**Title: The Most Terrifying Financial Scenarios That Frighten Us: A Halloween Insight**

Halloween often brings excitement, suspense, and light-hearted scares, particularly for children enjoying the celebrations. However, for adults mindful of their finances, the real horrors emerge not from specters or creatures, but from the realities of budgeting, unexpected costs, and market declines that can turn a secure financial situation into something out of a horror story.

After more than thirty years of traversing changing financial terrains, it’s evident that the most unsettling occurrences arise from our own decisions and actions. Here are eight of the most daunting financial challenges that can affect anyone, some of which I have faced personally while others I managed to evade.

### 1. The Terror of Job Termination Without Savings

The eerie moment when a supervisor requests a private meeting can induce panic in anyone. For those living paycheck to paycheck, an unexpected job loss feels like navigating a shadowy, haunted woods without a flashlight or supplies.

Having observed countless colleagues during chaotic periods like the dot-com collapse and the Great Recession, I witnessed how swiftly fortunes could change. Adequate preparation is crucial.

**The Remedy:** Keep a financial buffer of at least six months’ living expenses, preferably a year. This cushion allows you to weather unanticipated job losses and financial turmoil.

### 2. The Fright of Overwhelming Debt With No Escape

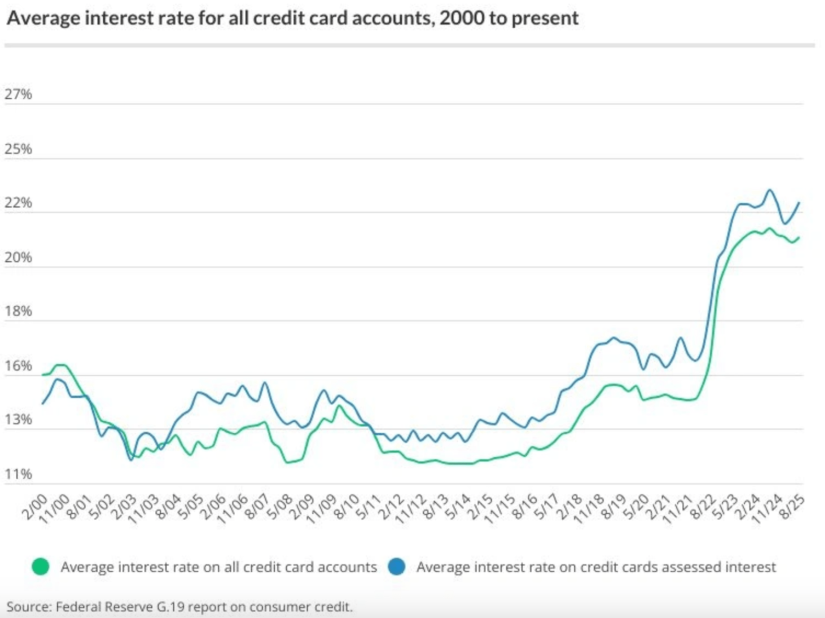

Debt lurks like a menacing villain, always threatening once you start to feel free. Whether it’s student loans, car debts, or high-interest credit card balances, breaking free from this fiscal confinement may seem impossible.

My own journey with considerable mortgage debt illustrated this battle. The initial thrill of homeownership soon turned into a burden weighing heavily on my financial health, especially during recessions.

**The Remedy:** Focus on paying off high-interest debts first and set a goal to eliminate all debt. Limit credit cards to those with the most favorable terms and understand that your value isn’t determined by comparing your finances to others.

### 3. The Ghost of a Market Collapse Right After You Retire

For many, retirement represents the ultimate success. However, the fear of witnessing a market crash shortly thereafter can be catastrophic, wiping out years of dedication and savings in an instant.

I personally experienced this anxiety in early 2020, when market drops raised uncertainties regarding my retirement choice. It’s vital to avoid swift, emotion-driven decisions.

**The Remedy:** Before retiring, evaluate your financial standing under possible market declines to ensure you can endure them without having to sell investments at a loss.

### 4. The Jinx of Medical Emergencies

Life can shift dramatically due to unforeseen health issues. Medical emergencies can drain savings quicker than market slips, and healthcare expenses in the U.S. remain exorbitant.

With alarming instances of emergency visits costing thousands, it is crucial to manage this risk.

**The Remedy:** Obtain health insurance to safeguard against severe expenses. Investing in a Health Savings Account (HSA) can offer a financial safeguard against medical bills. Emphasize preventive health measures to protect your health and finances.

### 5. The Specter of Lifestyle Inflation

As income increases, so can expenses, often resulting in lifestyle inflation. New vehicles, larger houses, and extravagant vacations can impede savings and leave one feeling financially ensnared despite higher earnings.

I found myself in this predicament, rationalizing frivolous spending and ultimately feeling less fulfilled.

**The Remedy:** Stay disciplined by saving or investing any raises instead of increasing expenditures. Recognize that true happiness stems from financial stability and growth, not from an inflated lifestyle.

### 6. Leaving Your Job Without a Backup Strategy

Quitting a job on a whim without a plan is like jumping out of a plane without a parachute. Preparing for this important transition is essential to mitigate potential financial repercussions.

**The Remedy:** If feasible, negotiate a severance package and have alternative income sources or another position secured to cushion the effects of your departure.

### 7. Failing to Take Necessary Risks

Regret frequently arises from missed opportunities that could have altered life’s course. Fear of failure or ego may impede decision-making, resulting in stagnation.

**The Remedy:** Contemplate potential regrets and actively pursue those opportunities, even if they seem intimidating.

### 8. Not Allowing Your Partner to Be Free as Well

Financial independence is most gratifying when it is a shared experience. It can be unsettling when one partner enjoys financial freedom while the other is constrained.

**The Remedy:** Work together on a collective financial plan, setting shared objectives and timelines for achieving mutual independence.

### Closing Thoughts: Embracing Fear as a Financial Asset

Fear can act as a source of motivation and a reminder of our fragility in financial matters. By acknowledging and preparing for potential pitfalls, we equip ourselves to confront any challenges with confidence.

This Halloween, as you reflect on your financial well-being, take the time to