# The Difficulties of Investing in a Bull Market Without a Reliable Income

In a flourishing economic environment, the thrill of a bull market can be tangible. With rising stock prices and increasing real estate values, those with disposable income frequently find themselves well-positioned to take advantage of various investment prospects. Nonetheless, for individuals facing cash flow issues, even with significant assets, the experience can be disheartening. This circumstance prompts essential reflections for high-net-worth individuals who aren’t currently earning a regular salary, especially for those who have sought financial independence (FI) or early retirement (FIRE).

## The Significance of Liquidity

Liquidity stands out as a vital element defining financial well-being. In the absence of adequate cash flow from a consistent income, it’s easy to feel sidelined amid swift market expansion. Observers witnessing their contemporaries capitalize on stable W-2 wages to invest considerable sums in stocks and property may experience a twinge of envy when they cannot follow suit. This feeling often highlights the truth that while assets may be plentiful, the capability to actively participate in the market is restricted without liquidity.

## Addressing Existential Concerns

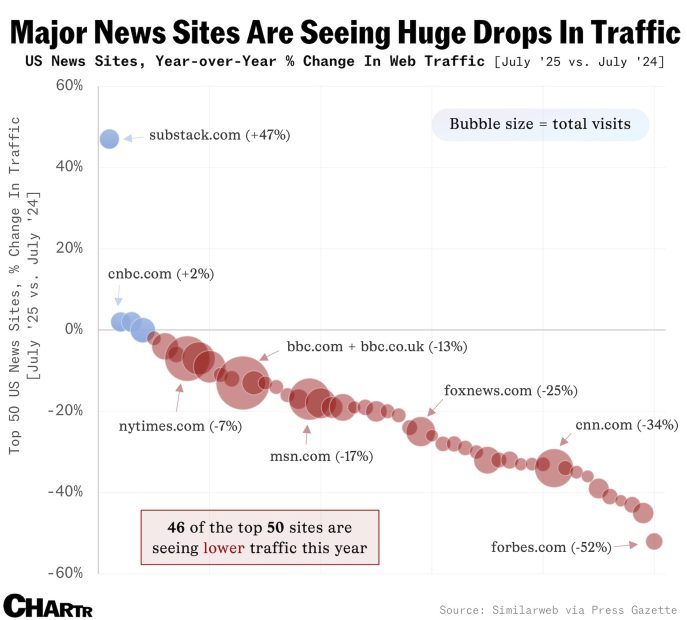

For those monitoring changes in the economic arena, like AI affecting job markets and media platforms, future anxieties can become prominent. With an unpredictable job landscape anticipated for upcoming generations, proactive investing is crucial. It is not only important to invest judiciously but also urgent to educate younger individuals on navigating financial ecosystems that may vary significantly from those encountered today.

## The Risks of Passive Investment

Take, for instance, investing in a powerhouse like Google. Even when acknowledging its market dominance, issues such as valuation apprehensions, approaching tax deadlines, and a lack of steady cash flow can restrict investment choices. Missing opportunities can foster regrets, particularly when subsequent market responses turn out positively.

This highlights a larger concern: without a constant income, seizing market dips or new opportunities becomes more challenging.

## Strategies for Diversification

As investors strive to enhance their investment portfolios, especially in emerging fields like artificial intelligence, the challenge posed by sporadic cash flow becomes clear. While public market investments typically provide easier accessibility, there may exist a fundamental necessity to secure private equity positions in promising startups to safeguard future financial health. These investments often entail high minimums that can be difficult to meet without an active income.

The intricacies of capital commitment—necessitating careful financial strategy due to their extended timelines—often exacerbate the situation. Ensuring adequate financing for participation while sustaining liquidity is vital, particularly concerning future capital calls.

## Embracing Financial Autonomy

Obtaining financial independence opens up alternatives to conventional income; however, it can create internal tension during vigorous market rallies. The paradox of achieving FIRE is that the absence of an active income may push the urge to take greater risks, complicating investment tactics.

To maneuver through this delicate area, it’s essential to balance risk with tranquility. Acknowledging that financial wealth is not only a measure of assets but also of time and options can help alleviate feelings of missing out. The focus should shift towards cultivating a portfolio that promotes personal freedom rather than solely pursuing every fleeting chance.

## Practical Insights for Investors

1. **Optimize Your Earnings:** For those currently working, this is a prime time to save and invest. The current bull market offers a rare convergence of steady income and growth potential.

2. **Accept Enoughness:** If you’ve reached a phase of financial independence, learn to embrace the idea of not having access to every investment option. Compound growth from existing assets can yield satisfactory returns.

3. **Avoid FOMO Investment Approaches:** Resist the urge to jump into every trend or attractive deal, as many may not lead to positive results.

4. **Preserve Mental Freedom:** Ensure your investment choices do not create undue pressure. The ultimate aim is to enhance the quality of your life rather than merely accumulating wealth.

5. **Remain Aware of Risk:** Assess your risk appetite and modify your investment strategy accordingly, especially considering the unpredictable nature of the markets.

In conclusion, achieving financial independence in a bull market can evoke a range of emotions, including feelings of deprivation or the fear of missing out. However, understanding how to navigate these obstacles—guided by a balance of risk, liquidity, and long-term objectives—can empower individuals to handle their investments more efficiently while enjoying the freedoms that financial independence affords.