Introduction to Trading Decisions

In the fast-paced realm of trading, the ability to make well-informed decisions can significantly differentiate profit from loss. Traders have engaged in extensive discussions regarding the advantages of various market analysis techniques, with the two most notable being Technical Analysis and Order Flow. Each method brings distinct insights and tools to assist traders in maneuvering through the intricacies of financial markets.

Understanding Technical Analysis

Technical analysis is a technique that employs historical price data and trading volumes to project future price shifts. By evaluating price charts and detecting patterns, traders strive to foresee the direction of price movements.

Key Concepts in Technical Analysis

– Price Patterns: These are shapes formed by the price movement on a chart, including head-and-shoulders, double tops, and triangles.

– Indicators: Instruments such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) offer insights into market trends and possible reversal points.

– Support and Resistance Levels: These are pivotal price levels where a security usually halts and reverses.

Technical analysis posits that all market information is already encapsulated in prices, enabling traders to concentrate solely on historical data for their forecasts.

Chart Types

– Line Charts: The most basic type, useful for trend identification.

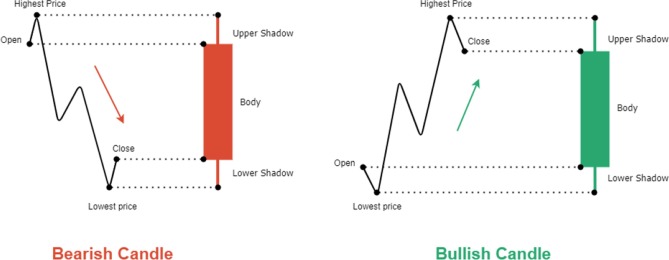

– Bar Charts: Present opening, closing, high, and low prices.

– Candlestick Charts: Provide more intricate information with visual appeal.

Popular Indicators

– Bollinger Bands: Indicate volatility by positioning bands above and below a moving average.

– Fibonacci Retracement: Utilized to identify possible reversal levels.

These instruments assist traders in formulating strategies based on past price movements, which facilitates informed trading choices.

Exploring Order Flow

Order flow analysis centers on comprehending the actions of buyers and sellers in the market. It delivers real-time data concerning how orders are placed, filled, or cancelled, presenting a detailed view of market dynamics.

Basics of Order Flow

– Order Book: Displays live orders awaiting execution; illustrates bid and ask prices.

– Volume Profile: Illustrates traded volume over a given period at each price level.

Order flow seeks to capture the intentions behind trades by analyzing how orders are conducted rather than depending solely on past price data.

The Role of Market Participants in Order Flow

Recognizing who participates in the market can provide valuable insights into order flow:

Types of Market Participants

– Retail Traders: Generally exert less influence on market prices but can offer liquidity.

– Institutional Investors: Hold substantial sway because of their large trade volumes.

– Market Makers: Supply liquidity by being prepared to buy or sell at openly quoted prices.

The actions of institutional investors typically have a significant impact on order flow due to their considerable capital resources, making it essential for traders employing order flow analysis to closely observe institutional activity.

Comparing Technical Analysis and Order Flow

Each methodology has its advantages and drawbacks:

Advantages of Technical Analysis

– Exceptional for detecting long-term trends.

– Provides a wide array of tools for diverse strategies.

Advantages of Order Flow

– Delivers real-time market insights.

– Aids in comprehending immediate supply-demand dynamics.