banking and investment solutions for major organizations.

– **U.S. Specialty Finance and International:** Specialized financing through subsidiaries like Credigy Ltd. and Advanced Bank of Asia Limited.

**Recent Developments:**

National Bank has distinguished itself as a leading performer in Canada’s banking sector. Over the past 15 years, it has effectively evolved from a regional player into a formidable growth contender in wealth management and capital markets.

As 2025 approaches, the bank is poised to benefit from its acquisition of Canadian Western Bank. This transaction will strengthen National Bank’s balance sheet, enhance cross-selling opportunities between commercial banking and private wealth management, and expand its foothold in Western Canada. Furthermore, NA continues to pursue international growth, demonstrating strength in Cambodia through ABA Bank and making strategic advancements in the U.S. market with Credigy.

*National Bank’s consistent five-year dividend growth and performance.*

—

### 3. **Hydro One (H.TO)**

**Business Model:**

Hydro One is the leading electricity transmission and distribution company in Ontario. Its operations