**Analyzing Small Cap Investment Approaches: Paul Merriman vs. Dr. Karsten Jeske – A Critical Evaluation**

In the realm of long-term wealth accumulation, small-cap stocks frequently play a vital role in enhancing portfolio diversification and overall performance. These stocks are associated with smaller enterprises that possess significant growth prospects, but they also introduce volatility and heightened risks. Among the numerous experts providing insights in this field, Paul Merriman and Dr. Karsten Jeske are particularly noted for their unique and compelling methodologies. This article presents a critical evaluation of their small-cap investment strategies, exploring their philosophies, allocation models, risk management tactics, and long-term performance expectations.

—

### Paul Merriman: Strategic Asset Allocation with a Focus

**Background:**

Paul Merriman, a seasoned financial educator and founder of Merriman Wealth Management, is recognized for his evidence-backed, academically informed investment strategies. He champions passive investing with a strong focus on diversification, risk-adjusted returns, and factor-based tilts—especially towards small-cap and value stocks.

**Small Cap Strategy:**

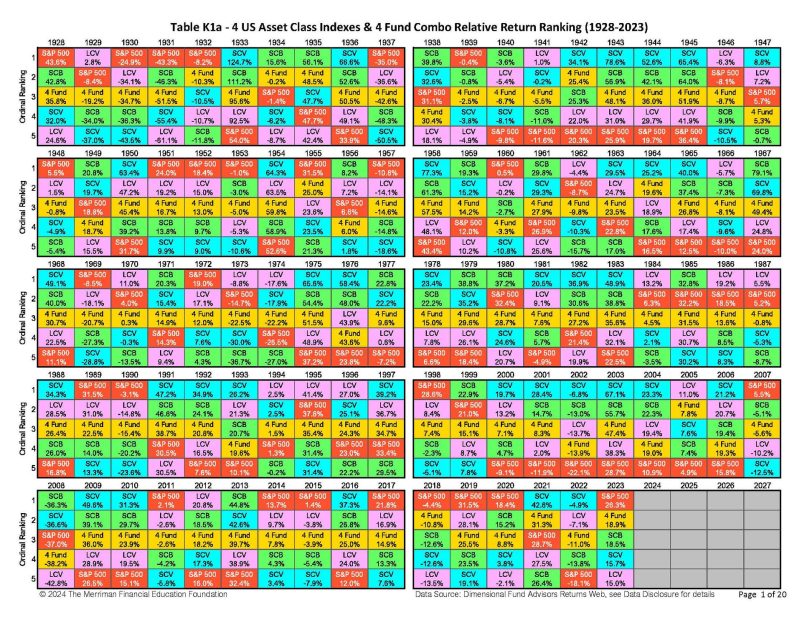

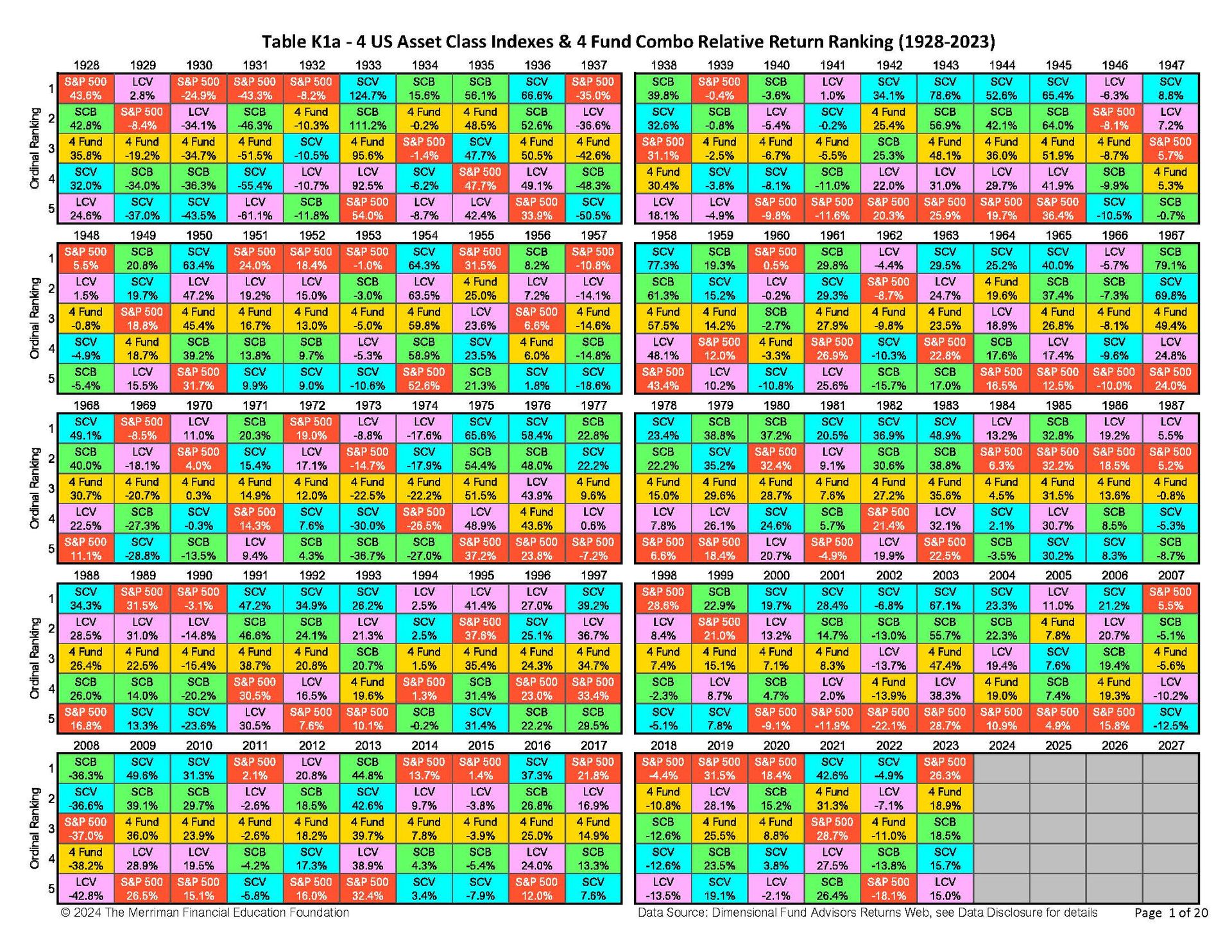

– **Small Cap Value Emphasis:** Merriman suggests a substantial allocation to small-cap value stocks based on comprehensive academic studies (e.g., Fama-French Three-Factor Model) indicating they yield higher expected returns over time when compared with large-cap growth.

– **Varied Asset Classes:** His portfolios encompass a variety of up to 10 different asset classes, often incorporating U.S. and international small-cap value, REITs, large cap growth, and emerging markets.

– **”Total Buy-and-Hold Approach”:** In this strategy, small-cap value might constitute 10–20% of the equity portfolio, boosting historical returns while ensuring effective diversification.

– **Preference for Index Funds and ETFs:** Merriman promotes low-cost, broadly diversified instruments like Vanguard and DFA funds to achieve efficient access to small-cap segments.

**Strengths:**

– Strong reliance on academic research.

– Defined, rules-based asset allocation frameworks.

– User-friendly for do-it-yourself investors.

– In-depth historical data endorses the strength of his approach.

**Criticisms/Challenges:**

– May lag the market over shorter periods.

– Necessitates investor discipline and a willingness to accept tracking errors.

– Balancing across numerous asset classes can be intricate.

—

### Dr. Karsten Jeske: Exacting Framework from the Early Retirement Now Platform

**Background:**

Dr. Karsten Jeske, a previous economist at the Federal Reserve and the founder of the Early Retirement Now blog, applies quantitative precision and an econometric perspective to portfolio development—especially for those aiming for early financial independence.

**Small Cap Strategy:**

– **Drawdown Risk Management:** While Jeske acknowledges the historical advantages of small-cap value stocks, he prioritizes *sequence of return risk* over maximization of returns.

– **Sensitivity to Withdrawal Rates:** In his “Safe Withdrawal Rate Series,” he examines how various asset allocations (including small-cap tilts) affect portfolio durability over decades, particularly in early retirement contexts.

– **Caution Against Over-Tilting:** Though he may incorporate small-cap equities in a diversified portfolio, he frequently cautions against excessive weighting based solely on historical performance, citing anomalous decades and the possibility of prolonged underperformance.

– **Quantitative Analysis:** Employs Monte Carlo simulations and sophisticated risk assessments to refine asset allocation strategy—striking a balance between returns and spending requirements as well as exposure to volatility.

**Strengths:**

– Comprehensive, data-centered risk assessment.

– Highly pertinent insights for those pursuing Early Retirement or FIRE (Financial Independence, Retire Early).

– Focus on real-world situations and spending demands, rather than merely on theoretical returns.

– Robust comprehension of economic trends and macroeconomic influences.

**Criticisms/Challenges:**

– Reduced emphasis on high-growth factors like small-cap value in contrast to Merriman.

– Strategy complexity could be daunting for the average investor.

– May adopt a conservative stance, potentially missing out on higher gains.

—

### Direct Comparison: Merriman vs. Jeske

| Aspect | Paul Merriman | Dr. Karsten Jeske |

|———————————-|—————————————-|——————————————-|

| **Philosophy** | Long-term, buy-and-hold with factor tilts | Risk-first, data-driven with focus on withdrawals |

| **Use of Small Cap** | Strong tilt towards small-cap value | Limited, cautious inclusion |

| **Portfolio Complexity** | High (multiple asset classes) | High (custom simulations and scenarios) |

| **Optimization Goal** | Maximize returns through diversification and tilting | Minimize sequence-of-return risk for retirees |

| **Time Horizon** | 20+ years, conventional retirement | Tailored, FIRE/early retirement focus |

| **Risk Tolerance Impact** | Promotes broader inclusion of high-risk asset classes | Cautions regarding volatility’s influence on withdrawals |

| **Tools Used** | | |